Exhibit 10.3

Deed of Trust and Security Agreement

Terms

| Date: | March 30, 2023 |

| Grantor: | LV PENINSULA HOLDING, LLC, a Texas limited liability company |

| Grantor’s Mailing Address: | 990 Biscayne Blvd., Suite 501 Miami, Florida 33132 |

| Trustee: | BENJAMIN K. WILLIAMS or BENJAMIN H. HA |

| Trustee’s Mailing Address: | 10119 Lake Creek Parkway, Ste 201 Austin, Texas 78729 |

| Lender: | AUSTERRA STABLE GROWTH FUND, LP |

| Lender’s Mailing Address: | c/o Stallion Funding, LLC |

| 10119 Lake Creek Parkway, Ste 202 | |

| Austin, Texas 78729 |

Obligation

Note

| Date: | of even date hereof | |

| Original principal amount: | $5,000,000.00 | |

| Borrower: | LV PENINSULA HOLDING, LLC, | |

| a Texas limited liability company | ||

| Lender: | AUSTERRA STABLE GROWTH FUND, LP | |

| Maturity date: | April 1, 2024 |

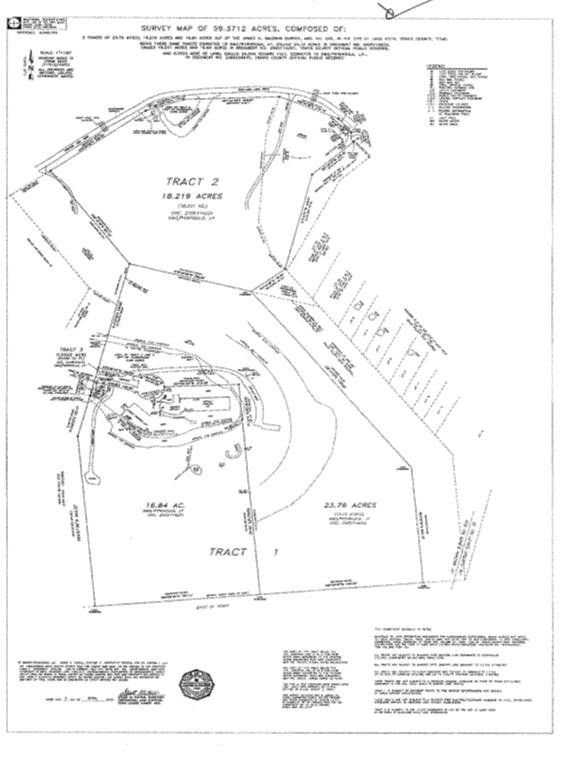

Property (including any improvements):

Being that certain tract of land stated to contain 59.3712 acres, more or less, out of the K. BALDWIN SURVEY NO. 600, ABST 90, Travis County, Texas; and out of a portion of Lot 1, AMENDED PLAT OF THE COVE AT LAGO VISTA, a subdivision in Travis County, Texas, according to the map or plat thereof recorded in Volume 87, Page 174C, Plat Records of Travis County, Texas. Said 59.3712 acre tract being more particularly described by metes and bounds in Exhibit “A” attached hereto and made a part hereof.

Page 1 of 13

Together with the following personal property:

All fixtures, supplies, building materials, and other goods of every nature now or hereafter located, used, or intended to be located or used on the Property;

All plans and specifications for development of or construction of improvements on the Property;

All contracts and subcontracts relating to the construction of improvements on the Property;

All accounts, contract rights, instruments, documents, general intangibles, and chattel paper arising from or by virtue of any transactions relating to the Property;

All permits, licenses, franchises, certificates, and other rights and privileges obtained in connection with the Property;

All proceeds payable or to be payable under each policy of insurance relating to the Property; and

All products and proceeds of the foregoing.

Notwithstanding any other provision in this deed of trust, the term “Property” does not include personal effects used primarily for personal, family, or household purposes.

Prior Liens: None

Other Exceptions to Conveyance and Warranty:

Subject to the Permitted Exceptions listed in the attached Exhibit “B” only.

For value received and to secure payment of the Obligation, Grantor conveys the Property to Trustee in trust. Grantor warrants and agrees to defend the title to the Property, subject to the Other Exceptions to Conveyance and Warranty. On payment of the Obligation and all other amounts secured by this deed of trust, this deed of trust will have no further effect, and Lender will release it at Grantor’s expense.

Clauses and Covenants

| A. | Grantor’s Obligations |

Grantor agrees to—

1. keep the Property in good repair and condition;

2. pay all taxes and assessments on the Property before delinquency, not authorize a taxing entity to transfer its tax lien on the Property to anyone other than Lender, and not request a deferral of the collection of taxes pursuant to section 33.06 of the Texas Tax Code;

Page 2 of 13

3. defend title to the Property subject to the Other Exceptions to Conveyance and Warranty and preserve the lien’s priority as it is established in this deed of trust;

4. maintain all insurance coverages with respect to the Property, revenues generated by the Property, and operations on the Property that Lender reasonably requires (“Required Insurance Coverages”), issued by insurers and written on policy forms acceptable to Lender, and as to property loss, that are payable to Lender under policies containing standard mortgagee clauses, and deliver evidence of the Required Insurance Coverages in a form acceptable to Lender at least ten days before the expiration of the Required Insurance Coverages;

5. obey all laws, ordinances, and restrictive covenants applicable to the Property;

6. keep any buildings occupied as required by the Required Insurance Coverages;

7. if the lien of this deed of trust is not a first lien, pay or cause to be paid all prior lien notes and abide by or cause to be abided by all prior lien instruments; and

8. notify Lender of any change of address.

| B. | Lender’s Rights |

1. Lender or Lender’s mortgage servicer may appoint in writing one or more substitute trustees, succeeding to all rights and responsibilities of Trustee. Such written appointments need not be filed in the Official Public Records of the county where the property is located or in any other public or governmental records in order to be effective. All rights, remedies and duties of Trustee under this Deed of Trust may be exercised or performed by one or more trustees acting alone or together.

| a. | Lender, at its option and with or without cause, may from time to time, by power of attorney or otherwise, remove or substitute any trustee, add one or more trustees, or appoint a successor trustee to any Trustee without the necessity of any formality other than a designation by Lender in writing. Without any further act or conveyance of the Property the substitute, additional or successor trustee shall become vested with the title, rights, remedies, powers and duties conferred upon Trustee herein and by Applicable Law. |

| b. | Neither the Trustee named herein nor any Trustee who may act hereunder shall in any way be disqualified from acting as such Trustee for the reason that he may now be, may become or at any applicable time may be a manager, director, an officer, an employee, a shareholder, an agent, or an attorney of Lender or may be otherwise related to Lender. |

Page 3 of 13

| c. | Trustee shall not be liable if acting upon any notice, request, consent, demand, statement or other document believed by Trustee to be correct. Trustee shall not be liable for any act or omission unless such act or omission is willful. |

2. If the proceeds of the Obligation are used to pay any debt secured by prior liens, Lender is subrogated to all the rights and liens of the holders of any debt so paid.

3. Lender may apply any proceeds received under the property insurance policies covering the Property either to reduce the Obligation or to repair or replace damaged or destroyed improvements covered by the policy. If the Property is Grantor’s primary residence and Lender reasonably determines that repairs to the improvements are economically feasible, Lender will make the property insurance proceeds available to Grantor for repairs.

4. Notwithstanding the terms of the Note to the contrary, and unless applicable law prohibits, all payments received by Lender from Grantor with respect to the Obligation or this deed of trust may, at Lender’s discretion, be applied first to amounts payable under this deed of trust and then to amounts due and payable to Lender with respect to the Obligation, to be applied to late charges, principal, or interest in the order Lender in its discretion determines.

5. If Grantor fails to perform any of Grantor’s obligations, Lender may perform those obligations and be reimbursed by Grantor on demand for any amounts so paid, including attorney’s fees, plus interest on those amounts from the dates of payment at the rate stated in the Note for matured, unpaid amounts. The amount to be reimbursed will be secured by this deed of trust.

6. COLLATERAL PROTECTION INSURANCE NOTICE

In accordance with the provisions of section 307.052(a) of the Texas Finance Code, the Lender hereby notifies the Grantor as follows:

(A) the Grantor is required to:

| (i) | keep the collateral insured against damage in the amount the Lender specifies; |

| (ii) | purchase the insurance from an insurer that is authorized to do business in the state of Texas or an eligible surplus lines insurer; and |

| (iii) | name the Lender as the person to be paid under the policy in the event of a loss; |

(B) the Grantor must, if required by the Lender, deliver to the Lender a copy of the policy and proof of the payment of premiums; and

(C) if the Grantor fails to meet any requirement listed in Paragraph (A) or (B), the Lender may obtain collateral protection insurance on behalf of the Grantor at the Grantor’s expense.

Page 4 of 13

7. If there is a default on the Obligation or if Grantor fails to perform any of Grantor’s obligations and the default continues after any required notice of the default and the time allowed to cure, Lender may—

| a. | declare the unpaid principal balance and earned interest on the Obligation immediately due; |

| b. | exercise Lender’s rights with respect to rent under the Texas Property Code as then in effect; |

| c. | direct Trustee to foreclose this lien, in which case Lender or Lender’s agent will cause notice of the foreclosure sale to be given as provided by the Texas Property Code as then in effect; and |

| d. | purchase the Property at any foreclosure sale by offering the highest bid and then have the bid credited on the Obligation. |

8. Lender may remedy any default without waiving it and may waive any default without waiving any prior or subsequent default.

9. Protection of Lender’s Interest in the Property and Rights Under this Security Instrument. If (a) Borrower fails to perform the covenants and agreements contained in this Security Instrument, (b) there is a legal proceeding that might significantly affect Lender’s interest in the Property and/or rights under this Security Instrument (such as a proceeding in bankruptcy, probate, for condemnation or forfeiture, for enforcement of a lien which may attain priority over this Security Instrument or to enforce laws or regulations), or (c) Borrower has abandoned the Property, then Lender may do and pay for whatever is reasonable or appropriate to protect Lender’s interest in the Property and rights under this Security Instrument, including protecting and/or assessing the value of the Property, and securing and/or repairing the Property. Lender’s actions can include, but are not limited to: (a) paying any sums secured by a lien which has priority over this Security Instrument; (b) appearing in court; and (c) paying reasonable attorneys’ fees to protect its interest in the Property and/or rights under this Security Instrument, including its secured position in a bankruptcy proceeding. Securing the Property includes, but is not limited to, entering the Property to make repairs, change locks, replace or board up doors and windows, drain water from pipes, eliminate building or other code violations or dangerous conditions, and have utilities turned on or off. Although Lender may take action under this Section 9, Lender does not have to do so and is not under any duty or obligation to do so. It is agreed that Lender incurs no liability for not taking any or all actions authorized under this Section 9.

Any amounts disbursed by Lender under this Section 9 shall become additional debt of Borrower secured by this Security Instrument. These amounts shall bear interest at the Note rate from the date of disbursement and shall be payable, with such interest, upon notice from Lender to Borrower requesting payment.

Page 5 of 13

| C. | Trustee’s Rights and Duties |

If directed by Lender to foreclose this lien, Trustee will—

1. either personally or by agent give notice of the foreclosure sale as required by the Texas Property Code as then in effect;

2. sell and convey all or part of the Property “AS IS” to the highest bidder for cash with a general warranty binding Grantor, subject to the Prior Lien and to the Other Exceptions to Conveyance and Warranty and without representation or warranty, express or implied, by Trustee;

3. from the proceeds of the sale, pay, in this order—

| a. | expenses of foreclosure, including a reasonable commission to Trustee; |

| b. | to Lender, the full amount of principal, interest, attorney’s fees, and other charges due and unpaid; |

| c. | any amounts required by law to be paid before payment to Grantor; and |

| d. | to Grantor, any balance; and |

4. be indemnified, held harmless, and defended by Lender against all costs, expenses, and liabilities incurred by Trustee for acting in the execution or enforcement of the trust created by this deed of trust, which includes all court and other costs, including attorney’s fees, incurred by Trustee in defense of any action or proceeding taken against Trustee in that capacity.

| D. | General Provisions |

1. If any of the Property is sold under this deed of trust, Grantor must immediately surrender possession to the purchaser. If Grantor fails to do so, Grantor will become a tenant at sufferance of the purchaser, subject to an action for forcible detainer.

2. Recitals in any trustee’s deed conveying the Property will be presumed to be true.

3. Proceeding under this deed of trust, filing suit for foreclosure, or pursuing any other remedy will not constitute an election of remedies.

4. This lien will remain superior to liens later created even if the time of payment of all or part of the Obligation is extended or part of the Property is released.

5. If any portion of the Obligation cannot be lawfully secured by this deed of trust, payments will be applied first to discharge that portion.

Page 6 of 13

6. Grantor assigns to Lender all amounts payable to or received by Grantor from condemnation of all or part of the Property, from private sale in lieu of condemnation, and from damages caused by public works or construction on or near the Property. After deducting any expenses incurred, including attorney’s fees and court and other costs, Lender will either release any remaining amounts to Grantor or apply such amounts to reduce the Obligation. Lender will not be liable for failure to collect or to exercise diligence in collecting any such amounts. Grantor will immediately give Lender notice of any actual or threatened proceedings for condemnation of all or part of the Property.

7. Grantor collaterally assigns to Lender all present and future rent from the Property and its proceeds. Grantor warrants the validity and enforceability of the assignment. Grantor will apply all rent to payment of the Obligation and performance of this deed of trust, but if the rent exceeds the amount due with respect to the Obligation and the deed of trust, Grantor may retain the excess. If a default exists in payment of the Obligation or performance of this deed of trust, Lender may exercise Lender’s rights with respect to rent under the Texas Property Code as then in effect. Lender neither has nor assumes any obligations as lessor or landlord with respect to any occupant of the Property. Lender may exercise Lender’s rights and remedies under this paragraph without taking possession of the Property. Lender will apply all rent collected under this paragraph as required by the Texas Property Code as then in effect. Lender is not required to act under this paragraph, and acting under this paragraph does not waive any of Lender’s other rights or remedies.

8. Interest on the debt secured by this deed of trust will not exceed the maximum amount of nonusurious interest that may be contracted for, taken, reserved, charged, or received under law. Any interest in excess of that maximum amount will be credited on the principal of the debt or, if that has been paid, refunded. On any acceleration or required or permitted prepayment, any such excess will be canceled automatically as of the acceleration or prepayment or, if already paid, credited on the principal of the debt or, if the principal of the debt has been paid, refunded. This provision overrides any conflicting provisions in this and all other instruments concerning the debt.

9. In no event may this deed of trust secure payment of any debt that may not lawfully be secured by a lien on real estate or create a lien otherwise prohibited by law.

10. Grantor may not sell, transfer, or otherwise dispose of any Property, whether voluntarily or by operation of law, without the prior written consent of Lender. If granted, consent may be conditioned upon (a) the grantee’s integrity, reputation, character, creditworthiness, and management ability being satisfactory to Lender; and (b) the grantee’s executing, before such sale, transfer, or other disposition, a written assumption agreement containing any terms Lender may require, such as a principal pay down on the Obligation, an increase in the rate of interest payable with respect to the Obligation, a transfer fee, or any other modification of the Note, this deed of trust, or any other instruments evidencing or securing the Obligation.

Grantor may not cause or permit any Property to be encumbered by any liens, security interests, or encumbrances other than the liens securing the Obligation and the liens securing ad valorem taxes not yet due and payable without the prior written consent of Lender. If granted, consent may be conditioned upon Grantor’s executing, before granting such lien, a written modification agreement containing any terms Lender may require, such as a principal pay down on the Obligation, an increase in the rate of interest payable with respect to the Obligation, an approval fee, or any other modification of the Note, this deed of trust, or any other instruments evidencing or securing the Obligation.

Page 7 of 13

Grantor may not grant any lien, security interest, or other encumbrance (a “Subordinate Instrument”) covering the Property that is subordinate to the liens created by this deed of trust without the prior written consent of Lender. If granted, consent may be conditioned upon the Subordinate Instrument’s containing express covenants to the effect that—

| a. | the Subordinate Instrument is unconditionally subordinate to this deed of trust; |

| b. | if any action is instituted to foreclose or otherwise enforce the Subordinate Instrument, no action may be taken that would terminate any occupancy or tenancy without the prior written consent of Lender, and that consent, if granted, may be conditioned in any manner Lender determines; |

| c. | rents, if collected by or for the holder of the Subordinate Instrument, will be applied first to the payment of the Obligation then due and to expenses incurred in the ownership, operation, and maintenance of the Property in any order Lender may determine, before being applied to any indebtedness secured by the Subordinate Instrument; |

| d. | written notice of default under the Subordinate Instrument and written notice of the commencement of any action to foreclose or otherwise enforce the Subordinate Instrument must be given to Lender concurrently with or immediately after the occurrence of any such default or commencement; and |

| e. | in the event of the bankruptcy of Grantor, all amounts due on or with respect to the Obligation and this deed of trust will be payable in full before any payments on the indebtedness secured by the Subordinate Instrument. |

Grantor may not cause or permit any of the following events to occur without the prior written consent of Lender: if Grantor is (a) a corporation, the dissolution of the corporation or the sale, pledge, encumbrance, or assignment of any shares of its stock; (b) a limited liability company, the dissolution of the company or the sale, pledge, encumbrance, or assignment of any of its membership interests; (c) a general partnership or joint venture, the dissolution of the partnership or venture or the sale, pledge, encumbrance, or assignment of any of its partnership or joint venture interests, or the withdrawal from or admission into it of any general partner or joint venturer; or (d) a limited partnership, (i) the dissolution of the partnership, (ii) the sale, pledge, encumbrance, or assignment of any of its general partnership interests, or the withdrawal from or admission into it of any general partner, (iii) the sale, pledge, encumbrance, or assignment of a controlling portion of its limited partnership interests, or (iv) the withdrawal from or admission into it of any controlling limited partner or partners. If granted, consent may be conditioned upon (a) the integrity, reputation, character, creditworthiness, and management ability of the person succeeding to the ownership interest in Grantor (or security interest in such ownership) being satisfactory to Lender; and (b) the execution, before such event, by the person succeeding to the interest of Grantor in the Property or ownership interest in Grantor (or security interest in such ownership) of a written modification or assumption agreement containing such terms as Lender may require, such as a principal pay down on the Obligation, an increase in the rate of interest payable with respect to the Obligation, a transfer fee, or any other modification of the Note, this deed of trust, or any other instruments evidencing or securing the Obligation.

Page 8 of 13

11. When the context requires, singular nouns and pronouns include the plural.

12. The term Note includes all extensions, modifications, and renewals of the Note and all amounts secured by this deed of trust.

13. This deed of trust binds, benefits, and may be enforced by the successors in interest of all parties.

14. If Grantor and Borrower are not the same person, the term Grantor includes Borrower.

15. Grantor and each surety, endorser, and guarantor of the Obligation waive, to the extent permitted by law, all (a) demand for payment, (b) presentation for payment, (c) notice of intention to accelerate maturity, (d) notice of acceleration of maturity, (e) protest, (f) notice of protest, and (g) rights under sections 51.003, 51.004, and 51.005 of the Texas Property Code.

16. Grantor agrees to pay reasonable attorney’s fees, trustee’s fees, and court and other costs of enforcing Lender’s rights under this deed of trust if this deed of trust is placed in the hands of an attorney for enforcement.

17. If any provision of this deed of trust is determined to be invalid or unenforceable,

the validity or enforceability of any other provision will not be affected.

18. The term Lender includes any mortgage servicer for Lender.

19. Grantor represents that this deed of trust and the Note are given for the following purposes:

The Note renews and extends the balance that Grantor owes on a prior note in the original principal amount of TWO MILLION DOLLARS and 00/100 ($2,000,000.00), which is dated July 14, 2021, executed by SGB DEVELOPMENT CORP., a Delaware corporation, and payable to WEINRITTER REALTY, LP, a Texas limited partnership. Prior note is more fully described in and secured by a deed of trust on the Property, which is dated of even date, and recorded under Document Number 2021157556 of the Real Property Records of Travis County, Texas. Additionally, this Note renews and extends the balance that Grantor owes on a second lien note in the original principal amount of FIVE HUNDRED THOUSAND and 00/100 Dollars, which is dated September 8, 2022, executed by SGB DEVELOPMENT CORP, a Delaware limited liability company, and payable to WEINRITTER REALTY, LP, a Texas limited partnership. Prior second lien is more fully described in and secured by a deed of trust on the Property, which is dated of even date, and recorded under Document Number 2022152151, Official Public Records of Travis County, Texas. The balance of the indebtedness is for closing costs, interest carry, and cash out of the Property.

Page 9 of 13

Grantor warrants to Lender and agrees that the proceeds of the Note will be used primarily for business or commercial purposes and not primarily for personal, family, or household purposes.

Grantor warrants to Lender that the Property will not be used as the Grantor’s residence during the term of the Obligation.

20. This conveyance is also made in trust to secure payment of all other present and future debts that Grantor may owe to Lender, regardless of how any other such debt is incurred or evidenced. Payment on all present and future debts of Grantor to Lender will be made and the debts will bear interest as provided in notes or other evidences of debt that Grantor will give to Lender. This conveyance is also made to secure payment of any renewal or extension of any present or future debt that Grantor owes to Lender, including any loans and advancements from Lender to Grantor under the provisions of this deed of trust. When Grantor repays all debts owed to Lender, this deed-of-trust lien will terminate only if Lender releases this deed of trust at the request of Grantor. Until Lender releases it, this deed of trust will remain fully in effect to secure other present and future advances and debts, regardless of any additional security given for any debt and regardless of any modification.

21. Grantor agrees to make an initial deposit in a reasonable amount to be determined by Lender and then make monthly payments to a fund for taxes on the Property. Monthly payments will be made on the payment dates specified in the Note, and each payment will be one-twelfth of the amount that Lender estimates will be required annually for payment of taxes. The fund will accrue no interest, and Lender will hold it without bond in escrow and use it to pay the taxes. If Grantor has complied with the requirements of this paragraph, Lender must pay taxes before the end of the calendar year. Grantor agrees to make additional deposits on demand if the fund is ever insufficient for its purpose. If an excess accumulates in the fund, Lender may either credit it to future monthly deposits until the excess is exhausted or refund it to Grantor. When Grantor makes the final payment on the Note, Lender will credit to that payment the whole amount then in the fund or, at Lender’s option, refund it after the Note is paid. If this deed of trust is foreclosed, any balance in the fund over that needed to pay taxes, including taxes accruing but not yet payable, and to pay insurance premiums will be paid under part C, “Trustee’s Rights and Duties.” Deposits to the fund described in this paragraph are in addition to the monthly payments provided for in the Note.

22. Grantor hereby grants Lender a right of first refusal with respect to Grantor’s power to authorize any third party (other than Lender pursuant to its rights as set forth in this instrument) to pay ad valorem taxes on the Property and authorize a taxing entity to transfer its tax lien on the Property to that third party. Grantor’s authorization to any third party (other than Lender) to pay the ad valorem taxes and receive transfer of a taxing entity’s lien for ad valorem taxes shall be null and void and of no force and effect unless Lender, within ten days after receiving written notice from Grantor, fails to pay the ad valorem taxes pursuant to Lender’s rights as set forth in this instrument.

Page 10 of 13

22.23. As used in this section: (a) “Hazardous Substances” are those substances defined as toxic or hazardous substances, pollutants, or wastes by Environmental Law and the following substances: gasoline, kerosene, other flammable or toxic petroleum products, toxic pesticides and herbicides, volatile solvents, materials containing asbestos or formaldehyde, and radioactive materials; (b) “Environmental Law” means federal laws and laws of the jurisdiction where the Property is located that relate to health, safety or environmental protection; (c) “Environmental Cleanup” includes any response action, remedial action, or removal action, as defined in Environmental Law; and (d) an “Environmental Condition” means a condition that can cause, contribute to, or otherwise trigger an Environmental Cleanup.

Grantor shall not cause or permit the presence, use, disposal, storage, or release of any Hazardous Substances, or threaten to release any Hazardous Substances, on or in the Property. Grantor shall not do, nor allow anyone else to do, anything affecting the Property (a) that is in violation of any Environmental Law, (b) which creates an Environmental Condition, or (c) which, due to the presence, use, or release of a Hazardous Substance, creates a condition that adversely affects the value of the Property. The preceding two sentences shall not apply to the presence, use, or storage on the Property of small quantities of Hazardous Substances that are generally recognized to be appropriate to normal residential uses and to maintenance of the Property (including, but not limited to, hazardous substances in consumer products).

Grantor shall promptly give Lender written notice of (a) any investigation, claim, demand, lawsuit or other action by any governmental or regulatory agency or private party involving the Property and any Hazardous Substance or Environmental Law of which Grantor has actual knowledge, (b) any Environmental Condition, including but not limited to, any spilling, leaking, discharge, release or threat of release of any Hazardous Substance, and (c) any condition caused by the presence, use or release of a Hazardous Substance which adversely affects the value of the Property. If Grantor learns, or is notified by any governmental or regulatory authority, or any private party, that any removal or other remediation of any Hazardous Substance affecting the Property is necessary, Grantor shall promptly take all necessary remedial actions in accordance with Environmental Law. Nothing herein shall create any obligation on Lender for an Environmental Cleanup.

24. Grantor agrees to deliver to Lender, at Lender’s request from time to time, financial statements of Grantor and each guarantor of the Note prepared in accordance with generally accepted accounting principles consistently applied, in detail reasonably satisfactory to Lender and certified to be true and correct by Grantor.

25. WAIVER OF JURY TRIAL. GRANTOR WAIVES ANY RIGHT TO A TRIAL BY JURY IN ANY ACTION OR PROCEEDING TO ENFORCE OR DEFEND ANY RIGHTS (i) UNDER THIS DEED OF TRUST OR ANY RELATED DOCUMENT OR UNDER ANY AMENDMENT, INSTRUMENT, DOCUMENT OR AGREEMENT WHICH MAY IN THE FUTURE BE DELIVERED IN CONNECTION HEREWITH OR ANY RELATED DOCUMENT OR (ii) ARISING FROM ANY LENDING RELATIONSHIP EXISTING IN CONNECTION HEREWITH, AND AGREES THAT ANY SUCH ACTION OR PROCEEDING WILL BE TRIED BEFORE A COURT AND NOT BEFORE A JURY. GRANTOR AGREES THAT IT WILL NOT ASSERT ANY CLAIM AGAINST LENDER OR ANY OTHER PERSON INDEMNIFIED UNDER THIS DEED OF TRUST ON ANY THEORY OF LIABILITY FOR SPECIAL, INDIRECT, CONSEQUENTIAL, INCIDENTAL OR PUNITIVE DAMAGES.

26. Venue. Debtor agrees that this Loan shall be deemed to have been made in the State of Texas at Lender’s mailing address indicated at the beginning of this Deed of Trust and shall be governed by, and construed in accordance with, the laws of the State of Texas and is performable in Williamson County, Texas. In any litigation in connection with or to enforce this Deed of Trust, the Note, or any Loan Documents, Grantors, and any guarantors irrevocably consent to and confer personal jurisdiction on the courts of the State of Texas or the United States courts located within the State of Texas. Nothing contained herein shall, however, prevent Lender from bringing any action or exercising any rights within any other state or jurisdiction or from obtaining personal jurisdiction by any other means available under applicable law.

Page 11 of 13

27. Cross-Collateral; Cross Default. Without limiting any of the foregoing provisions of this Deed of Trust, and for clarification, Grantor agrees that this Deed of Trust is pledged as security for any and all other sums, indebtedness, obligations and liabilities of any and every kind now or hereafter existing owing and to become due, from any or all of Grantor or any of its successors, assigns, members, managers, guarantors, or affiliates (collectively, the “Grantor Parties”) to Lender or to assignees thereof, howsoever created, whether under this Deed of Trust, the Loan Documents or any other instrument, obligation, contract, guarantee or agreement of any and every kind among any of the Grantor Parties and Lender, and whether direct, indirect, primary or secondary, fixed or contingent and any renewals, modifications or extensions of any of the foregoing; provided, however, that notwithstanding anything to the contrary herein or therein neither any Guaranty nor any Environmental Indemnity referenced in the Loan Documents nor any other similar agreement between Grantor or any of its Affiliates and Lender or any of its Affiliates are secured by this Deed of Trust and, notwithstanding anything to the contrary herein or in any other Loan Document, all obligations arising under any such documents bare unsecured obligations. A default, not cured within any applicable curative period by any of the Grantor Parties, as applicable, in any such other instrument, obligation, contract, guarantee or agreement of any kind now or hereafter existing among any of the Grantor Parties and Lender, shall constitute a default hereunder and, in like manner, a default hereunder not cured within any applicable curative period shall constitute a default under the terms of such other instrument, obligation, contract, guarantee or agreement. All property of any of the Grantor Parties which stands as security for any of the loans made by Lender to any of the Grantor Parties, whether currently existing or hereafter advanced, shall stand as cross collateral security for all such loans.

28. The lien created by this deed of trust will be cross collateralized with the lien securing payment of ONE MILLION and 00/100 out of the Promissory Note in the original principal amount of FIVE MILLION and 00/100 DOLLARS ($5,000,000.00), which is dated of even date, executed by LV PENINSULA HOLDING, LLC, a Texas limited liability company, payable to the order of AUSTERRA STABLE GROWTH FUND, LP, and more fully described in and securing said loan with a mortgage with power of sale, of even date, against the following described property, to-wit;

Tract II:

Parcel 1: All that part of Lots 1 and 2 lying North and East of the Railroad Right-of-way in Section 4, Township 7 South, Range 9 East of the Indian Base and Meridian, Bryan County, State of Oklahoma, according to the U.S. Government Survey thereof.

Parcel 2: The S/2 SE/4 SE/4 and all of that part of the SW/4 SE/4 lying North and East of the A&C Railroad Right-of-Way in Section 33, Township 6 South, Range 9 East of the Indian Base and Meridian, Bryan County, State of Oklahoma, according to the U.S. Government Survey thereof, LESS AND EXCEPT a roadway and utility easement reserved over the North 80 feet of the West 60 feet of the SW/4 of the SE/4 of Section 33, Township 6 South, Range 9 East.

Parcel 3: The N/2 SE/4 SE/4 of Section 33, Township 6 South, Range 9 East of the Indian Base and Meridian, Bryan County, State of Oklahoma, according to the U.S. Government Survey thereof

The above described mortgage with power of sale to be recorded approximately contemporaneously with this Document, in the Official Public Records of Bryan County, Oklahoma. If default occurs in payment of any part of principal or interest of the note referenced herein or in observance of any covenants of the deed of trust or mortgage with power of sale securing it, the entire debt secured by this deed of trust will immediately become payable at the option of Lender.

29. In addition to creating a deed-of-trust lien on all the real and other property described above, Grantor also grants to Lender a security interest in all of the above-described personal property pursuant to and to the extent permitted by the Texas Uniform Commercial Code.

Page 12 of 13

In the event of a foreclosure sale under this deed of trust, Grantor agrees that all the Property may be sold as a whole at Lender’s option and that the Property need not be present at the place of sale.

| LV PENINSULA HOLDING, LLC, | ||

| a Texas limited liability company | ||

| By: | /s/ Nicolai Brune | |

| NICOLAI BRUNE, CFO and | ||

| Authorized Agent | ||

THE STATE OF TEXAS

COUNTY OF TRAVIS

This instrument was acknowledged before me on the 30TH day of March, 2023, by NICOLAI BRUNE, CFO and Authorized Agent, of LV PENINSULA HOLDING, LLC, a Texas limited liability company, on behalf of said limited liability company.

| /s/ Laura Ann Pagnozzi | |

| Notary Public, State of Texas |

PREPARED BY:

Law

Office of Ben Williams, PLLC

10119 Lake Creek Parkway, Ste 201

Austin, Texas 78729

Page 13 of 13

EXHIBIT A

Exhibit “B”

Permitted Exceptions

| a. | Volume 87, Page 174C, Plat Records, Volume 10693, Page 559, Volume 10768, Page 1667, Real Property Records, Document No(s) 2007045942, 2012064861, 2012064862, 2013217511, Official Public Records, Travis County, Texas, but omitting any covenant or restriction based on race, color, religion, sex, disability, handicap, familial status or national origin. (As to that portion of Lot 1, AMENDED PLAT OF THE COVE AT LAGO VISTA, a subdivision in Travis County, Texas, according to the map or plat thereof recorded in Volume 87, Page 174C, Plat Records of Travis County, Texas.) |

| b. | Maintenance charges and/or assessments secured by a lien as set out in instrument(s) recorded in Document No. 2007045942, Official Public Records, Travis County, Texas. Said lien for charges and assessments is subordinate to purchase money or construction liens as set out therein. (That portion of Lot 1, AMENDED PLAT OF THE COVE AT LAGO VISTA, a subdivision in Travis County, Texas, according to the map or plat thereof recorded in Volume 87, Page 174C, Plat Records of Travis County, Texas) |

| c. | Any and all easements, building lines and conditions, covenants and restrictions as set forth in plat recorded in Volume 87, Page 174C, Plat Records, Travis County, Texas. (That portion of Lot 1, AMENDED PLAT OF THE COVE AT LAGO VISTA, a subdivision in Travis County, Texas, according to the map or plat thereof recorded in Volume 87, Page 174C, Plat Records of Travis County, Texas) |

| e. | Public Utility and Drainage Easement, Recorded in Volume 10768, Page 1667, Real Property Records, Travis County, Texas. (That portion of Lot 1, AMENDED PLAT OF THE COVE AT LAGO VISTA, a subdivision in Travis County, Texas, according to the map or plat thereof recorded in Volume 87, Page 174C, Plat Records of Travis County, Texas) |

| f. | A perpetual easement and right to flood, inundate and submerge granted to the Lower Colorado River Authority, Recorded in Volume 612, Page 38, Deed Records, Travis County, Texas. |

| g. | A perpetual easement and right to flood, inundate and submerge granted to the Lower Colorado River Authority, Recorded in Volume 613, Page 295, Deed Records, Travis County, Texas. |

| h. | A perpetual easement and right to flood, inundate and submerge granted to the Lower Colorado River Authority, Recorded in Volume 1169, Page 89, Deed Records, Travis County, Texas. |

| i. | Right to construct, maintain and operate electric transmission line(s) over and across all or part of the subject property, as described in Volume 1169, Page 89, Deed Records, Travis County, Texas. |

| j. | Channel Easement to the State of Texas, Recorded in Volume 1714, Page 394, Deed Records, Travis County, Texas. |

| k | Electric and/or Telephone Easement to Pedernales Electric Cooperative, Inc., Recorded in Volume 3950, Page 1678, Deed Records, Travis County, Texas |

| l. | Access and Public Utility Easement to Travis County Municipal Utility District No. 1, Recorded in Volume 6921, Page 1336, Deed Records, Travis County, Texas and as shown on that survey dated 4/3/2013, prepared by Stuart W. Watson, R.P.L.S. 4550. |

| m. | Access easement by necessity over and across the subject tract for the benefit of that certain 0.499 acre tract conveyed to Travis County in Constable’s Deed dated July 9, 2003, recorded in Document No. 2003158403, Official Public Records, Travis County, Texas. |

| n. | Rights of the public to use that portion of American Drive R.O.W. as described under Document No(s) 2008034575 & 2012104068, Official Public Records, Travis County, Texas and as shown on the plats recorded in Volume 65, Page 43 and as amended in Volume 68, Page 23, Plat Records, Travis County, Texas. |

| o. | Terms, Conditions, and Stipulations in the Notice: Notice to Purchaser Property in Flood Hazard Area, Recorded in Volume 8506, Page 58, re-filed in Volume 8666, Page 286, Deed Records, Travis County, Texas. |

| p. | Mineral and/or royalty interest Recorded in Volume 2145, Page 73, Deed Records, Travis County, Texas. |

| q. | Mineral and/or royalty interest Recorded in Volume 2411, Page 30, Deed Records, Travis County, Texas. |

| r. | All leases, grants, exceptions or reservation of coal, lignite, oil, gas and other mineral, together with all rights, privileges, and immunities relating thereto appearing in the public records to the extent same are valid and subsisting against the Property. |

| s. | (1) All right, title or claim of any character by the United States, State of Texas, local government or by the public generally in and to any portion of the land lying within the current or former bed, or below the ordinary highwater mark, or between the cut banks of a stream navigable in fact or in law. |

(2) Right of riparian water rights owners to the use and flow of the water.

| t. | Rights of parties in and to existing roadways extending over, across and onto the insured property northwest corner as shown on survey dated April 3, 2013 prepared by Stuart W. Watson, RPLS No. 4550. |