Exhibit 10.1

LOAN AGREEMENT

BRIDGELINE CAPITAL VENTURES

Securitisation Fund

Organised Under the Laws of Luxembourg

Compartment: BCV

RCS: K2157

Legal Entity Identifier LEI (Securitisation Fund): 549300S93SM1WYXIJ424

DATED: as of 16th June 2023

by and between

Safe and Green Development Corporation

Trust Center, 1209 Orange Street, City of Wilmington, County of Newcastle 19801

USA

EIN identity code no 87-1375590

(The Borrower)

AND

Bridgeline Capital Ventures

2, Place de Strasbourg, L-2562 Luxembourg

Registered with the Luxembourg trade and companies register (Registre de Commerce et des Sociétés, Luxembourg), RCS number K2157. Acting on behalf of its compartment BCV S&G DevCorp and represented by Bridgeline Capital Partners a Luxembourg Société anonyme, having its registered office at registered 2, Place de Strasbourg, 2562 Luxembourg, and registered with the RCS under the number B259246, acting in its capacity of management company ( the “Management Company”).

(The Issuer)

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 1 |

TABLE OF CONTENTS

| Whereas | 3 |

| Definitions | 3 |

| Loan | 4 |

| Purpose | 4 |

| Conditions Precedent | 5 |

| Disbursement | 5 |

| Repayment | 5 |

| Interest | 6 |

| Loan Security | 7 |

| Taxes | 7 |

| Representations | 8 |

| Information Undertakings | 9 |

| General Undertakings | 9 |

| Events of Default | 10 |

| General Provisions | 11 |

| Applicable Law and Place of Jurisdiction | 13 |

| Annex 1 – Conditions Precedent | 15 |

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 2 |

Whereas

| A. | The Issuer is an unregulated securitisation fund (fonds de titrisation) governed by the laws of the Grand Duchy of Luxembourg, subject to the Luxembourg act dated 22 March 2004 on securitisation, as amended (the Securitisation Act 2004), and registered with the Luxembourg trade and companies register (Registre de Commerce et des Sociétés, Luxembourg) under RCS number K2157. Acting on behalf of its compartment BCV S&G DevCorp (the “Compartment”), represented by the Management Company, to grant loans financed by the issuance of notes referencing such loans. |

| B. | The Issuer intends to issue via the Compartment debt securities under a notes programme, whose the terms and conditions are detailed in a private placement memorandum, the (“Issuance”). |

| C. | The Borrower is a company active in modular real estate development area incorporated under the Corporation Law of the State of Delaware, USA, with its registered office at Corporation Trust Center, 1209 Orange Street, City of Wilmington, County of Newcastle 19801. |

| D. | The Issuer intends to provide the Borrower with a loan, subject to the terms and conditions set forth in this loan agreement. |

Now, therefore, the parties hereto agree as follows:

Definitions

Capitalized terms used in this Agreement have the meanings assigned to them here below.

Agreement means this loan agreement.

Alternative Collateral has the meaning ascribed in section “Loan Security”.

Business Day means any day (other than a Saturday or Sunday) on which banks are open for general business at the place of business of the Borrower and in the Grand Duchy of Luxembourg.

Default means an Event of Default or any event or circumstance which would (with the expiry of a grace period, the giving of notice, the making of any determination under this Agreement, lapse of time or any combination of any of the foregoing) be an Event of Default.

Compartment has the meaning ascribed in the recitals.

Denomination(s) means the notes will be issued in such denomination(s) of $150’000.

Early Repayment Date has the meaning ascribed in the section “Repayment”.

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 3 |

Event of Default has the meaning ascribed in the section “Events of Default”.

Issuance has the meaning ascribed in the recitals.

Loan means the loan made available under this Agreement.

Loan Disbursement Date has the meaning ascribed in section “Disbursement”.

Management Company has the meaning ascribed in the recitals.

Maturity Date has the meaning ascribed in section “Repayment”.

Notes means the credit linked notes issued by the Issuer in the context of the Programme, to grant the Loan.

Party means a party to this Agreement.

Pledged Shares has the meaning ascribed in section “Loan Security”.

Saint Marys Property has the meaning ascribed in section “Loan Security”.

Unpaid Sum means any sum due and payable but unpaid by the Borrower under this Agreement.

Loan

Subject to the terms and conditions of this Agreement, the Issuer makes available to the Borrower a loan in the aggregate amount of USD 1’450’000 (one million four hundred and fifty US dollars), (the “Loan”).

Purpose

| 3 | General Description of Borrower’s Business |

The Borrower is a real estate developer which has been and intends on continuing to engage primarily in the acquisition, development, management, sale, and leasing of green single or multi-family projects nationally. They plan to construct many of the developments using modular structures constructed by SG Holdings. In addition to these development projects, they intend, subject to their ability to raise sufficient capital, to build strategically placed manufacturing facilities. They expect to begin to break ground on several projects in 2023.

The Borrower intends to list on the Nasdaq stock exchange before the end of June 2023 under the ticker SGD.

| 4 | Specific Use of Loan |

The Parties agree that the Loan shall be used by the Borrower to finance its real estate projects.

The Issuer and its associated parties shall have no responsibility with respect to the use of the Loan by the Borrower.

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 4 |

Conditions Precedent

The Issuer will only be obliged to make the Loan available to the Borrower if on the Loan Disbursement Date (as defined below):

| I. | no Default is continuing or would result from the proposed Loan, |

| II. | the representations set out in clause 0 are correct, |

| III. | the Issuer has received all the documents and other evidence listed in Annex 1 (Conditions precedent) in form and substance satisfactory to it and |

| IV. | the Note is successfully issued and placed with investors. |

Disbursement

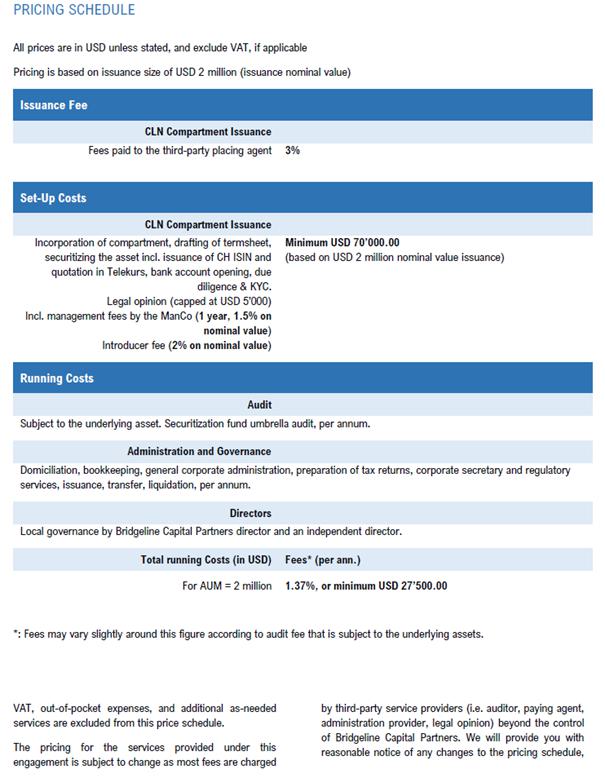

| a) | The Issuer shall disburse the net Loan (i.e. net of any fees due and payable by the Borrower under the Note Fee Schedule (as provided by the Annex 3) by payment upon satisfaction of the conditions precedent in accordance with clause 0 on 23.06.2023 (the Loan Disbursement Date), to the following bank account: |

| ● | Beneficiary / Account Holder: | Safe and Green Development Corporation | |

| ● | Name & Address of Bank: | City National Bank of Florida, 25 W Flagler Street, Miami FL | |

| 33130 | |||

| ● | SWIFT: | CNBFUS3M | |

| ● | IBAN: | 30000509383 | |

| ● | Currency: | USD | |

| ● | Further Payment Details / Reference: | N/A |

| b) | If on the Loan Disbursement Date, the Issuer has not received funds under the Notes in the net amount (i.e. net of any fees due and payable by the Borrower under the Note Fee Schedule) equal to the Loan, the Issuer shall disburse the Loan in accordance with paragraph (a) above as soon as reasonable practicable upon receipt of the respective funds under the Notes or as otherwise agreed between the Parties. |

Repayment

| 5 | Repayment on the Maturity Date |

| a) | The Borrower shall repay the Loan as well as any other Unpaid Sum without further notice on 01.12.2024 (the Maturity Date). |

| b) | If the Maturity Date does not fall on a Business Day, the payment shall be made on the preceding Business Day. |

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 5 |

| c) | All payments under this Agreement shall first be applied towards payment of any reasonable and necessary enforcement costs incurred by the Issuer, then towards payment of accrued interest and finally towards payment of the Loan. |

OR

| 6 | Early Repayment |

| a) | The early repayment date may not be earlier than 12 (twelve) months following the issue date of the Notes (“Early Repayment Date”). |

| b) | The Issuer shall reserve the right to repay the full amount of the Loan then outstanding as of the Early Repayment Date, including interest accrued thereon every six months, by giving written notice of 30 (thirty) days to the Issuer preceding the Early Repayment Date. |

| c) | Any Loan repaid shall first be applied towards payment of any reasonable and necessary enforcement costs incurred by the Issuer, then towards payment of accrued interest, and finally towards payment of the Loan. |

| d) | Any Loan repaid shall no longer be available to the Borrower as a loan under the terms of this Agreement. |

No set-off by Borrower

| 7 | All payments to be made by the Borrower under this Agreement shall be made without set-off and the Borrower may not set-off any obligation due from the Issuer against an obligation owed by the Borrower. |

Interest

| 8 | Calculation of Interest |

| a) | Interest shall be payable on any outstanding notes at a fixed rate of 14% per annum from the date on which the notes are issued, payable on a semi-annual basis. |

| b) | Interest shall be calculated on a 30/360-basis. |

| 9 | Payment of Interest |

| a) | The Borrower shall pay accrued interest on the outstanding Loan without notice on a semi-annual basis. If the due date for such an interest payment does not fall on a Business Day, the payment shall be made on the preceding Business Day. |

Interest Payment Date(s) |

| 01.12.2023 |

| 01.06.2024 |

| 01.12.2024 |

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 6 |

| b) | Upon the occurrence of an Event of Default, the Borrower undertakes to pay interest on the outstanding Loan and any Unpaid Sum at the interest rate pursuant to clause 8. (a), plus 200 basis points p.a. calculated in accordance with clause 8. (b). |

Loan Security

| 10 | Escrow |

The Parties agree that the Loan and the interest shall be secured by shares of the Borrower held in escrow with American Stock Transfer & Trust Company, LLC, a New York limited liability trust company, with principal offices located at 6201 15th Avenue, Brooklyn, New York, 11219 ( the “Escrow Agent”) under the name of the issuer ( the “Escrow”).

In the context of the Escrow, the Borrower shall deposit in the escrow account held by the Escrow Agent a number of shares corresponding to 19.9% (nineteen-point nine percent) of its share capital in the escrow account under the name of the Issuer (the “Pledged Shares”).

The Borrower commits to organize the Escrow by a separate agreement. This escrow agreement shall be communicated to the Issuer upon request of the latter.

| 11 | Alternative Collateral |

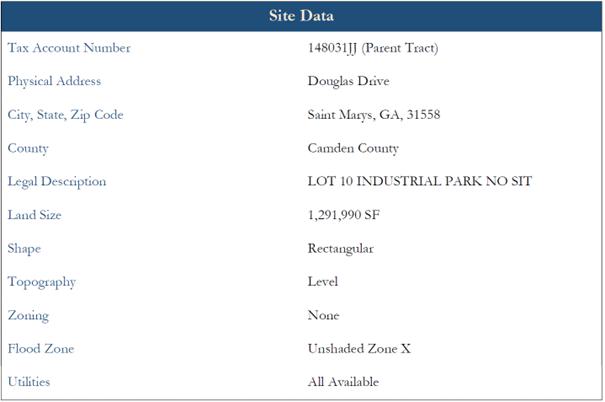

The Parties agree that if the Borrower is not able to be listed on the Nasdaq stock exchange before the 30th August 2023 under the ticker SGD, the Loan will be secured by a collateral on the 29.66 acres of underlying land and entitlements of a proposed manufacturing facility, located along Douglas Drive, in Saint Marys, GA 31558 ( United States of America), whose the features are described in annex 2 of the Agreement, (“Saint Marys Property”), ( the “Alternative Collateral”).

The Parties agree that after the listing of the Borrower on the Nasdaq if the total market value of the Pledged shares held in the Escrow falls below twice the value of the Loan based on the last traded price in a recognized market, the Issuer shall receive the Alternative Collateral.

The Borrower guarantees that the Saint Marys Property is free of any encumbrance, liens or claims.

Therefore, the Parties Agree that the Alternative Collateral granted to the Issuer shall be a first rank mortgage.

For avoidance of any doubt, in this, case, the Parties agree the Alternative Collateral shall replace the Escrow to secure the Loan.

The Parties agree that the Issuer shall receive the Alternative Collateral additionally to the Pledged Shares, in case of Event of Default, if the sale of the Pledge Shares does not provide enough liquidity to reimburse the Loan.

For avoidance of any doubt, the documentation relating to the Alternative Collateral shall be communicated to the Issuer upon request of the latter.

Taxes

Payments by the Borrower shall be made without any deduction of any taxes, penalties, duties, or governmental charges of any kind, present or future (the Taxes), except to the extent that the Borrower is required by law to withhold or deduct any Taxes.

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 7 |

If the Borrower is required by law to deduct any Taxes from any amounts payable or paid by the Borrower pursuant to or under this Agreement, the Borrower shall pay such additional amounts as may be necessary to ensure that the Issuer receives a net amount equal to the full amount which it would have received, had payment not be made subject to the Taxes.

Representations (Clause 0)

The Borrower makes the representations and warranties set out in this clause 0 to the Issuer at the times specified.

| 12 | Status |

| a) | It is a Delaware Company with EIN identity code no 87-1375590 duly incorporated and validly existing under the laws of its jurisdiction of incorporation. |

| b) | It has the power to own its assets and carry on its business as it is being conducted. |

| 13 | Power and Authority |

It has the power to enter into, perform, and deliver, and has taken all necessary action to authorize its entry into and performance of, this Agreement and the transactions contemplated by this Agreement.

| 14 | Binding Obligations |

| a) | The obligations expressed to be assumed by it under this Agreement are legal, valid, binding, and enforceable obligations. |

| b) | Without limiting the generality of the foregoing, the Security Agreement creates the security interests which it purports to create, and this security interest is valid and effective. |

| 15 | Non-conflict with other Obligations |

The entry into, and performance by it of, and the transactions contemplated by, this Agreement do not and will not conflict with:

| a) | any law or regulation applicable to it; |

| b) | its constitutional documents; or |

| c) | any agreement or financial instrument binding upon it or its assets. |

| 16 | Choice of law |

The choice of Luxembourg law as the governing law of this Agreement will be recognized and enforced in its jurisdiction of incorporation.

Any judgment obtained in Luxembourg in relation to this Agreement will be recognized and enforced in its jurisdiction of incorporation.

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 8 |

| 17 | Insolvency |

No corporate action, legal proceeding or other procedure or step described in clause 27 (Insolvency Proceedings) has been taken or threatened in relation to it; and none of the circumstances described in clause 26 (Insolvency) applies to it.

| 18 | No misleading Information |

Any information provided by it (including, for the avoidance of doubt, information transmitted by e-mail or similar means) to the Issuer was true, accurate and not misleading in all relevant aspects as at the date it was provided or as at the date (if any) at which it is stated.

| 19 | Times when Representations made. |

All the representations and warranties in Clause 0 are made by the Borrower on the date of this Agreement and the date of disbursement in accordance with clause Disbursement, and on any interest payment date.

Information Undertakings

The undertakings in this clause remain in force from the date of this Agreement for so long as any amount is outstanding under the Agreement.

| 20 | Financial and other Information |

The Borrower shall supply to the Issuer if requested on a timely basis, but in any case, no later than six months after the end of each financial year, annual financial statements of the Borrower (statutory), prepared in accordance with the applicable accounting standards.

| 21 | Information on Default |

The Borrower shall notify the Issuer of any Default (and the steps, if any, being taken to remedy it) promptly upon becoming aware of its occurrence.

General Undertakings

The undertakings in this Clause 0 remain in force from the date of this Agreement for so long as any amount is outstanding under this Agreement.

| 22 | Negative Pledge |

The Borrower shall not grant, create or permit to subsist any security interest, including personal securities such as any surety and guarantee, over any of its present or future assets or revenues, except for any security interests (a) arising by law (but, in any case, not as a result of any default or omission) or resulting from a bank’s general business terms and conditions, (b) granted in favor of the Issuer or (c) granted in the ordinary course of business.

| 23 | Change of Business |

The Borrower shall procure that no substantial change is made to the general nature of its business from that carried on at the date of this Agreement.

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 9 |

Events of Default

Each of the events or circumstances set out in this clause is an Event of Default.

| 24 | Non-payment |

The Borrower does not pay on the due date any amount payable pursuant to this Agreement unless its failure to pay is caused by administrative or technical reasons and payment is made within 5 (five) Business Days of its due date.

| 25 | Other Obligations |

| a) | The Borrower does not comply with any provision of this Agreement and especially the section “Loan Security” and that referred to in Clause 24 (Non-payment). |

| b) | No Event of Default under the foregoing paragraph will occur if failure to comply is capable of remedy and is remedied within 5 (five) Business Days of the earlier of (i) of the Issuer giving notice to the Borrower and (ii) the Borrower becoming aware of the failure to comply. |

| 26 | Misrepresentation |

Any representation made or deemed to be made by the Borrower in this Agreement is or proves to have been incorrect when made or deemed to be made.

| 27 | Cessation of Business |

The Borrower suspends or ceases to carry on (or threatens or takes any action to suspend or cease to carry on) all or a material part of its business.

| 28 | Security |

An event or series of events has occurred which, taking into account all the circumstances and in the reasonable opinion of the Issuer, has or is likely to have a material adverse effect on the validity, enforceability, effectiveness or ranking of the securities to be granted under the section Loan Security.

| 29 | Insolvency |

| a) | The Borrower becomes bankrupt or insolvent or is unable or admits inability to pay its debts as they fall due, suspends making payments on any of its debts, applies for insolvency proceedings, winding-up, its assets are expropriated, security is realized or similar proceedings take place, or, by reason of actual or anticipated financial difficulties, commences negotiations with one or more of its creditors with a view to rescheduling any of its indebtedness or any such action is threatened. |

| b) | The Borrower is over-indebted, in each case within the meaning of article 725 CO (or analogous provisions under foreign law). |

| c) | A moratorium is declared in respect of any indebtedness of the Borrower. |

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 10 |

| 30 | Insolvency Proceedings |

| a) | Any corporate action, legal proceeding or other procedure or step (including the opening insolvency proceedings and filings for debt or protection) is taken in relation to: |

| (i) | the suspension of payments, a moratorium of any indebtedness, winding-up, dissolution, administration or reorganization (by way of voluntary arrangement, scheme of arrangement or otherwise) of the Borrower or any such action is threatened; |

| (ii) | a composition, assignment or arrangement with any creditor of the Borrower; |

| (iii) | the appointment of a liquidator, receiver, administrative receiver, administrator, compulsory manager or other similar officer in respect of the Borrower or any of its assets; |

| (iv) | enforcement of any security over any assets of the Borrower; |

| (v) | or any analogous procedure or step is taken in any jurisdiction. |

| b) | Paragraph (a) shall not apply to any debt enforcement proceeding which is frivolous or vexatious and which is discharged, stayed or dismissed within the applicable time frame under applicable law, but in any event within 20 (twenty) days. |

| 31 | Cross Default |

Any financial indebtedness of the Borrower is not paid when due or is declared to be or otherwise becomes due and payable prior to its specified maturity as a result of an event of default.

| 32 | Acceleration |

On and at any time after the occurrence of an Event of Default, the Issuer may by notice to the Borrower

| a) | declare that the Loan and any Unpaid Sum, together with accrued interest, and all other amounts accrued or out- standing under this Agreement be immediately due and payable, at which time they shall become immediately due and payable; and |

| b) | exercise any or all of its rights, remedies, powers or discretions under this Agreement. |

General Provisions

| 33 | Confidentiality |

| a) | The Parties undertake for themselves, their employees, contractors, agents and consultants to (i) maintain strict confidentiality with respect to the provisions contained in this Agreement and all information, data and documentation that is not publicly known and that is disclosed or made available under or in relation to this Agreement (Confidential Information) of the other Party, (ii) not make Confidential Information available to third parties in whole or in parts or permit third parties to access Confidential Information, unless and to the extent that this Agreement expressly permits so or this is required by a legal obligation or requested by a competent court, tribunal or authority, and (iii) not use Confidential Information for any other purpose than the fulfilment of this Agreement. |

| b) | The Issuer may disclose Confidential Information to investors and potential investors in, and agents and others acting in connection with, the Notes and use Confidential Information in connection with the issuance of the Notes. |

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 11 |

| 34 | Payment mechanics |

| a) | On each date on which the Borrower is required to make a payment under this Agreement it shall make the same available to the Issuer (unless a contrary indication appears in this Agreement) for value on the due date. |

| b) | Any payment by the Borrower to the Issuer shall be made to the following bank account: |

| ● | Beneficiary / Account Holder: Bridgeline Capital Ventures |

| ● | Name & Address of Custodian Bank: Kaiser Partner Privatbank AG, Herrengasse 23, 9490 Vaduz, Liechtenstein |

| ● | SWIFT: SERBLI22XXX |

| ● | IBAN: LI66 0880 6025 6803 2200 4 |

| ● | Currency: USD |

| ● | Further Payment Details / Reference: BCV Safe & Green Development Corp. Dez. 2024 USD |

| 35 | Notices |

Unless otherwise specified in this Agreement, all notices, or other communications to be given under or in connection with this Agreement shall be in writing and delivered by hand or sent by registered, certified or express mail (return receipt requested), courier or email:

| - | if to the Issuer Address: | |||

| Bridgeline Capital Ventures, BCV S&G DevCorp | ||||

| 2, Place de Strasbourg | ||||

| 2562 Luxembourg | ||||

| Email: | ||||

| Attention: | The Directors | |||

| - | with a copy to: | Bridgeline Capital Partners S.A. | ||

| Address: | 2, Place de Strasbourg, 2562 Luxembourg | |||

| Email: | ||||

| Attention: | George Pal / Hervé Croset | |||

| - | if to Borrower: | |||

| Address: | Safe & Green Development Corp | |||

| 990 Biscayne Blvd, Suite 501, Office 12, Miami, FL 33132 | ||||

| Attention: | Nicolai Brune | |||

| Email: | ||||

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 12 |

Notices delivered by hand shall be deemed delivered when actually delivered. Notices given by courier shall be deemed delivered on the date delivery is promised by the courier. Notices given by electronic transmission shall be deemed given on the date of receipt (if a business day), otherwise, the first business day following.

| 36 | First Point of Contact |

In case of any issues with complying with any of its payment obligations, the Borrower shall contact one of the following persons:

Rainer Nachbauer / Elodie Hasler

Kaiser Partners Privatebank AG

| 37 | Amendment and Waiver |

This Agreement (including this clause 36) may only be modified or amended by a document signed by all Parties. Any provision contained in this Agreement may only be waived by a document signed by the Party waiving such provision.

| 38 | Severability |

Should any part or provision of this Agreement be, be held, or become illegal, invalid or unenforceable in any respect by any competent arbitral tribunal, court, governmental or administrative authority having jurisdiction, the legality, validity or enforceability of, the remaining provisions of this Agreement shall nonetheless remain valid and shall not in any way be affected or impaired. In such case, the Parties shall replace the illegal, invalid or unenforceable provision with such valid and enforceable provision which best reflects the commercial and legal purpose of the replaced provision and shall execute all agreements and documents required in this connection.

| 39 | No Assignment |

The Borrower shall not assign or transfer this Agreement or any rights or obligations hereunder, including, but not limited to, by way of a business transfer or demerger, to any third party without the prior written consent of the Issuer.

The Issuer may assign and transfer this Agreement or any rights and obligations hereunder to any third party at any time.

Applicable Law and Place of Jurisdiction

| 40 | Governing Law |

This Agreement shall be governed by and construed in accordance with the substantive laws of the Grand Duchy of Luxembourg.

| 41 | Jurisdiction |

The exclusive place of jurisdiction for any dispute, claim or controversy arising under, out of or in connection with or related to this Agreement (or subsequent amendments thereof), including, without limitation, disputes, claims or controversies regarding its existence, validity, interpretation, performance, breach, or termination, shall be the city of Luxembourg, Grand Duchy of Luxembourg.

The Commercial Court of Luxembourg, Grand Duchy of Luxembourg shall have exclusive subject matter jurisdiction.

The Issuer shall have the right to institute legal proceedings against the Borrower before any other competent court or authority, in which case Luxembourg law shall nevertheless be applicable.

[Signatures on next page]

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 13 |

Executed as of the date written on the cover page to this Agreement.

Bridgeline Capital Ventures on behalf of its Compartment BCV S&G DevCorp Notes

Represented by Bridgeline Capital Partners int its capacity of Management Company

| /s/ George Pal | /s/ Hervé Croset | |

| Name: George Pal | Name: Hervé Croset | |

| Function: Director | Function: Director | |

| Safe & Green Development Corporation | ||

| /s/ Nicolai Brune | /s/ David Villarreal | |

| Name: Nicolai Brune | Name: David Villarreal | |

| Function: Chief Financial Officer | Function: Chief Executive Officer |

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 14 |

Annex 1 – Conditions Precedent

The Borrower must deliver the following documents and other evidence (where applicable) in form and substance satisfactory to the Issuer.

| a) | A copy of an excerpt from the commercial register. |

| b) | A copy of the articles of incorporation or the articles of association. |

| c) | Evidence of directors including their signatories (if not contained already in the commercial register). |

| d) | Passport copies of all directors and Unique Beneficial Owners (UBO) that hold more than 25% of share capital. |

| e) | Shareholder registry including the percentage ownerships. |

| f) | In case the of a majority shareholder being a legal entity or the borrower being part of a group structure, a copy of the ownership structure chart up to the UBO(s). |

| g) | A copy of the latest audited financial statements, if applicable. |

| h) | The Note Fee Schedule duly executed by the Borrower. |

The Issuer may, in consultation with the Paying Agent and Calculation Agent for the Note, request further corporate and commercial documents where required in the sole discretion of the aforementioned parties.

Should the Borrower assign, on-lend, securitize or otherwise disburse the Loan in part or in whole to any one or more Assignees, the Borrower must provide, in relation to each Assignee, the same set of documents and such other evidence (where applicable) as shall be requested for the Borrower, together with the applicable assignment agreement and such other documents as the Issuer or such aforementioned parties may additionally request.

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 15 |

ANNEX 2: ALTERNATIVE COLLATERAL

The alternative collateral includes the 29.66 acres of underlying land and entitlements of a Proposed Manufacturing Facility, located in Saint Marys, GA, 31558, Camden County, with a total of 120,000 square feet of gross building area, on 1,291,990 square feet of land with Tax Parcel Number 135C-011.

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 16 |

ANNEX 3: Note Fee Schedule

| Bridgeline Capital Partners S.A. | |

| Registered office at 2, place de Strasbourg, 2562 Luxembourg | Page | 17 |