Exhibit 10.1

PROMULGATED BY THE TEXAS REAL ESTATE COMMISSION (TREC) 2-12-18 UNIMPROVED PROPERTY CONTRACT NOTICE: Not For Use For Condominium Transactions 1. PARTIES: The parties to this contract are Northport Harbor LLC (Seller) and S G Blocks Inc. By Paul Galvin (Buyer). Seller agrees to sell and convey to Buyer and Buyer agrees to buy from Seller the Property defined below. 2. PROPERTY: Lot , Block , ABS 90 SUR 600 BALDWIN K ACR 59.138& .2330 AC OF LOT 1 COVE AT LAGO VISTA Addition, City of Lago Vista , County of Travis , Texas, known as 1900 & 1901 American Dr 78645 (address/zip code), or as described on attached exhibit together with all rights, privileges and appurtenances pertaining thereto, including but not limited to: water rights, claims, permits, strips and gores, easements, and cooperative or association memberships (the Property). RESERVATIONS: Any reservation for oil, gas, or other minerals, water, timber, or other interests is made in accordance with an attached addendum. 3. SALES PRICE: A. Cash portion of Sales Price payable by Buyer at closing. $3,500,000.00 B. Sum of all financing described in the attached: Third Party Financing Addendum, Loan Assumption Addendum, Seller Financing Addendum. $ C. Sales Price (Sum of A and B) $3,500,000.00 4. LICENSE HOLDER DISCLOSURE: Texas law requires a real estate license holder who is a party to a transaction or acting on behalf of a spouse, parent, child, business entity in which the license holder owns more than 10%, or a trust for which the license holder acts as a trustee or of which the license holder or the license holder's spouse, parent or child is a beneficiary, to notify the other party in writing before entering into a contract of sale. Disclose if applicable: N/A . 5. EARNEST MONEY: Within 3 days after the Effective Date, Buyer must deliver $100,000.00 as earnest money to Independence Title- Laura Pagnozzi , as escrow agent, at 6836 Bee Cave Rd Bldg III Suite 100 Austin, TX 78746 (address). Buyer shall deposit additional earnest money of $N/A to escrow agent within days after the effective date of this contract. If Buyer fails to deliver the earnest money within the time required, Seller may terminate this contract or exercise Seller's remedies under Paragraph 15, or both, by providing notice to Buyer before Buyer delivers the earnest money. If the last day to deliver the earnest money falls on a Saturday, Sunday, or legal holiday, the time to deliver the earnest money is extended until the end of the next day that is not a Saturday, Sunday, or legal holiday. Time is of the essence for this paragraph. 6. TITLE POLICY AND SURVEY: A. TITLE POLICY: Seller shall furnish to Buyer at X Seller's Buyer's expense an owner's policy of title insurance (Title Policy) issued by Independence Title (Title Company) in the amount of the Sales Price, dated at or after closing, insuring Buyer against loss under the provisions of the Title Policy, subject to the promulgated exclusions (including existing building and zoning ordinances) and the following exceptions: (1) Restrictive covenants common to the platted subdivision in which the Property is located. (2) The standard printed exception for standby fees, taxes and assessments. (3) Liens created as part of the financing described in Paragraph 3. (4) Utility easements created by the dedication deed or plat of the subdivision in which the Property is located. (5) Reservations or exceptions otherwise permitted by this contract or as may be approved by Buyer in writing. (6) The standard printed exception as to marital rights. (7) The standard printed exception as to waters, tidelands, beaches, streams, and related matters. (8) The standard printed exception as to discrepancies, conflicts, shortages in area or boundary lines, encroachments or protrusions, or overlapping improvements: (i) will not be amended or deleted from the title policy; or X (ii) will be amended to read, "shortages in area" at the expense of Buyer Seller. (9) The exception or exclusion regarding minerals approved by the Texas Department of Insurance. B. COMMITMENT: Within 20 days after the Title Company receives a copy of this contract, Seller shall furnish to Buyer a commitment for title insurance (Commitment) and, at Buyer's expense, legible copies of restrictive covenants and documents evidencing exceptions in the Commitment (Exception Documents) other than the standard printed exceptions. Seller authorizes the Title Company to deliver the Commitment and Exception Documents to Buyer at Buyer's address TXR 1607 Initialed for identification by Buyer and Seller TREC NO. 9-13 AustinRealEstate.com, 3103 Bee Cave Rd Suite 102 Austin TX 78746 Phone: 5124680449

Contract Concerning 1900 & 1901 American Dr Lago Vista, TX 78645 Page 2 of 9 2-12-18 (Address of Property) shown in Paragraph 21. If the Commitment and Exception Documents are not delivered to Buyer within the specified time, the time for delivery will be automatically extended up to 15 days or 3 days before the Closing Date, whichever is earlier. If the Commitment and Exception Documents are not delivered within the time required, Buyer may terminate this contract and the earnest money will be refunded to Buyer. C. SURVEY: The survey must be made by a registered professional land surveyor acceptable to the Title Company and Buyer's lender(s). (Check one box only) X (1) Within 3 days after the Effective Date of this contract, Seller shall furnish to Buyer and Title Company Seller's existing survey of the Property and a Residential Real Property Affidavit promulgated by the Texas Department of Insurance (T-47 Affidavit). If Seller fails to furnish the existing survey or affidavit within the time prescribed, Buyer shall obtain a new survey at Seller's expense no later than 3 days prior to Closing Date. If the existing survey or affidavit is not acceptable to Title Company or Buyer's lender(s), Buyer shall obtain a new survey at Seller's X Buyer's expense no later than 3 days prior to Closing Date. (2) Within days after the Effective Date of this contract, Buyer shall obtain a new survey at Buyer's expense. Buyer is deemed to receive the survey on the date of actual receipt or the date specified in this paragraph, whichever is earlier. (3) Within days after the Effective Date of this contract, Seller, at Seller's expense shall furnish a new survey to Buyer. D. OBJECTIONS: Buyer may object in writing to (i) defects, exceptions, or encumbrances to title: disclosed on the survey other than items 6A(1) through (7) above; or disclosed in the Commitment other than items 6A(1) through (9) above; (ii) any portion of the Property lying in a special flood hazard area (Zone V or A) as shown on the current Federal Emergency Management Agency map; or (iii) any exceptions which prohibit the following use or activity: . Buyer must object the earlier of (i) the Closing Date or (ii) 5 days after Buyer receives the Commitment, Exception Documents, and the survey. Buyer's failure to object within the time allowed will constitute a waiver of Buyer's right to object; except that the requirements in Schedule C of the Commitment are not waived. Provided Seller is not obligated to incur any expense, Seller shall cure any timely objections of Buyer or any third party lender within 15 days after Seller receives the objections (Cure Period) and the Closing Date will be extended as necessary. If objections are not cured within the Cure Period, Buyer may, by delivering notice to Seller within 5 days after the end of the Cure Period: (i) terminate this contract and the earnest money will be refunded to Buyer; or (ii) waive the objections. If Buyer does not terminate within the time required, Buyer shall be deemed to have waived the objections. If the Commitment or Survey is revised or any new Exception Document(s) is delivered, Buyer may object to any new matter revealed in the revised Commitment or Survey or new Exception Document(s) within the same time stated in this paragraph to make objections beginning when the revised Commitment, Survey, or Exception Document(s) is delivered to Buyer. E. TITLE NOTICES: (1) ABSTRACT OR TITLE POLICY: Broker advises Buyer to have an abstract of title covering the Property examined by an attorney of Buyer's selection, or Buyer should be furnished with or obtain a Title Policy. If a Title Policy is furnished, the Commitment should be promptly reviewed by an attorney of Buyer's choice due to the time limitations on Buyer's right to object. (2) MEMBERSHIP IN PROPERTY OWNERS ASSOCIATION(S): The Property is X is not subject to mandatory membership in a property owners association(s). If the Property is subject to mandatory membership in a property owners association(s), Seller notifies Buyer under §5.012, Texas Property Code, that, as a purchaser of property in the residential community identified in Paragraph 2 in which the Property is located, you are obligated to be a member of the property owners association(s). Restrictive covenants governing the use and occupancy of the Property and all dedicatory instruments governing the establishment, maintenance, and operation of this residential community have been or will be recorded in the Real Property Records of the county in which the Property is located. Copies of the restrictive covenants and dedicatory instruments may be obtained from the county clerk. You are obligated to pay assessments to the property owners association(s). The amount of the assessments is subject to change. Your failure to pay the assessments could result in enforcement of the association's lien on and the foreclosure of the Property. Section 207.003, Property Code, entitles an owner to receive copies of any document that governs the establishment, maintenance, or operation of a subdivision, including, but not limited to, restrictions, bylaws, rules and regulations, and a resale certificate from a property owners' association. A resale certificate contains information including, but not limited to, statements specifying the amount and frequency of regular assessments and the style and cause number of lawsuits to which the property owners' association is a party, other than lawsuits relating to unpaid ad valorem taxes of an individual member of the association. These documents must be made available to you by the property owners' association or the association's agent on your request. If Buyer is concerned about these matters, the TREC promulgated Addendum for Property Subject to Mandatory Membership in a Property Owners Association should be used. TXR 1607 Initialed for identification by Buyer and Seller TREC NO. 9-13 Produced with zipForm® by zipLogix 18070 Fifteen Mile Road, Fraser, Michigan 48026 www.zipLogix.com American Drive

Contract Concerning 1900 & 1901 American Dr Lago Vista, TX 78645 Page 3 of 9 2-12-18 (Address of Property) (3) STATUTORY TAX DISTRICTS: If the Property is situated in a utility or other statutorily created district providing water, sewer, drainage, or flood control facilities and services, Chapter 49, Texas Water Code, requires Seller to deliver and Buyer to sign the statutory notice relating to the tax rate, bonded indebtedness, or standby fee of the district prior to final execution of this contract. (4) TIDE WATERS: If the Property abuts the tidally influenced waters of the state, §33.135, Texas Natural Resources Code, requires a notice regarding coastal area property to be included in the contract. An addendum containing the notice promulgated by TREC or required by the parties must be used. (5) ANNEXATION: If the Property is located outside the limits of a municipality, Seller notifies Buyer under §5.011, Texas Property Code, that the Property may now or later be included in the extraterritorial jurisdiction of a municipality and may now or later be subject to annexation by the municipality. Each municipality maintains a map that depicts its boundaries and extraterritorial jurisdiction. To determine if the Property is located within a municipality's extraterritorial jurisdiction or is likely to be located within a municipality's extraterritorial jurisdiction, contact all municipalities located in the general proximity of the Property for further information. (6) PROPERTY LOCATED IN A CERTIFICATED SERVICE AREA OF A UTILITY SERVICE PROVIDER: Notice required by §13.257, Water Code: The real property, described in Paragraph 2, that you are about to purchase may be located in a certificated water or sewer service area, which is authorized by law to provide water or sewer service to the properties in the certificated area. If your property is located in a certificated area there may be special costs or charges that you will be required to pay before you can receive water or sewer service. There may be a period required to construct lines or other facilities necessary to provide water or sewer service to your property. You are advised to determine if the property is in a certificated area and contact the utility service provider to determine the cost that you will be required to pay and the period, if any, that is required to provide water or sewer service to your property. The undersigned Buyer hereby acknowledges receipt of the foregoing notice at or before the execution of a binding contract for the purchase of the real property described in Paragraph 2 or at closing of purchase of the real property. (7) PUBLIC IMPROVEMENT DISTRICTS: If the Property is in a public improvement district, §5.014, Property Code, requires Seller to notify Buyer as follows: As a purchaser of this parcel of real property you are obligated to pay an assessment to a municipality or county for an improvement project undertaken by a public improvement district under Chapter 372, Local Government Code. The assessment may be due annually or in periodic installments. More information concerning the amount of the assessment and the due dates of that assessment may be obtained from the municipality or county levying the assessment. The amount of the assessments is subject to change. Your failure to pay the assessments could result in a lien on and the foreclosure of your property. (8) TEXAS AGRICULTURAL DEVELOPMENT DISTRICT: The Property is X is not located in a Texas Agricultural Development District. For additional information, contact the Texas Department of Agriculture. (9) TRANSFER FEES: If the Property is subject to a private transfer fee obligation, §5.205, Property Code requires Seller to notify Buyer as follows: The private transfer fee obligation may be governed by Chapter 5, Subchapter G of the Texas Property Code. (10) PROPANE GAS SYSTEM SERVICE AREA: If the Property is located in a propane gas system service area owned by a distribution system retailer, Seller must give Buyer written notice as required by §141.010, Texas Utilities Code. An addendum containing the notice approved by TREC or required by the parties should be used. (11) NOTICE OF WATER LEVEL FLUCTUATIONS: If the Property adjoins an impoundment of water, including a reservoir or lake, constructed and maintained under Chapter 11, Water Code, that has a storage capacity of at least 5,000 acre-feet at the impoundment's normal operating level, Seller hereby notifies Buyer: “The water level of the impoundment of water adjoining the Property fluctuates for various reasons, including as a result of: (1) an entity lawfully exercising its right to use the water stored in the impoundment; or (2) drought or flood conditions.” 7. PROPERTY CONDITION: A. ACCESS, INSPECTIONS AND UTILITIES: Seller shall permit Buyer and Buyer's agents access to the Property at reasonable times. Buyer may have the Property inspected by inspectors selected by Buyer and licensed by TREC or otherwise permitted by law to make inspections. Seller at Seller's expense shall immediately cause existing utilities to be turned on and shall keep the utilities on during the time this contract is in effect. NOTICE: Buyer should determine the availability of utilities to the Property suitable to satisfy Buyer's needs. B. ACCEPTANCE OF PROPERTY CONDITION: “As Is” means the present condition of the Property with any and all defects and without warranty except for the warranties of title and the warranties in this contract. Buyer's agreement to accept the Property As Is under Paragraph 7B (1) or (2) does not preclude Buyer from inspecting the Property under Paragraph 7A, from negotiating repairs or treatments in a subsequent amendment, or from terminating this contract during the Option Period, if any. TXR 1607 Initialed for identification by Buyer and Seller TREC NO. 9-13 Produced with zipForm® by zipLogix 18070 Fifteen Mile Road, Fraser, Michigan 48026 www.zipLogix.com American Drive

Contract Concerning 1900 & 1901 American Dr Lago Vista, TX 78645 Page 4 of 9 2-12-18 (Address of Property) (Check one box only) X (1) Buyer accepts the Property As Is. (2) Buyer accepts the Property As Is provided Seller, at Seller's expense, shall complete the following specific repairs and treatments: . (Do not insert general phrases, such as “subject to inspections” that do not identify specific repairs and treatments.) C. COMPLETION OF REPAIRS: Unless otherwise agreed in writing: (i) Seller shall complete all agreed repairs and treatments prior to the Closing Date; and (ii) all required permits must be obtained, and repairs and treatments must be performed by persons who are licensed to provide such repairs or treatments or, if no license is required by law, are commercially engaged in the trade of providing such repairs or treatments. At Buyer's election, any transferable warranties received by Seller with respect to the repairs and treatments will be transferred to Buyer at Buyer's expense. If Seller fails to complete any agreed repairs and treatments prior to the Closing Date, Buyer may exercise remedies under Paragraph 15 or extend the Closing Date up to 5 days, if necessary, for Seller to complete repairs and treatments. D. ENVIRONMENTAL MATTERS: Buyer is advised that the presence of wetlands, toxic substances, including asbestos and wastes or other environmental hazards, or the presence of a threatened or endangered species or its habitat may affect Buyer's intended use of the Property. If Buyer is concerned about these matters, an addendum promulgated by TREC or required by the parties should be used. E. SELLER'S DISCLOSURES: Except as otherwise disclosed in this contract, Seller has no knowledge of the following: (1) any flooding of the Property which has had a material adverse effect on the use of the Property; (2) any pending or threatened litigation, condemnation, or special assessment affecting the Property; (3) any environmental hazards that materially and adversely affect the Property; (4) any dumpsite, landfill, or underground tanks or containers now or previously located on the Property; (5) any wetlands, as defined by federal or state law or regulation, affecting the Property; or (6) any threatened or endangered species or their habitat affecting the Property. 8. BROKERS' FEES: All obligations of the parties for payment of brokers' fees are contained in separate written agreements. 9. CLOSING: A. The closing of the sale will be on or before May 3 , 2021 , or within 7 days after objections made under Paragraph 6D have been cured or waived, whichever date is later (Closing Date). If either party fails to close the sale by the Closing Date, the non-defaulting party may exercise the remedies contained in Paragraph 15. B. At closing: (1) Seller shall execute and deliver a general warranty deed conveying title to the Property to Buyer and showing no additional exceptions to those permitted in Paragraph 6 and furnish tax statements or certificates showing no delinquent taxes on the Property. (2) Buyer shall pay the Sales Price in good funds acceptable to the escrow agent. (3) Seller and Buyer shall execute and deliver any notices, statements, certificates, affidavits, releases, loan documents and other documents reasonably required for the closing of the sale and the issuance of the Title Policy. (4) There will be no liens, assessments, or security interests against the Property which will not be satisfied out of the sales proceeds unless securing the payment of any loans assumed by Buyer and assumed loans will not be in default. 10. POSSESSION: A. Buyer's Possession: Seller shall deliver to Buyer possession of the Property in its present or required condition upon closing and funding. B. Leases: (1) After the Effective Date, Seller may not execute any lease (including but not limited to mineral leases) or convey any interest in the Property without Buyer's written consent. (2) If the Property is subject to any lease to which Seller is a party, Seller shall deliver to Buyer copies of the lease(s) and any move-in condition form signed by the tenant within 7 days after the Effective Date of the contract. 11. SPECIAL PROVISIONS: (Insert only factual statements and business details applicable to the sale. TREC rules prohibit license holders from adding factual statements or business details for which a contract addendum or other form has been promulgated by TREC for mandatory use.) 10,000 Option Money is non refundable $10,000 option fee is non-refundable Special Addendum Provisions attached to this email TXR 1607 Initialed for identification by Buyer and Seller TREC NO. 9-13 Produced with zipForm® by zipLogix 18070 Fifteen Mile Road, Fraser, Michigan 48026 www.zipLogix.com American Drive

Contract Concerning 1900 & 1901 American Dr Lago Vista, TX 78645 Page 5 of 9 2-12-18 (Address of Property) 12. SETTLEMENT AND OTHER EXPENSES: A. The following expenses must be paid at or prior to closing: (1) Expenses payable by Seller (Seller's Expenses): (a) Releases of existing liens, including prepayment penalties and recording fees; release of Seller's loan liability; tax statements or certificates; preparation of deed; one-half of escrow fee; and other expenses payable by Seller under this contract. (b) Seller shall also pay an amount not to exceed $N/A to be applied in the following order: Buyer's Expenses which Buyer is prohibited from paying by FHA, VA, Texas Veterans Land Board or other governmental loan programs, and then to other Buyer's Expenses as allowed by the lender. (2) Expenses payable by Buyer (Buyer's Expenses): Appraisal fees; loan application fees; origination charges; credit reports; preparation of loan documents; interest on the notes from date of disbursement to one month prior to dates of first monthly payments; recording fees; copies of easements and restrictions; loan title policy with endorsements required by lender; loan-related inspection fees; photos; amortization schedules; one-half of escrow fee; all prepaid items, including required premiums for flood and hazard insurance, reserve deposits for insurance, ad valorem taxes and special governmental assessments; final compliance inspection; courier fee; repair inspection; underwriting fee; wire transfer fee; expenses incident to any loan; Private Mortgage Insurance Premium (PMI), VA Loan Funding Fee, or FHA Mortgage Insurance Premium (MIP) as required by the lender; and other expenses payable by Buyer under this contract. B. If any expense exceeds an amount expressly stated in this contract for such expense to be paid by a party, that party may terminate this contract unless the other party agrees to pay such excess. Buyer may not pay charges and fees expressly prohibited by FHA, VA, Texas Veterans Land Board or other governmental loan program regulations. 13. PRORATIONS AND ROLLBACK TAXES: A. PRORATIONS: Taxes for the current year, interest, maintenance fees, assessments, dues and rents will be prorated through the Closing Date. The tax proration may be calculated taking into consideration any change in exemptions that will affect the current year's taxes. If taxes for the current year vary from the amount prorated at closing, the parties shall adjust the prorations when tax statements for the current year are available. If taxes are not paid at or prior to closing, Buyer shall pay taxes for the current year. B. ROLLBACK TAXES: If this sale or Buyer's use of the Property after closing results in the assessment of additional taxes, penalties or interest (Assessments) for periods prior to closing, the Assessments will be the obligation of Buyer. If Assessments are imposed because of Seller's use or change in use of the Property prior to closing, the Assessments will be the obligation of Seller. Obligations imposed by this paragraph will survive closing. 14. CASUALTY LOSS: If any part of the Property is damaged or destroyed by fire or other casualty after the Effective Date of this contract, Seller shall restore the Property to its previous condition as soon as reasonably possible, but in any event by the Closing Date. If Seller fails to do so due to factors beyond Seller's control, Buyer may (a) terminate this contract and the earnest money will be refunded to Buyer (b) extend the time for performance up to 15 days and the Closing Date will be extended as necessary or (c) accept the Property in its damaged condition with an assignment of insurance proceeds, if permitted by Seller's insurance carrier, and receive credit from Seller at closing in the amount of the deductible under the insurance policy. Seller's obligations under this paragraph are independent of any other obligations of Seller under this contract. 15. DEFAULT: If Buyer fails to comply with this contract, Buyer will be in default, and Seller may (a) enforce specific performance, seek such other relief as may be provided by law, or both, or (b) terminate this contract and receive the earnest money as liquidated damages, thereby releasing both parties from this contract. If Seller fails to comply with this contract Seller will be in default and Buyer may (a) enforce specific performance, seek such other relief as may be provided by law, or both, or (b) terminate this contract and receive the earnest money, thereby releasing both parties from this contract. 16. MEDIATION: It is the policy of the State of Texas to encourage resolution of disputes through alternative dispute resolution procedures such as mediation. Any dispute between Seller and Buyer related to this contract which is not resolved through informal discussion will be submitted to a mutually acceptable mediation service or provider. The parties to the mediation shall bear the mediation costs equally. This paragraph does not preclude a party from seeking equitable relief from a court of competent jurisdiction. 17. ATTORNEY'S FEES: A Buyer, Seller, Listing Broker, Other Broker, or escrow agent who prevails in any legal proceeding related to this contract is entitled to recover reasonable attorney's fees and all costs of such proceeding. 18. ESCROW: A. ESCROW: The escrow agent is not (i) a party to this contract and does not have liability for the performance or nonperformance of any party to this contract, (ii) liable for interest on the earnest money and (iii) liable for the loss of any earnest money caused by the failure of any financial institution in which the earnest money has been deposited unless the financial institution is acting as escrow agent. B. EXPENSES: At closing, the earnest money must be applied first to any cash down payment, then to Buyer's Expenses and any excess refunded to Buyer. If no closing occurs, escrow TXR 1607 Initialed for identification by Buyer and Seller TREC NO. 9-13 Produced with zipForm® by zipLogix 18070 Fifteen Mile Road, Fraser, Michigan 48026 www.zipLogix.com American Drive

Contract Concerning 1900 & 1901 American Dr Lago Vista, TX 78645 Page 6 of 9 2-12-18 (Address of Property) agent may: (i) require a written release of liability of the escrow agent from all parties, (ii) require payment of unpaid expenses incurred on behalf of a party, and (iii) only deduct from the earnest money the amount of unpaid expenses incurred on behalf of the party receiving the earnest money. C. DEMAND: Upon termination of this contract, either party or the escrow agent may send a release of earnest money to each party and the parties shall execute counterparts of the release and deliver same to the escrow agent. If either party fails to execute the release, either party may make a written demand to the escrow agent for the earnest money. If only one party makes written demand for the earnest money, escrow agent shall promptly provide a copy of the demand to the other party. If escrow agent does not receive written objection to the demand from the other party within 15 days, escrow agent may disburse the earnest money to the party making demand reduced by the amount of unpaid expenses incurred on behalf of the party receiving the earnest money and escrow agent may pay the same to the creditors. If escrow agent complies with the provisions of this paragraph, each party hereby releases escrow agent from all adverse claims related to the disbursal of the earnest money. D. DAMAGES: Any party who wrongfully fails or refuses to sign a release acceptable to the escrow agent within 7 days of receipt of the request will be liable to the other party for (i) damages; (ii) the earnest money; (iii) reasonable attorney's fees; and (iv) all costs of suit. E. NOTICES: Escrow agent's notices will be effective when sent in compliance with Paragraph 21. Notice of objection to the demand will be deemed effective upon receipt by escrow agent. 19. REPRESENTATIONS: All covenants, representations and warranties in this contract survive closing. If any representation of Seller in this contract is untrue on the Closing Date, Seller will be in default. Unless expressly prohibited by written agreement, Seller may continue to show the Property and receive, negotiate and accept back up offers. 20. FEDERAL TAX REQUIREMENTS: If Seller is a "foreign person," as defined by Internal Revenue Code and its regulations, or if Seller fails to deliver an affidavit or a certificate of non- foreign status to Buyer that Seller is not a "foreign person," then Buyer shall withhold from the sales proceeds an amount sufficient to comply with applicable tax law and deliver the same to the Internal Revenue Service together with appropriate tax forms. Internal Revenue Service regulations require filing written reports if currency in excess of specified amounts is received in the transaction. 21. NOTICES: All notices from one party to the other must be in writing and are effective when mailed to, hand-delivered at, or transmitted by fax or electronic transmission as follows: To Buyer at: c/o Ted Kasper To Seller at: Northport Harbor LLC C/O Crystal@AustinRealEstate.com Phone: (512)468-0449 Phone: (512)344-6000 Fax: Fax: E-mail: ted@austinrealestate.com E-mail: 22. AGREEMENT OF PARTIES: This contract contains the entire agreement of the parties and cannot be changed except by their written agreement. Addenda which are a part of this contract are (check all applicable boxes): Third Party Financing Addendum Seller Financing Addendum Addendum for Property Subject to Mandatory Membership in a Property Owners Association Buyer's Temporary Residential Lease Seller's Temporary Residential Lease Addendum for Reservation of Oil, Gas and Other Minerals Addendum for "Back-Up" Contract Addendum Concerning Right to Terminate Due to Lender's Appraisal Addendum for Coastal Area Property Environmental Assessment, Threatened or Endangered Species and Wetlands Addendum Addendum for Property Located Seaward of the Gulf Intracoastal Waterway Addendum for Sale of Other Property by Buyer Addendum for Property in a Propane Gas System Service Area X Other (list): Intermediary Relationship Notice special addendum provisions TXR 1607 Initialed for identification by Buyer and Seller TREC NO. 9-13 Produced with zipForm® by zipLogix 18070 Fifteen Mile Road, Fraser, Michigan 48026 www.zipLogix.com American Drive

Contract Concerning 1900 & 1901 American Dr Lago Vista, TX 78645 Page 7 of 9 2-12-18 (Address of Property) 23. TERMINATION OPTION: For nominal consideration, the receipt of which is hereby acknowledged by Seller, and Buyer's agreement to pay Seller $10,000.00 (Option Fee) within 3 days after the Effective Date of this contract, Seller grants Buyer the unrestricted right to terminate this contract by giving notice of termination to Seller within 75 days after the Effective Date of this contract (Option Period). Notices under this paragraph must be given by 5:00 p.m. (local time where the Property is located) by the date specified. If no dollar amount is stated as the Option Fee or if Buyer fails to pay the Option Fee to Seller within the time prescribed, this paragraph will not be a part of this contract and Buyer shall not have the unrestricted right to terminate this contract. If Buyer gives notice of termination within the time prescribed, the Option Fee will not be refunded; however, any earnest money will be refunded to Buyer. The Option Fee X will will not be credited to the Sales Price at closing. Time is of the essence for this paragraph and strict compliance with the time for performance is required. 24. CONSULT AN ATTORNEY BEFORE SIGNING: TREC rules prohibit real estate license holders from giving legal advice. READ THIS CONTRACT CAREFULLY. Buyer's Attorney is: Advised Seller's Attorney is: Phone: Fax: E-mail: Phone: Fax: E-mail: EXECUTED the 25th day of February , 2021 (Effective Date). (BROKER: FILL IN THE DATE OF FINAL ACCEPTANCE.) 2/16/2021 Buyer Seller S G Blocks Inc. By Paul Galvin Northport Harbor LLC Buyer Seller The form of this contract has been approved by the Texas Real Estate Commission. TREC forms are intended for use only by trained real estate license holders. No representation is made as to the legal validity or adequacy of any provision in any specific transactions. It is not intended for complex transactions. Texas Real Estate Commission, P.O. Box 12188, Austin, TX 78711-2188, (512) 936-3000 (http://www.trec.texas.gov) TREC NO. 9-13. This form replaces TREC NO. 9-12. TXR 1607 TREC NO. 9-13 American Drive Produced with zipForm® by zipLogix 18070 Fifteen Mile Road, Fraser, Michigan 48026 www.zipLogix.com

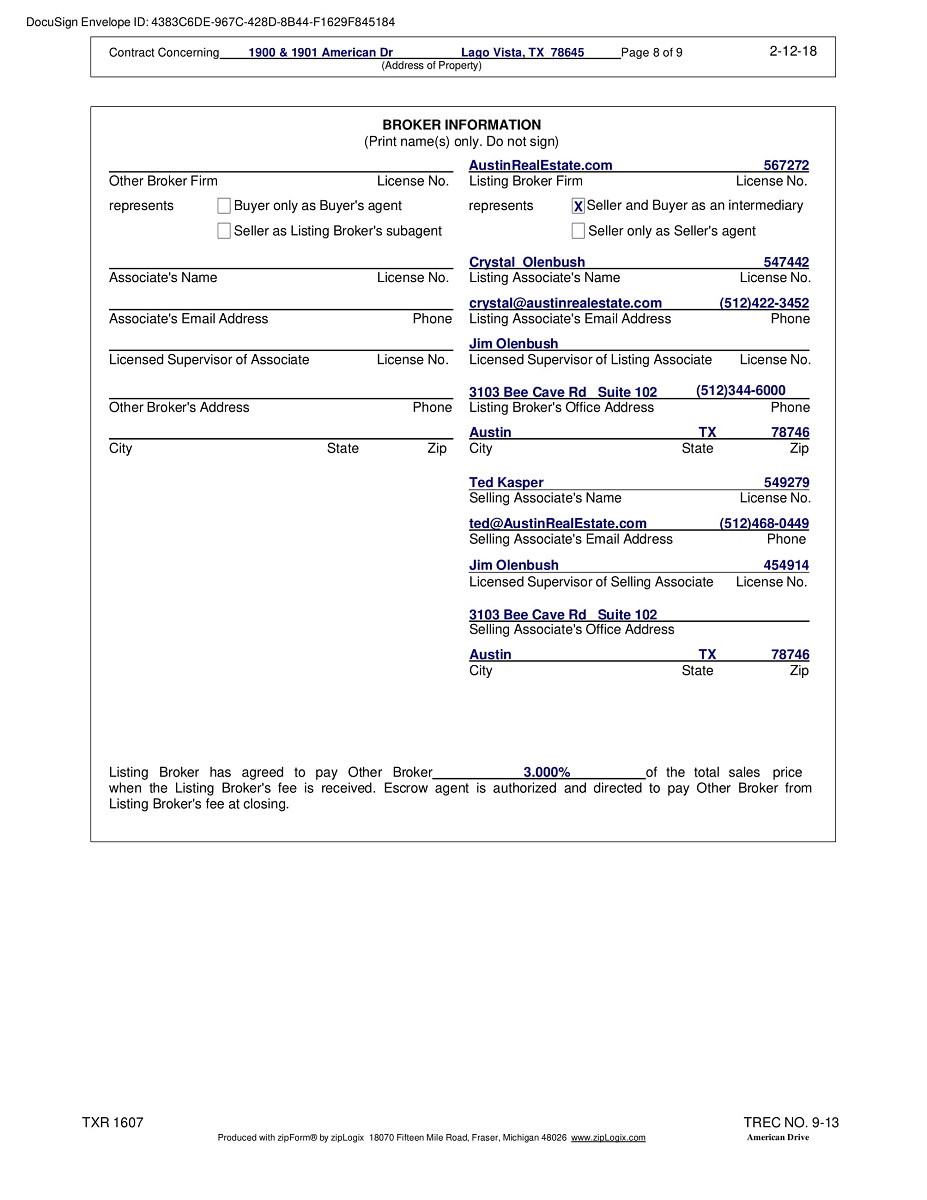

Contract Concerning 1900 & 1901 American Dr Lago Vista, TX 78645 Page 8 of 9 2-12-18 (Address of Property) BROKER INFORMATION (Print name(s) only. Do not sign) AustinRealEstate.com 567272 Other Broker Firm License No. Listing Broker Firm License No. represents Buyer only as Buyer's agent Seller as Listing Broker's subagent represents X Seller and Buyer as an intermediary Seller only as Seller's agent Crystal Olenbush 547442 Associate's Name License No. Listing Associate's Name License No. crystal@austinrealestate.com (512)422-3452 Associate's Email Address Phone Listing Associate's Email Address Phone Jim Olenbush Licensed Supervisor of Associate License No. Licensed Supervisor of Listing Associate License No. 3103 Bee Cave Rd Suite 102 (512)344-6000 Other Broker's Address Phone Listing Broker's Office Address Phone Austin TX 78746 City State Zip City State Zip Ted Kasper 549279 Selling Associate's Name License No. ted@AustinRealEstate.com (512)468-0449 Selling Associate's Email Address Phone Jim Olenbush 454914 Licensed Supervisor of Selling Associate License No. 3103 Bee Cave Rd Suite 102 Selling Associate's Office Address Austin TX 78746 City State Zip Listing Broker has agreed to pay Other Broker 3.000% of the total sales price when the Listing Broker's fee is received. Escrow agent is authorized and directed to pay Other Broker from Listing Broker's fee at closing. TXR 1607 Produced with zipForm® by zipLogix 18070 Fifteen Mile Road, Fraser, Michigan 48026 www.zipLogix.com TREC NO. 9-13 American Drive

Contract Concerning 1900 & 1901 American Dr Lago Vista, TX 78645 Page 9 of 9 2-12-18 (Address of Property) OPTION FEE RECEIPT Receipt of $(Option Fee) in the form of is acknowledged. Seller or Listing Broker Date EARNEST MONEY RECEIPT Receipt of $Earnest Money in the form of is acknowledged. Escrow Agent Received by Email Address Date/Time Address Phone City State Zip Fax CONTRACT RECEIPT Receipt of the Contract is acknowledged. Escrow Agent Received by Email Address Date Address Phone City State Zip Fax ADDITIONAL EARNEST MONEY RECEIPT Receipt of $additional Earnest Money in the form of is acknowledged. Escrow Agent Received by Email Address Date/Time Address Phone City State Zip Fax

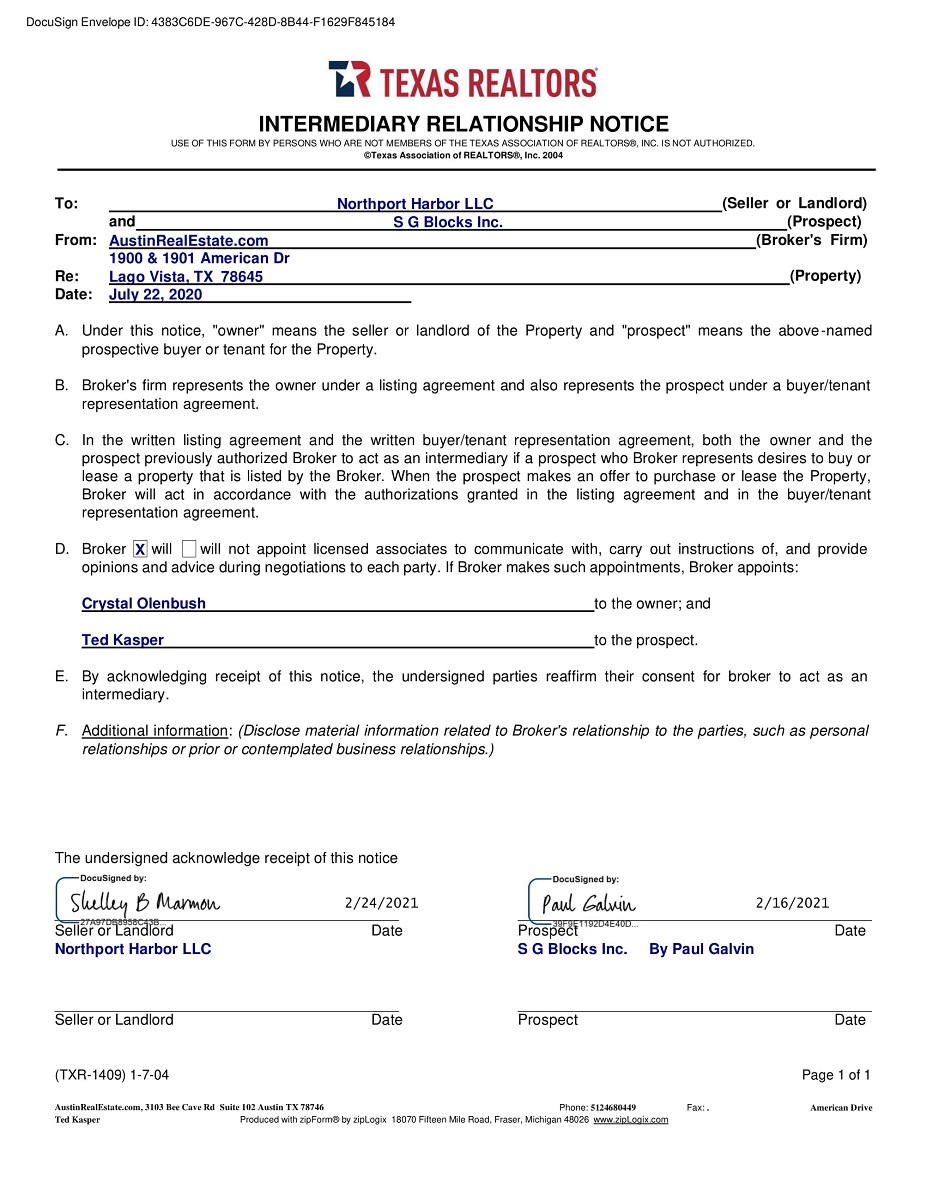

INTERMEDIARY RELATIONSHIP NOTICE USE OF THIS FORM BY PERSONS WHO ARE NOT MEMBERS OF THE TEXAS ASSOCIATION OF REALTORS®, INC. IS NOT AUTHORIZED. ©Texas Association of REALTORS®, Inc. 2004 To: From: Re: Date: Northport Harbor LLC (Seller or Landlord) and S G Blocks Inc. (Prospect) AustinRealEstate.com (Broker's Firm) 1900 & 1901 American Dr Lago Vista, TX 78645 (Property) July 22, 2020 A. Under this notice, "owner" means the seller or landlord of the Property and "prospect" means the above-named prospective buyer or tenant for the Property. B. Broker's firm represents the owner under a listing agreement and also represents the prospect under a buyer/tenant representation agreement. C. In the written listing agreement and the written buyer/tenant representation agreement, both the owner and the prospect previously authorized Broker to act as an intermediary if a prospect who Broker represents desires to buy or lease a property that is listed by the Broker. When the prospect makes an offer to purchase or lease the Property, Broker will act in accordance with the authorizations granted in the listing agreement and in the buyer/tenant representation agreement. D. Broker will will not appoint licensed associates to communicate with, carry out instructions of, and provide X opinions and advice during negotiations to each party. If Broker makes such appointments, Broker appoints: Crystal Olenbush to the owner; and Ted Kasper to the prospect. E. By acknowledging receipt of this notice, the undersigned parties reaffirm their consent for broker to act as an intermediary. F. Additional information: (Disclose material information related to Broker's relationship to the parties, such as personal relationships or prior or contemplated business relationships.) The undersigned acknowledge receipt of this notice 2/16/2021 Prospect Date 2/24/2021 Seller or Landlord Date Northport Harbor LLC S G Blocks Inc. By Paul Galvin Seller or Landlord Date Prospect Date (TXR-1409) 1-7-04 Page 1 of 1 AustinRealEstate.com, 3103 Bee Cave Rd Suite 102 Austin TX 78746 Phone: 5124680449 Fax: .. American Drive Ted Kasper Produced with zipForm® by zipLogix 18070 Fifteen Mile Road, Fraser, Michigan 48026 www.zipLogix.com

SPECIAL PROVISIONS ADDENDUM TO TREC FORM COMMERCIAL UNIMPROVED PROPERTY CONTRACT Seller: Northport Harbor, LLC Buyer: SG Blocks Inc. The terms, conditions, provisions, and agreements set forth in this Addendum shall prevail over the terms, conditions, provisions and agreements set forth in the Printed Form of Commercial Unimproved Property Contract (collectively, “Contract”) to which this Addendum is attached to the extent that they conflict. 1. AS IS Conveyance: a. Buyer acknowledges that (i) Buyer has made, or will make during the inspection period provided herein and prior to the closing of the sale contemplated hereby, all physical, financial, and other examinations relating to the acquisition of the Property hereunder as Buyer deems necessary or prudent and will acquire the same solely on the basis of such examinations, (ii) in entering into this Contract, Buyer intends to rely solely on such examinations of the Property, and (iii) Buyer is acquiring the Property “AS IS,” “WHERE IS,” and “WITH ALL FAULTS.” No patent or latent physical condition of the Property, whether or not now known or discovered or discoverable through inspection or not, shall affect the rights of either party hereto. No agreement, warranty, or representation, unless expressly contained herein, shall bind Seller. b. NOTWITHSTANDING ANYTHING HEREIN TO THE CONTRARY, BUYER HEREBY ACKNOWLEDGES, REPRESENTS, WARRANTS, COVENANTS, AND AGREES THAT AS A MATERIAL INDUCEMENT TO SELLER TO EXECUTE AND ACCEPT THIS CONTRACT AND IN CONSIDERATION OF THE PERFORMANCE BY SELLER OF SELLER’S DUTIES AND OBLIGATIONS UNDER THIS CONTRACT, SELLER AND ANYONE ACTING ON BEHALF OF SELLER HAVE NOT MADE, DO NOT MAKE, AND SPECIFICALLY NEGATE AND DISCLAIM ANY REPRESENTATIONS, WARRANTIES, OR GUARANTIES OF ANY KIND, TYPE, CHARACTER, OR NATURE WHATSOEVER, WHETHER EXPRESS OR IMPLIED, ORAL OR WRITTEN, PAST, PRESENT, FUTURE, OR OTHERWISE, OF, AS TO, CONCERNING, OR WITH RESPECT TO THE PROPERTY, INCLUDING WITHOUT LIMITATION: (i) THE EXISTENCE OF HAZARDOUS MATERIALS OR SUBSTANCES OR ANY ENVIRONMENTAL CONDITIONS UPON OR AFFECTING THE PROPERTY OR ANY PORTION THEREOF; (ii) USAGES OF ADJOINING PROPERTIES; (iii) DEVELOPMENT RIGHTS, ENTITLEMENTS, AND EXTRACTIONS; (iv) THE ABILITY OF BUYER TO REZONE THE PROPERTY OR CHANGE THE USE OF THE PROPERTY; (v) THE EXISTENCE AND POSSIBLE LOCATION OF ANY UNDERGROUND UTILITIES; (vi) THE CONDITION OR USE OF THE PROPERTY OR COMPLIANCE OF THE PROPERTY WITH ANY OR ALL PAST, PRESENT, OR FUTURE FEDERAL, STATE, OR LOCAL ORDINANCES, RULES, REGULATIONS, OR LAWS, BUILDING, FIRE, OR ZONING ORDINANCES, CODES, OR OTHER SIMILAR LAWS; (vii) THOSE AS TO CONDITION, MERCHANTABILITY, TENANTABILITY, HABITABILITY, SUITABILITY, AND FITNESS FOR A PARTICULAR PURPOSE OR USE; OR (viii) THE ADEQUACY AND ACCURACY OF ANY

DESCRIPTION OF THE PROPERTY. BUYER HEREBY ACKNOWLEDGES AND AGREES THAT BUYER HAS AND WILL RELY SOLELY ON THE INSPECTIONS, INVESTIGATIONS, EXAMINATIONS, JUDGMENT, AND EXPERTISE OF BUYER IN ACQUIRING THE PROPERTY, AND NOT UPON ANY ALLEGED WARRANTIES, REPRESENTATIONS, OR GUARANTIES OF SELLER OR ANYONE ACTING FOR OR ON BEHALF OF SELLER. BUYER FURTHER ACKNOWLEDGES AND AGREES THAT ANY DUE DILIGENCE MATERIALS AND OTHER INFORMATION MADE AVAILABLE TO BUYER OR PROVIDED OR TO BE PROVIDED BY OR ON BEHALF OF SELLER WITH RESPECT TO THE PROPERTY FROM THIRD PARTY SOURCES WAS OBTAINED FROM A VARIETY OF SOURCES AND THAT SELLER HAS NOT MADE ANY INDEPENDENT INVESTIGATION OR VERIFICATION OF SUCH INFORMATION AND MAKES NO REPRESENTATIONS AS TO THE ACCURACY OR COMPLETENESS OF SUCH INFORMATION. SELLER IS NOT LIABLE OR BOUND IN ANY MANNER BY ANY ORAL OR WRITTEN STATEMENTS, REPRESENTATIONS, OR INFORMATION PERTAINING TO THE PROPERTY OR THE OPERATION THEREOF FURNISHED BY ANY REAL ESTATE BROKER, AGENT, EMPLOYEE, SERVANT, OR OTHER PERSON. THE PROVISIONS OF THIS PARAGRAPH SHALL SURVIVE THE CLOSING. c. THE CLOSING OF THE PURCHASE OF THE PROPERTY BY BUYER HEREUNDER SHALL BE CONCLUSIVE EVIDENCE THAT: (i) BUYER HAS FULLY AND COMPLETELY INSPECTED (OR HAS CAUSED TO BE FULLY AND COMPLETELY INSPECTED) THE PROPERTY; (ii) BUYER ACCEPTS THE PROPERTY AS BEING IN GOOD AND SATISFACTORY CONDITION AND SUITABLE FOR BUYER’S PURPOSES; AND (iii) BUYER IS ASSUMING ALL RISKS WITH RESPECT TO THE PROPERTY INCLUDING, WITHOUT LIMITATION, THE ADEQUACY AND ACCURACY OF ANY DESCRIPTION OF THE PROPERTY, THE CONDITION, VALUE AND MARKETABILITY OF THE PROPERTY, AND ALL OTHER ASPECTS AND CHARACTERISTICS OF THE PROPERTY WHICH MAY AFFECT BUYER’S PROPOSED DEVELOPMENT, USE, AND OPERATION OF THE PROPERTY. THE PROVISIONS OF THIS PARAGRAPH SHALL SURVIVE THE CLOSING. 2. Removal of Blocks. No later than thirty (30) days after the Closing, Seller shall be allowed to remove the stone blocks located on the Property. 3. 1031 Transaction. Buyer understands and agrees that Seller may complete this transaction as part of an exchange of like-kind properties in accordance with Section 1031 of the Internal Revenue Code, as amended. Buyer agrees to take all reasonable steps requested by Seller so that the sale is consummated as an exchange that complies with the provisions of Section 1031. The other provisions of the Contract will not be affected in the event the potential exchange does not occur. 4. Breach by Seller. If Seller breaches the Contract and fails to close, Buyer’s sole remedy shall be to sue for specific performance no later than September 1, 2021. 5. Increase in Option Fee. If Buyer has not terminated the Contract on or before April 1, 2021, Ten Thousand Dollars ($10,000.00) of the Earnest Money shall be added to the Option Fee (so that the Option Fee will then be Twenty Thousand Dollars ($20,000.00)) and the entire

Option Fee shall be released to Seller by the Title Company. At Closing, if Closing occurs, the Option Fee shall be credited to the Purchase Price. 6. Return of Earnest Money. Should the buyer timely exercise its right to terminate the Contract, the earnest money deposit will be returned to the Buyer 7 to 10 days after it receives the termination less the Option Fee which, if it has not already been paid, shall be paid to Seller. 7. Title Insurance. The title insurance shall be effective at closing. 8. No Other Amendments. Other than as amended herein, the Contract shall remain as originally written and in full force and effect. Defined terms used but not defined herein shall have the same meaning as those in the Contract. 9. Confidentiality. Seller and Buyer agree to keep the identity of the parties, the terms of the Contract and its existence strictly confidential and will disclose such information only to their respective counsel, accountants and brokers; to the Title Company and such other persons as are necessary to complete the transaction contemplated hereby (and each such person shall be requested to keep such information confidential and to no other persons unless such disclosure is compelled by law, court or governmental order. 10. Counterparts: Facsimile Signatures. The Contract may be executed in multiple counterparts, each of which counterpart shall be deemed an original and all of which, when taken together, shall constitute one and the same agreement. The delivery of execution counterparts of this Contract by facsimile transmission or email shall have the force and effect of original signatures. [Signature Page Follows]

AGREED TO effective as of the Effective Date of the Contract. SELLER: Northport Harbor, LLC By: Shelley B. Marmon, Managing Member BUYER: 2/25/2021 Paul Galvin, S G Blocks Inc.