UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________

SCHEDULE 14A

___________________

PROXY STATEMENT

PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

Filed by the Registrant |

☒ |

|

|

Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to Section 240.14a-12 |

SAFE & GREEN HOLDINGS CORP.

(Name of Registrant as Specified in Its Charter)

_________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing Fee (Check all boxes that apply):

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rule 14a-6(i)(1) and 0-11 |

990 Biscayne Blvd., Suite 501, Office 12

Miami, Florida 33132

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held on October 5, 2023

To the Stockholders of Safe & Green Holdings Corp.:

NOTICE IS HEREBY GIVEN that a special meeting of stockholders (the “Special Meeting”) of Safe & Green Holdings Corp., a Delaware corporation (the “Company”), will be held on October 5, 2023, at 10:00 a.m., Eastern Time at the offices of Blank Rome LLP, 1271 Avenue of the Americas, 16th Floor, New York, New York 10020.

At the Special Meeting, stockholders will be asked to vote on the following matters:

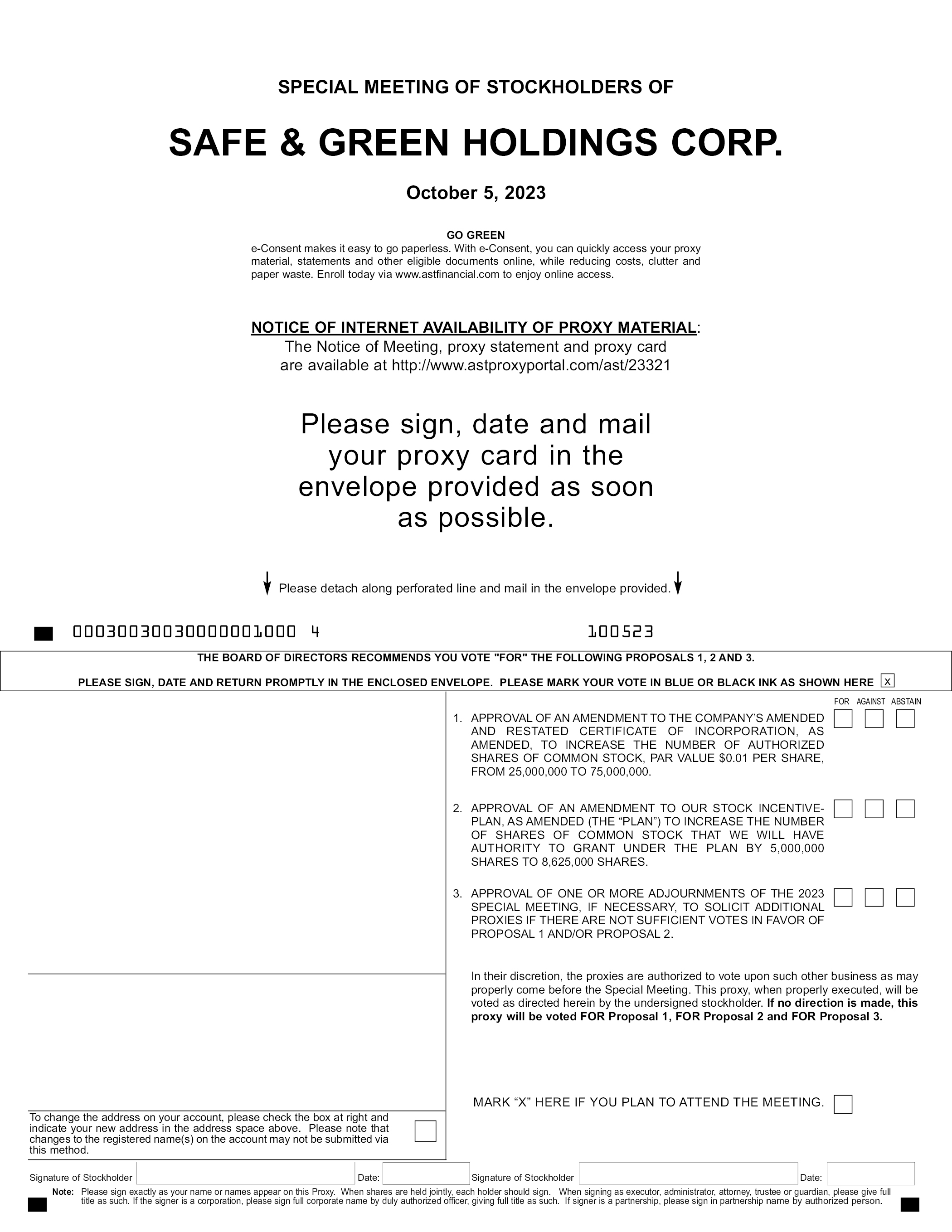

(1) to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation, as amended, to increase the number of authorized shares of common stock, par value $0.01 per share (the “Common Stock”), from 25,000,000 to 75,000,000. We refer to this proposal as the “Increase in Number of Authorized Shares of Common Stock Proposal” or “Proposal 1.”

(2) to approve an amendment to our Stock Incentive Plan, as amended (the “Plan”) to increase the number of shares of Common Stock that we will have authority to grant under the Plan by 5,000,000 shares to 8,625,000 shares. We refer to this proposal as the “Plan Amendment Proposal” or “Proposal 2”; and

(3) to approve one or more adjournments of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal 1 and/or Proposal 2. We refer to this proposal as the “Adjournment Proposal” or “Proposal 3.”

The matters listed in this notice of meeting are described in detail in the accompanying proxy statement. The Board of Directors has fixed the close of business on August 11, 2023 as the record date (the “Record Date”) for determining those stockholders who are entitled to notice of and to vote at the Special Meeting or any adjournment or postponement of the Special Meeting. The list of the stockholders of record as of the Record Date will be available for inspection during the ten days preceding the meeting at the offices of Blank Rome LLP, 1271 Avenue of the Americas, 16th Floor, New York, New York 10020. The Board of Directors knows of no other business that will come before the Special Meeting. The proxy materials, including this Proxy Statement, are being distributed and made available on or about September 7, 2023. The proxy materials are also available at http://www.astproxyportal.com/ast/23321.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON OCTOBER 5, 2023.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING, PLEASE SUBMIT A PROXY TO HAVE YOUR SHARES VOTED AS PROMPTLY AS POSSIBLE BY USING THE INTERNET, OR BY SIGNING, DATING AND RETURNING BY MAIL THE PROXY CARD ENCLOSED WITH THE PROXY STATEMENT. IF YOU DO NOT RECEIVE THE PROXY MATERIALS IN PRINTED FORM AND WOULD LIKE TO SUBMIT A PROXY BY MAIL, YOU MAY REQUEST A PRINTED COPY OF THE PROXY MATERIALS (INLCUDING THE PROXY) AND SUCH MATERIALS WILL BE SENT TO YOU.

On behalf of the Board of Directors and the employees of Safe & Green Holdings Corp. we thank you for your continued support.

|

/s/ Paul Galvin |

||

|

Paul Galvin |

September 6, 2023

990 Biscayne Blvd., Suite 501, Office 12

Miami, Florida 33132

PROXY STATEMENT

For the Special Meeting of Stockholders to be held on October 5, 2023

GENERAL INFORMATION

The Company is providing this proxy statement in connection with the solicitation by its Board of Directors (the “Board of Directors” or the “Board”) of proxies to be voted at the Special Meeting to be held on October 5, 2023, at 10:00 a.m., Eastern Time, and any adjournment or postponement thereof at the offices of Blank Rome LLP, 1271 Avenue of the Americas, 16th Floor, New York, New York 10020.

The Board of Directors is soliciting votes (1) FOR approval of an amendment to our Amended and Restated Certificate of Incorporation, as amended (the “Amended and Restated Certificate of Incorporation”) to increase the number of authorized shares of common stock, par value $0.01 per share (“Common Stock”), from 25,000,000 to 75,000,000. We refer to this proposal as the “Increase in Number of Authorized Shares of Common Stock Proposal” or “Proposal 1”; (2) FOR approval of an amendment to our Stock Incentive Plan, as amended (the “Plan”) to increase the number of shares of Common Stock that we will have authority to grant under the Plan by 5,000,000 shares (the “Plan Amendment Proposal”); and (3) FOR one or more adjournments of the Special Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Special Meeting to approve the Increase in Number of Authorized Shares of Common Stock and/or the Plan Amendment Proposal (the “Adjournment Proposal”).

SPECIAL MEETING ADMISSION

Only stockholders as of August 11, 2023 (the “Record Date”) may attend the Special Meeting. If you attend, please note that you will be asked to present government-issued identification (such as a driver’s license or passport) and evidence of your share ownership of our Common Stock on the Record Date. Such evidence of ownership can be your proxy card. If your shares are held beneficially in the name of a bank, broker or other holder of record and you plan to attend the Special Meeting, you will be required to present proof of your ownership of our Common Stock on the Record Date, such as a bank or brokerage account statement or voting instruction card, to be admitted to the Special Meeting.

No cameras, recording equipment or electronic devices will be permitted in the Special Meeting.

ADDITIONAL INFORMATION ABOUT THESE PROXY MATERIALS AND VOTING

We are providing you with these proxy materials because the Board of Directors is soliciting your proxy to vote at the Special Meeting to be held on October 5, 2023, at 10:00 a.m. Eastern Time or any adjournments or postponements thereof.

You are invited to attend the Special Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Special Meeting to vote your shares. Instead, you may simply follow the instructions below to submit your proxy. The purpose of the Special Meeting and the matters to be acted on are stated in the accompanying Notice of Special Meeting of Stockholders. The Board of Directors knows of no other business that will come before the Special Meeting. The proxy materials, including this Proxy Statement, are being distributed and made available on or about September 7, 2023. The proxy materials may also be accessed electronically by visiting http://www.astproxyportal.com/ast/23321.

1

QUESTIONS AND ANSWERS

Q: Why am I receiving these materials?

A: We are providing these proxy materials in connection with the solicitation by our Board of Directors of proxies to be voted at the Special Meeting or any postponement or adjournment thereof. We intend to mail these proxy materials on or about September 7, 2023 to all stockholders of record entitled to vote at the Special Meeting as of the Record Date.

Q: How do I attend the Special Meeting?

A: The Special Meeting will be held in person on October 5, 2023, at 10:00 a.m. Eastern Time at the offices of Blank Rome LLP, 1271 Avenue of the Americas, 16th Floor, New York, New York 10020. Information on how to vote in person at the Special Meeting is discussed below.

Q: What proposals are being presented for a stockholder vote at the Special Meeting?

A: The following proposals are being presented for stockholder vote at the Special Meeting:

• Proposal 1 — the approval of an amendment to our Amended and Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock from 25,000,000 to 75,000,000; and

• Proposal 2 — the approval of an amendment to our Plan to increase the number of shares of Common Stock that we will have authority to grant under the Plan by 5,000,000 shares; and

• Proposal 3 — the approval of one or more adjournments of the Special Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Special Meeting to approve the Increase in Number of Authorized Shares of Common Stock Proposal and/or the Plan Amendment Proposal.

Proposal 3 — the Adjournment Proposal will only be presented at the Special Meeting if there are not sufficient votes to approve Proposal 1 — the Increase in Number of Authorized Shares of Common Stock Proposal and/or Proposal 2 — the Plan Amendment Proposal.

Q: How does the Board of Directors recommend that I vote?

A: The Board of Directors unanimously recommends that you vote:

• “FOR” Proposal 1 — the Increase in Number of Authorized Shares of Common Stock Proposal; and

• “FOR” Proposal 2 — the Plan Amendment Proposal;

• “FOR” Proposal 3 — the Adjournment Proposal.

Q: What does it mean to vote by proxy?

A: When you vote “by proxy,” you grant another person the power to vote stock that you own. If you vote by proxy in accordance with this proxy statement, you will have designated each of the following individuals or their designees as your proxy holders for the Special Meeting: Paul Galvin, the Company’s Chairman and Chief Executive Officer, and Patricia Kaelin, the Company’s Chief Financial Officer.

Any proxy given pursuant to this solicitation and received in time for the Special Meeting will be voted in accordance with your specific instructions. If you provide a proxy, but you do not provide specific instructions on how to vote on each proposal, the proxy holder will vote your shares “FOR” Proposal 1 — the Increase in Number of Authorized Shares of Common Stock Proposal; “FOR” Proposal 2 — the Plan Amendment Proposal; and “FOR” Proposal 3 — the Adjournment Proposal. With respect to any other proposal that properly comes before the Special Meeting, the proxy holders will vote in their own discretion according to their best judgment, to the extent permitted by applicable laws and regulations.

2

Q: Who can vote at the Special Meeting?

A: Only stockholders of record at the Record Date, the close of business on August 11, 2023, will be entitled to vote at the Special Meeting. On the Record Date, there were 15,948,869 shares of Common Stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on August 11, 2023, your shares were registered directly in your name with the Company’s transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may directly vote your shares in person at the Special Meeting or submit a proxy to have your shares voted. Even if you plan to attend the Special Meeting, we urge you to fill out and return the enclosed proxy card or submit a proxy on the internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on August 11, 2023, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is the stockholder of record. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You will receive voting instructions from your broker, bank or nominee describing the available processes for voting your stock.

As a beneficial owner, you may not vote your shares in person at the Special Meeting unless you bring with you a legal proxy from the stockholder of record. A legal proxy may be obtained from your broker, bank or nominee.

Q: What information is contained in the Proxy Statement?

A: The information included in this proxy statement relates to the proposals to be voted on at the Special Meeting, the voting process and other required information.

Q: What shares can I vote?

A: You may vote or cause to be voted all shares owned by you as of the close of business on August 11, 2023, the Record Date. These shares include: (1) shares held directly in your name as a stockholder of record; and (2) shares held for you, as the beneficial owner, through a broker or other nominee, such as a bank.

Q: How may I vote?

A: With respect to the Increase in Number of Authorized Shares of Common Stock Proposal, the Plan Amendment Proposal and the Adjournment Proposal, you may vote FOR, AGAINST, or ABSTAIN. If you ABSTAIN it is not considered a vote cast and will have no effect on Proposal 1 and it will have the same effect as a vote AGAINST with respect to Proposal 2 and 3. Although we do not expect that there will be any broker non-votes with respect to the Proposals 1 and 3 (as described below), broker non-votes, if there are any, will not effect the outcome of the vote on Proposals 1, 2 and 3.

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Special Meeting, you may have your shares voted by proxy using the enclosed proxy card, or you may submit your proxy through the internet. We urge you to have your shares voted by proxy to ensure your vote is counted.

• By mail. To have your shares voted using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Special Meeting, the proxyholder will vote your shares as you direct.

3

• By internet. To have your shares voted through a proxy submitted by the internet, go to http://www.voteproxy.com to complete an electronic proxy card. If you vote by telephone call 1-800-776-9437 in the United States or 1-718-921-8500 from foreign countries and follow the instructions. You will be asked to provide the Company number and control number from the enclosed proxy card. Your internet proxy must be received by 11:59 p.m., Eastern Time on October 4, 2023, to be counted.

• By attending the Special Meeting. You may attend the Special Meeting and vote your shares.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a voting instruction form with these proxy materials from that organization rather than from the Company. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from internet access providers and telephone companies.

Q: How many votes do I have?

A: On each matter to be voted upon, you have one vote for each share of Common Stock you own as of August 11, 2023.

Q: What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote in person or by proxy by completing your proxy card or submitting your proxy through the internet, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange (the “NYSE”) deems the particular proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholder, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. If the broker or nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will not be able to vote your shares on such matter, often referred to as a broker non-vote.

The Company expects that (i) Proposal 1 — the Increase in Number of Authorized Shares of Common Stock Proposal; and (ii) Proposal 3 — the Adjournment Proposal will be considered routine matters. In this regard, we believe that your broker or nominee will be permitted to vote your “uninstructed” shares on Proposals 1 and 3. However, this remains subject to the final determination from the NYSE regarding which of the proposals are “routine” or “non-routine.”

4

If you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

Q: What if I return a proxy card or otherwise submit a proxy but do not make specific choices?

A: If you are a record holder and return a signed and dated proxy card or otherwise submit a proxy without marking voting selections, your shares will be voted, as applicable, FOR Proposal 1 — the Increase in Number of Authorized Shares of Common Stock Proposal; FOR Proposal 2 — the Plan Amendment Proposal; and FOR Proposal 3 — the Adjournment Proposal. If any other matter is properly presented at the Special Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares in his or her discretion.

Q: Can I change my vote or revoke my proxy?

A: You may change your vote or revoke your proxy at any time before the final vote at the Special Meeting. To change how your shares are voted or to revoke your proxy if you are the record holder, you may (1) notify our Corporate Secretary in writing at Safe & Green Holdings Corp., 990 Biscayne Blvd., Suite 501, Office 12, Miami, Florida 33132; (2) submit a later-dated proxy (either by mail or internet), subject to the voting deadlines that are described on the proxy card or voting instruction form, as applicable; or (3) deliver to our Corporate Secretary another duly executed proxy bearing a later date. You may also revoke your proxy by attending the Special Meeting and voting in person. Attending the meeting alone with not revoke any previously submitted proxy.

For shares you hold beneficially, you may change your voting instructions by following the instructions provided by your broker or bank.

Q: Who can help answer my questions?

A: If you have any questions about the Special Meeting or how to vote, submit a proxy or revoke your proxy, or you need additional copies of this Proxy Statement or voting materials, you should contact the Corporate Secretary, Safe & Green Holdings Corp., 990 Biscayne Blvd., Suite 501, Office 12, Miami, Florida 33132, or by phone at (936) 355-1910.

Q: What is a quorum and why is it necessary?

A: Conducting business at the Special Meeting requires a quorum. A quorum will be present if stockholders holding at least one-third of the outstanding shares of Common Stock entitled to vote on August 11, 2023 are present at the Special Meeting in person or by proxy. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you attend the Special Meeting in person. Abstentions and broker non-votes, if any, will be counted toward the quorum requirement. Because, as mentioned above, banks, brokers and other nominee holders of record have discretionary voting authority with respect to any of the proposals to be considered at the Special Meeting as described in this proxy statement, if a beneficial owner of shares held in “street name” does not give voting instructions to the broker, bank or other nominee holder of record, we do not expect there to be any broker non-votes with respect to Proposals 1 or 3, as described in this proxy statement. If there is no quorum, the Special Meeting may be adjourned by the chairperson of the Special Meeting or the vote of the stockholders entitled to vote the shares present at the meeting in person or represented by proxy may adjourn the Special Meeting to another time and place.

Q: What is the voting requirement to approve each of the proposals?

A: Proposal 1 — Increase in Number of Authorized Shares of Common Stock Proposal. Approval of the Increase in Number of Authorized Shares of Common Stock Proposal requires the votes cast in favor of such proposal to exceed the votes cast against such proposal of the holders of the entitled to vote thereon. Abstentions, which are considered present and entitled to vote on this matter, are not votes cast and will have no effect on this proposal. If you are a beneficial owner whose shares are held by a broker, bank or other nominee, you must instruct the broker, bank or nominee how to vote your shares. If you do not provide voting instructions, your shares will not

5

be voted on proposals that are non-routine matters on which brokers do not have discretionary authority to vote without instructions from the beneficial owner. Broker non-votes are not expected for this proposal because we believe this matter is a routine matter. If there were to be any broker non-votes they would have no effect on this proposal.

Proposal 2 — The Plan Amendment Proposal. Approval of the Plan Amendment Proposal requires the affirmative vote of a majority of the shares of the Company’s Common Stock, present in person or represented by proxy at the meeting and entitled to vote thereon. Abstentions, which are considered present and entitled to vote on this matter, will have the same effect as a vote “AGAINST” this proposal. Broker non-votes would have no effect on the vote with respect to this proposal.

Proposal 3 — Adjournment Proposal. Approval of the adjournment of the Special Meeting requires the affirmative vote of a majority of the shares of the Company’s Common Stock, present in person or represented by proxy at the meeting and entitled to vote thereon. Abstentions, which are considered present and entitled to vote on this matter, will have the same effect as a vote “AGAINST” this proposal. Broker non-votes are not expected for this proposal because we believe this matter is a routine matter. If there were to be any broker non-votes they would have no effect on the vote with respect to this proposal.

Q: What should I do if I receive more than one Proxy Statement?

A: You may receive more than one Proxy Statement. For example, if you are a stockholder of record and your shares are registered in more than one name, you will receive more than one Proxy Statement. Please follow the voting instructions on all of the Proxy Statements to ensure that all of your shares are voted.

Q: Where can I find the voting results of the Special Meeting?

A: We intend to announce preliminary voting results at the Special Meeting and publish final results in a Current Report on Form 8-K, which will be filed within four (4) business days of the Special Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four (4) business days after the Special Meeting, we intend to file a Current Report on Form 8-K to publish preliminary results and, within four (4) business days after the final results are known to us, file an additional Current Report on Form 8-K to publish the final results.

Q: What happens if additional matters are presented at the Special Meeting?

A: Other than the three (3) items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Special Meeting. If you grant a proxy, each of the persons named as proxy holders, Paul Galvin, our Chief Executive Officer, and Patricia Kaelin, our Chief Financial Officer, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Special Meeting.

Q: How many shares are outstanding and how many votes is each share entitled?

A: Each share of our Common Stock that is issued and outstanding as of the close of business on August 11, 2023, the Record Date, is entitled to be voted on all items being voted on at the Special Meeting, with each share being entitled to one vote on each matter. As of the Record Date, close of business on August 11, 2023, 16,016,107 shares of Common Stock were issued and 15,948,689 shares of Common Stock were outstanding.

Q: Who will count the votes?

A: One or more inspectors of election will tabulate the votes.

Q: Is my vote confidential?

A: Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed, either within the Company or to anyone else, except: (1) as necessary to meet applicable legal requirements; (2) to allow for the tabulation of votes and certification of the vote; or (3) to facilitate a successful proxy solicitation.

6

Q: Who will bear the cost of soliciting votes for the Special Meeting?

A: The Board of Directors is making this solicitation on behalf of the Company, which will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials. Certain of our directors, officers, and employees, without any additional compensation, may also solicit your vote in person, by telephone, or by electronic communication. On request, we will reimburse brokerage houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to stockholders. In addition to the use of the mail, proxies may be solicited by personal interview, telephone, telegram, facsimile and advertisement in periodicals and postings, in each case by our directors, officers and employees without additional compensation. Brokerage houses, nominees, fiduciaries and other custodians will be requested to forward solicitation materials to beneficial owners and will be reimbursed for their reasonable expenses incurred in so doing. We may request by telephone, facsimile, mail, electronic mail or other means of communication the return of the proxy cards. In addition, we have retained D.F. King & Co., Inc. to aid in the solicitation of proxies for this year. We will pay D.F. King & Co., Inc. fees of not more than $7,500 plus expense reimbursement for its services. We may request by telephone, facsimile, mail, electronic mail or other means of communication the return of the proxy cards. Please contact D.F. King & Co., Inc. toll-free at (800) 967-0261 with any questions you may have regarding our proposals.

Q: When are stockholder proposals and director nominations due for the 2023 Annual Meeting of Stockholders?

Stockholders who intended to present proposals for inclusion in this year’s proxy materials at the 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”) under SEC Rule 14a-8 must ensure that such proposals were received by the Corporate Secretary of the Company not later than April 24, 2023. Such proposals must meet the requirements of our Amended and Restated Bylaws and the SEC to be eligible for inclusion in the proxy materials for our 2023 Annual Meeting. In addition, our bylaws have an advance notice procedure with regard to nominations for the election of directors and the proposal of business to be considered by stockholders to be held at an annual meeting of stockholders by any stockholder. In general, the Company will consider nominations for directors submitted by any stockholder or the proposal of business to be considered by stockholders only if such stockholder has given timely notice in proper written form, setting forth certain specified information. Generally, to be timely, notice must be received by the Corporate Secretary no later than the 60th day nor earlier than the 75th day before the first anniversary of the date on which the Company first mailed its proxy materials for the prior year’s meeting. For the 2023 Annual Meeting, notice must have been received no later than July 12, 2023 nor earlier than June 27, 2023. However, if we hold the 2023 Annual Meeting on a date that is advanced by more than 30 days prior to or delayed by more than 60 days after October 14, 2023, the one-year anniversary of the 2022 Annual Meeting of Stockholders (the “2022 Annual Meeting”), we must receive the notice not earlier than the close of business on the 120th day prior to the 2023 Annual Meeting and not later than the close of business on the later of the 90th day prior to the 2023 Annual Meeting or the 10th day following the day on which public announcement of the date of the 2023 Annual Meeting is first made. Notices of intent to nominate candidates for election as directors or other stockholder communications should be submitted to: the Company, 990 Biscayne Blvd., Suite 501, Office 12, Miami, Florida 33132, Attention: Corporate Secretary. Any proxy granted with respect to the 2023 Annual Meeting will confer on the proxy holders discretionary authority to vote with respect to a stockholder proposal or director nomination if notice of such proposal or nomination is not received by our Corporate Secretary within the timeframe provided above. In addition to satisfying the foregoing requirements, to comply with the universal proxy rules, stockholders who intended to solicit proxies in support of director nominees other than the Company’s nominees must have provided notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than August 15, 2023. If the date of the 2023 Annual Meeting date is changed by more than 30 days before or after October 14, 2023, then notice required by Rule 14a-19 must be provided by the later of 60 calendar days prior to the date of the 2023 Annual Meeting or the 10th calendar day following the day on which public announcement of the date of the 2023 Annual Meeting is first made.

7

PROPOSAL 1

THE INCREASE IN NUMBER OF AUTHORIZED

SHARES OF COMMON STOCK PROPOSAL

The Board has approved and is asking shareholders to approve an increase in the number of authorized shares of Common Stock 25,000,000 shares to 75,000,000 shares (the “Authorized Share Increase”) and a corresponding amendment to the Amended and Restated Certificate of Incorporation to effect the Authorized Share Increase (the “Proposed Amendment”).

Approval of the Proposed Amendment requires the affirmative vote of the holders of a majority of the outstanding shares of Common Stock. At the close of business on the Record Date, there were 16,016,107 shares of Common Stock issued and 15,948,689 shares of Common Stock outstanding. There are 5,405,010 shares of preferred stock, $1.00 par value per share (the “Preferred Stock”) authorized, none of which are outstanding.

Purpose of the Authorized Share Increase

The purpose of the Authorized Share Increase is to enable the Company to effect potential future issuances under outstanding derivative securities which are convertible into or exercisable or exchangeable for, shares of the Company’s Common Stock. Under its Amended and Restated Certificate of Incorporation, the Company is currently authorized to issue up to 25,000,000 shares of Common Stock and 5,000,000 shares of Preferred Stock. As of the close of business on the Record Date, there were 16,016,107 shares of Common Stock issued, 15,948,689 shares of Common Stock outstanding and no shares of Preferred Stock issued and outstanding. There are also 5,022,233 shares of Common Stock reserved for issuance pursuant to: (i) outstanding stock options, restricted stock units (“RSUs”) and restricted stock under equity incentive plans, (ii) outstanding warrants, (iii) outstanding convertible notes, and (iv) future awards which may be made under the Company’s Stock Incentive Plan, leaving a balance of 11,696 shares of Common Stock available for issuance.

Given the above outstanding securities and agreements to which the Company is or may become subject, and the nominal amount of shares remaining available for issuance after giving effect to the foregoing, the Board believes it to be in the best interest of the Company to increase the number of shares of Common Stock the Company is authorized to issue in order to enable the Company to have greater flexibility in addressing its future general corporate needs, including, but not limited to, the offer and sale of Common Stock in one or more registered public offerings, the grant of awards under equity incentive plans, and issuance of shares of capital stock in strategic transactions or to raise capital. The Board believes that additional authorized shares of capital stock will also enable the Company to take timely advantage of market conditions and favorable acquisition opportunities that may become available to the Company. Subject to reserve requirements under outstanding derivative securities, the authorized but unissued shares of Common Stock will be issued at the direction of the Board, without shareholder approval unless required by applicable law or Nasdaq Rules.

Compensation Programs

We have historically compensated our employees with RSUs and/or stock options in addition to salaries and other forms of cash compensation.

Our non-employee directors receive compensation for their service as directors and members of committees of the Board, which has historically been granted at the end of each calendar year and consisted of cash and/or stock awards. Our non-employee directors can elect to receive restricted stock instead of all or a portion of their cash compensation for service as directors. Compensation for service on committees of the Board is paid in shares of Common Stock.

If approved by the shareholders, the Proposed Amendment will enable the Company to continue to compensate its directors in equity awards under its compensation programs.

Rights of Additional Authorized Shares

Any newly authorized shares of Common Stock will have the same rights as the shares of Common Stock now authorized and outstanding. The Proposed Amendment will not affect the rights of current holders of Common Stock, none of whom have preemptive or similar rights to acquire the newly authorized shares.

8

Potential Adverse Effects of the Proposed Amendment

The Board has no current plans to issue any additional shares of Common Stock following the effectiveness of the Proposed Amendment. Adoption of the Proposed Amendment alone will not have any immediate dilutive effect on the proportionate voting power or other rights of the Company’s existing shareholders. However, any issuance of Common Stock at the direction of the Board or otherwise in the future, generally without obtaining shareholder approval (unless specifically required by applicable law or Nasdaq Rules) may, among other things, result in dilution to our shareholders at the time such additional shares are issued.

Additionally, an increase in the number of authorized shares of Common Stock may make it more difficult to, or discourage an attempt to, obtain control of the Company by means of a takeover bid that the Board determines is not in the best interest of the Company and its shareholders. However, the Board does not deem the proposed increase in the number of authorized shares of Common Stock pursuant to the Proposed Amendment as an anti-takeover measure and is not aware of any attempt or plan by a third party to obtain control of the Company.

Although at this time, we do not have any plans, commitments, proposals, arrangements, understandings or agreements regarding the issuance of Common Stock other than issuances upon exercise or conversion of currently outstanding securities; we anticipate seeking future equity financing opportunities and will evaluate opportunities that are presented to us. We believe that the Proposed Amendment will help ensure that we have sufficient authorized shares available for issuance to allow us to pursue equity financings if the Board determines that it would be in our best interests based on our working capital needs and prevailing market conditions.

No Appraisal Rights

Shareholders have no rights under the Delaware General Corporation Law or under our Amended and Restated Certificate of Incorporation to exercise dissenters’ rights of appraisal with respect to the approval of the Proposed Amendment.

Vote Required

The approval of this proposal requires that the votes cast in favor of this proposal exceed the votes cast against this proposal from the holders entitled to vote thereon. Abstentions are not votes cast and will have no effect on the outcome of this vote and broker non-votes are not expected for this proposal because we believe this matter is a routine matter. If there were to be any broker non-votes they would have no effect on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE INCREASE IN NUMBER OF AUTHORIZED SHARES OF COMMON STOCK.

9

PROPOSAL 2

AMENDMENT TO THE SG BLOCKS, INC. STOCK INCENTIVE PLAN

The Plan was initially approved by the Board of Directors and our stockholders in January 2017. The Plan, as adopted, reserved an aggregate of 75,000 shares of Common Stock (1,500,000 shares on a pre-stock split basis) for issuance and was amended by Amendment No. 1 for an increase to 125,000 shares of Common Stock (1,000,000 shares on a pre-stock split basis) on June 1, 2018, was further amended by Amendment No. 2 for an increase to 1,125,000 shares of Common Stock, and was further amended by Amendment No. 3 for an increase to 3,625,000. The Board of Directors requests that stockholders approve an additional amendment to the Plan (the “Amendment”) to increase the maximum number of shares of Common Stock available for issuance of awards under the Plan by 5,000,000 shares to 8,625,000 shares. The Company implemented a reverse stock split of its shares of common stock at a ratio of one-for-twenty, which was effective on February 5, 2020.

As of the Record Date, 11,696 shares remained available for grant under the Plan.

Reasons for the Proposed Amendment

The Board of Directors recommends that stockholders vote “FOR” the adoption of the Amendment to the Plan to increase the number of authorized shares. In making such recommendation, the Board of Directors considered a number of factors, including the following:

• Equity-based compensation awards are a critical element of our overall compensation program. We believe that our long-term incentive compensation program aligns the interests of management, employees and the stockholders to create long-term stockholder value. The amendment to the Plan will allow us to continue to attract, motivate and retain our officers, key employees, non-employee directors and consultants.

• We believe the current amount of shares remaining available for grant under the Plan are not sufficient in light of our compensation structure and strategy, and that the additional 5,000,000 shares being sought will ensure that we continue to have a sufficient number of shares authorized and available for future awards issued under the Plan.

Stockholders are asked to approve the amendment to the Plan to satisfy Nasdaq requirements relating to stockholder approval of equity compensation and to qualify certain stock options authorized under the Plan for treatment as incentive stock options under Section 422 of the Internal Revenue Code.

Share Usage and Key Data

We manage our long-term stockholder dilution by limiting the number of equity incentive awards granted annually. The Compensation Committee monitors our annual stock award Burn Rate and Overhang (each as defined below), among other factors, in its efforts to maximize stockholders’ value by granting what, in the Committee’s judgment, are the appropriate number of equity incentive awards necessary to attract, reward, and retain employees, non-employee directors and consultants. The table below illustrates our Burn Rate and Overhang under our Plan for the past three fiscal years with details of each calculation noted below the table.

|

2022 |

2021 |

2020 |

|||||||

|

Burn Rate(1) |

22.29 |

% |

11.15 |

% |

10.37 |

% |

|||

|

Overhang(2) |

8.94 |

% |

15.04 |

% |

11.57 |

% |

|||

____________

(1) Burn Rate is (number of shares subject to equity awards granted during a fiscal year)/(total common shares outstanding for that fiscal year).

(2) Overhang is (number of shares subject to outstanding awards at the end of a fiscal year + number of shares available for new awards under incentive plan)/(number of shares subject to outstanding awards at the end of the fiscal year + number of shares available for new awards under incentive plan + total common shares outstanding for that fiscal year).

Text of the Amendment

The proposed amended and restated Plan (Amendment No. 4) is attached hereto as Appendix A.

10

Summary of the Plan

The Plan authorizes us to grant equity-based and cash-based incentive compensation in the form of stock options, stock appreciation rights (or “SARs”), restricted shares, restricted share units, other share-based awards and cash-based awards, for the purpose of providing the Company’s employees, officers, consultants and non-employee directors with incentives and rewards for performance. The principal features of the Plan are summarized below; such summary does not purport to be a complete description of the Plan.

Types of Awards

The Plan authorizes the issuance of awards in the form of stock options (which may be either incentive stock options within the meaning of Section 422 of the Internal Revenue Code or nonqualified stock options), SARs, restricted shares, restricted share units, other share-based awards and cash-based awards.

Administration

The Plan is administered by our Compensation Committee, which, to the extent required by applicable law or stock exchange listing standards, will consist entirely of two or more individuals who are “non-employee directors” within the meaning of Rule 16b-3 under the Securities Exchange Act and “independent directors” within the meaning of the applicable rules of any securities exchange on which the shares are listed. The Compensation Committee can make rules and regulations and establish such procedures for the administration of the Plan as it deems appropriate and may delegate any of its authority to one or more directors or executive officers of the Company, to the extent permitted by applicable laws. However, our Board of Directors reserves the authority to administer and issue awards under the Plan.

Eligibility

The Plan provides for awards to our non-employee directors and to our officers, employees and consultants, except that incentive stock options may only be granted to our employees. It is currently anticipated that approximately 20 employees and consultants and six non-employee directors will be eligible for awards under the Plan.

Shares Available

If our stockholders approve the Amendment to the Plan, the maximum number of shares of our Common Stock that may be issued or transferred with respect to awards under the Plan will be 8,625,000, shares (all of which may be granted as incentive stock options), subject to adjustment as provided below. Shares issued under the Plan may include authorized but unissued shares, treasury shares, shares purchased in the open market or a combination of the foregoing.

Shares underlying awards that are settled in cash or that terminate or are forfeited, cancelled or surrendered without the issuance of shares or the release of a substantial risk of forfeiture will again be available for issuance under the Plan, as will shares tendered in payment of the exercise price of a stock option, shares withheld to satisfy a tax withholding obligation with respect to any award and shares that are repurchased by us with stock option proceeds. Shares granted through awards that are granted in assumption of, or in substitution or exchange for, outstanding awards previously granted by an entity acquired directly or indirectly by us or with which we directly or indirectly combines will not count against the share limit above, except as may be required by the rules and regulations of any applicable stock exchange or trading market.

Non-Employee Director Award Limit

The Plan provides that the aggregate grant date fair value (computed as of the date of grant in accordance with applicable financial accounting rules) of all awards granted to any non-employee director under the Plan during any single calendar year, taken together with any cash fees paid to that person during the calendar year, may not exceed $150,000.

Stock Options

Subject to the terms and provisions of the Plan, options to purchase shares may be granted to eligible individuals at any time and from time to time as determined by the Compensation Committee. Options may be granted as incentive stock options (all of the shares available for issuance under the Plan may be issued pursuant to incentive stock options) or as

11

nonqualified stock options. Subject to the limits provided in the Plan, the Compensation Committee, or its delegate, determines the number of options granted to each recipient. Each option grant will be evidenced by a stock option agreement that specifies whether the options are intended to be incentive stock options or nonqualified stock options and such additional limitations, terms and conditions as the Compensation Committee may determine.

The exercise price for each option may not be less than 100% of the fair market value of a share on the date of grant. As of the Record Date, the closing price of a share of Common Stock was $1.168.

All options granted under the Plan will expire no later than 10 years from the date of grant. The method of exercising an option granted under the Plan will be set forth in the stock option agreement for that particular option and may include payment of cash or cash equivalent, tender of previously acquired shares with a fair market value equal to the exercise price, a cashless exercise (including withholding of shares otherwise deliverable on exercise or a broker-assisted arrangement as permitted by applicable laws), a combination of the foregoing methods or any other method approved by the Compensation Committee in its discretion.

Stock Appreciation Rights

The Compensation Committee in its discretion may grant SARs under the Plan. A SAR entitles the holder to receive from the Company, upon exercise, an amount equal to the excess, if any, of the aggregate fair market value of a specified number of shares that are the subject of such SAR, over the aggregate exercise price for the underlying shares.

The exercise price for each SAR may not be less than 100% of the fair market value of a share on the date of grant.

We may make payment of the amount to which the participant exercising SARs is entitled by delivering shares, cash or a combination of stock and cash as set forth in the applicable award agreement. Each SAR will be evidenced by an award agreement that specifies the date and terms of the award and such additional limitations, terms and conditions as the Compensation Committee may determine.

Restricted Shares

Under the Plan, the Compensation Committee may grant or sell to plan participants shares that are subject to forfeiture and restrictions on transferability. Except for these restrictions and any others imposed by the Compensation Committee, upon the grant of restricted shares, the recipient will have the rights of a stockholder with respect to the restricted shares, including the right to vote the restricted shares and to receive all dividends and other distributions paid or made with respect to the restricted shares. During the applicable restriction period, the recipient may not sell, transfer, pledge, exchange or otherwise encumber the restricted shares. Each restricted shares award will be evidenced by an award agreement that specifies the terms of the award and such additional limitations, terms and conditions, which may include restrictions based upon the achievement of performance objectives, as the Compensation Committee may determine.

Restricted Share Units

Under the Plan, the Compensation Committee may grant or sell to plan participants restricted share units, which constitute an agreement to deliver shares to the participant in the future at the end of a restriction period and subject to such other terms and conditions as the Compensation Committee may specify. Restricted share units are not shares and do not entitle the recipients to the rights of a stockholder. Restricted share units granted under the Plan may or may not be subject to performance conditions. Restricted share units will be settled in cash or shares, in an amount based on the fair market value of a share on the settlement date. Each restricted share unit award will be evidenced by an award agreement that specifies the terms of the award and such additional limitations, terms and conditions as the Compensation Committee may determine, which may include restrictions based upon the achievement of performance objectives.

12

Other Share-Based Awards

The Plan also provides for grants of other share-based awards under the Plan, which may include unrestricted shares or time-based or performance-based unit awards that are settled in shares or cash. Each other share-based award will be evidenced by an award agreement that specifies the terms of the award and such additional limitations, terms and conditions as the Compensation Committee may determine.

Dividend Equivalents

Awards may provide the participant with dividend equivalents, on any of a current, deferred or contingent basis, and either in cash or in additional shares, as determined by the Compensation Committee in its sole discretion and set forth in the related award agreement. However, no dividend equivalents shall be granted with respect to shares underlying a stock option or SAR.

Performance Objectives

The plan provides that performance objectives may be established by the Compensation Committee, in its discretion, in connection with any award granted under the Plan. Performance objectives may relate to performance of the Company or one or more of our subsidiaries, divisions, departments, units, functions, partnerships, joint ventures or minority investments, product lines or products or the performance of an individual participant, and performance objectives may be made relative to the performance of a group of companies or a special index of companies.

For example, without limiting the Compensation Committee’s discretion, performance objectives may be based on the attainment of specified levels of one or more performance criteria, which may include (but shall not be limited to) the following criteria: revenues, weighted average revenue per unit, earnings from operations, operating income, earnings before or after interest and taxes, operating income before or after interest and taxes, net income, cash flow, earnings per share, debt to capital ratio, increase in market capitalization, economic value added, return on total capital, return on invested capital, return on equity, return on assets, total return to stockholders, earnings before or after interest, taxes, depreciation, amortization or extraordinary or special items, operating income before or after interest, taxes, depreciation, amortization or extraordinary or special items, return on investment, free cash flow, cash flow return on investment (discounted or otherwise), net cash provided by operations, cash flow in excess of cost of capital, operating margin, profit margin, contribution margin, stock price and/or strategic business criteria consisting of one or more objectives based on meeting specified product development, strategic partnering, research and development, market penetration, geographic business expansion goals, cost targets, customer satisfaction, gross or net additional customers, average customer life, employee satisfaction, management of employment practices and employee benefits, supervision of litigation and information technology and goals relating to acquisitions or divestitures of subsidiaries, affiliates and joint ventures.

Change in Control

In the event of a change in control of the Company, the Compensation Committee, in its sole discretion, may take such actions, if any, as it deems necessary or desirable with respect to any outstanding award, without the consent of any affected participant. Those actions may include, without limitation: (a) acceleration of the vesting, settlement, and/or exercisability of an award; (b) payment of a cash amount in exchange for the cancellation of an award; (c) cancellation of stock options or SARs without any payment if the fair market value per share on the date of the change in control does not exceed the exercise price per share of the applicable award; or (d) issuance of substitute awards that substantially preserve the value, rights and benefits of any affected awards.

For purposes of the Plan, a change in control generally means (except as otherwise provided in the applicable award agreement): (a) the acquisition of effective control of more than 50% of the voting securities of the Company (other than by means of conversion or exercise of convertible debt or equity securities of the Company); (b) the Company merges into or consolidates with any other person, or any person merges into or consolidates with the Company and, after giving effect to such transaction, the stockholders of the Company immediately prior to such transaction own less than 50% of the aggregate voting power of the Company or the successor entity of such transaction; or (c) the Company sells or transfers all or substantially all of its assets to another person and the stockholders of the Company immediately prior to such transaction own less than 50% of the aggregate voting power of the acquiring entity immediately after the transaction.

13

Forfeiture of Awards

Awards granted under the Plan also may be subject to forfeiture or repayment to us as provided pursuant to any compensation recovery policy that we may adopt.

Adjustments

In the event of any equity restructuring, such as a stock dividend, stock split, spin off, rights offering or recapitalization through a large, nonrecurring cash dividend, the Compensation Committee will adjust the number and kind of shares that may be delivered under the Plan, the individual award limits and, with respect to outstanding awards, the number and kind of shares subject to outstanding awards and the exercise price or other price of shares subject to outstanding awards, to prevent dilution or enlargement of rights. In the event of any other change in corporate capitalization, such as a merger, consolidation or liquidation, the Compensation Committee may, in its discretion, make such equitable adjustment as described in the foregoing sentence to prevent dilution or enlargement of rights. However, unless otherwise determined by the Compensation Committee, we will always round down to a whole number of shares subject to any award. Moreover, in the event of any such transaction or event, the Compensation Committee, in its discretion, may provide in substitution for any or all outstanding awards such alternative consideration (including cash) as it, in good faith, may determine to be equitable in the circumstances and may require in connection therewith the surrender of all awards so replaced.

Transferability

Except as the Compensation Committee otherwise determines, awards granted under the Plan will not be transferable by a participant other than by will or the laws of descent and distribution. Except as otherwise determined by the Compensation Committee, stock options and SARs will be exercisable during a participant’s lifetime only by him or her or, in the event of the participant’s incapacity, by his or her guardian or legal representative. Any award made under the Plan may provide that any shares issued as a result of the award will be subject to further restrictions on transfer.

Term of Plan and Amendment

Unless earlier terminated by our Board of Directors, the Plan will expire on October 25, 2026, and no further awards may be made under the Plan after that date. However, any awards granted under the Plan prior to its termination will remain outstanding thereafter in accordance with their terms.

Our Board of Directors may amend, alter or discontinue the Plan at any time, with stockholder approval to the extent required by applicable law (including applicable stock exchange rules). No such amendment or termination, however, may adversely affect in any material way any holder of outstanding awards without his or her consent, except for amendments made to cause the plan to comply with applicable law, stock exchange rules or accounting rules, and no award may be amended or otherwise subject to any action that would be treated as a “repricing” of such award, unless such action is approved by our stockholders.

U.S. Federal Income Tax Consequences

The following is a brief summary of the general U.S. federal income tax consequences relating to the Plan. This summary is based on U.S. federal tax laws and regulations in effect on the date of this Proxy Statement and does not purport to be a complete description of the U.S. federal income tax laws.

Incentive Stock Options. Incentive stock options are intended to qualify for special treatment available under Section 422 of the Internal Revenue Code. A participant who is granted an incentive stock option will not recognize ordinary income at the time of grant. A participant will not recognize ordinary income upon the exercise of an incentive stock option provided that the participant was, without a break in service, an employee of the Company or a subsidiary during the period beginning on the grant date of the option and ending on the date three months prior to the date of exercise (one year prior to the date of exercise if the participant’s employment is terminated due to permanent and total disability).

If the participant does not sell or otherwise dispose of the shares of Common Stock acquired upon the exercise of an incentive stock option within two years from the grant date of the incentive stock option or within one year after he or she receives the shares of Common Stock, then, upon disposition of such shares of Common Stock, any amount recognized in excess of the exercise price will be taxed to the participant as a capital gain. The participant will generally recognize a capital loss to the extent that the amount recognized is less than the exercise price.

14

If the foregoing holding period requirements are not met, the participant will generally recognize ordinary income at the time of the disposition of the shares of Common Stock in an amount equal to the lesser of (i) the excess of the fair market value of the shares of Common Stock on the date of exercise over the exercise price or (ii) the excess, if any, of the amount recognized upon disposition of the shares of Common Stock over the exercise price. Any amount recognized in excess of the value of the shares of Common Stock on the date of exercise will be capital gain. If the amount recognized is less than the exercise price, the participant generally will recognize a capital loss equal to the excess of the exercise price over the amount recognized upon the disposition of the shares of Common Stock.

The rules described above that generally apply to incentive stock options do not apply when calculating any alternative minimum tax liability. The rules affecting the application of the alternative minimum tax are complex, and their effect depends on individual circumstances, including whether a participant has items of adjustment other than those derived from incentive stock options.

Nonqualified Stock Options. A participant will not recognize ordinary income when a nonqualified stock option is granted. When a nonqualified stock option is exercised, a participant will recognize ordinary income in an amount equal to the excess, if any, of the fair market value of the shares of Common Stock that the participant purchased over the exercise price he or she paid.

Stock Appreciation Rights. A participant will not recognize ordinary income when a SAR is granted. When a SAR is exercised, the participant will recognize ordinary income equal to the cash and/or the fair market value of shares of Common Stock the participant receives.

Restricted Shares. A participant who has been granted restricted shares will not recognize ordinary income at the time of grant, assuming that the underlying shares of Common Stock are not transferable and that the restrictions create a “substantial risk of forfeiture” for federal income tax purposes and that the participant does not make an election under Section 83(b) of the Internal Revenue Code. Generally, upon the vesting of restricted shares, the participant will recognize ordinary income in an amount equal to the then fair market value of the shares of Common Stock, less any consideration paid for such shares of Common Stock. Any gains or losses recognized by the participant upon disposition of the shares of Common Stock will be treated as capital gains or losses. However, a participant may elect, pursuant to Section 83(b) of the Internal Revenue Code, to have income recognized at the date of grant of a restricted share award equal to the fair market value of the shares of Common Stock on the grant date (less any amount paid for the restricted shares) and to have the applicable capital gain holding period commence as of that date.

Restricted Share Units. A participant generally will not recognize ordinary income when restricted share units are granted. Instead, a participant will recognize ordinary income when the restricted share units are settled in an amount equal to the fair market value of the shares of Common Stock or the cash he or she receives, less any consideration paid.

Other Share-Based Awards. Generally, participants will recognize ordinary income equal to the fair market value of the shares of Common Stock subject to other share-based awards when they receive the shares of Common Stock.

Cash-Based Awards. Generally, a participant will recognize ordinary income when a cash-based award is settled in an amount equal to the cash he or she receives.

Sale of Shares. When a participant sells shares of Common Stock that he or she has received under an award, the participant will generally recognize long-term capital gain or loss if, at the time of the sale, the participant has held the shares of Common Stock for more than one year (or, in the case of a restricted share award, more than one year from the date the restricted shares vested unless the participant made an election pursuant to Section 83(b) of the Internal Revenue Code, described above). If the participant has held the shares of Common Stock for one year or less, the gain or loss will be a short-term capital gain or loss.

Section 409A of the Tax Code. In 2004, the Internal Revenue Code was amended to add Section 409A, which created new rules for amounts deferred under nonqualified deferred compensation plans. Section 409A includes a broad definition of nonqualified deferred compensation plans which may extend to various types of awards granted under the Plan. If an award is subject to, but fails to comply with, Section 409A, the participant would generally be subject to accelerated income taxation, plus a 20% penalty tax and an interest charge. The Company intends that awards granted under the Plan will either be exempt from, or will comply with, Section 409A.

15

Tax Deductibility of Compensation Provided Under the Plan. When a participant recognizes ordinary compensation income as a result of an award granted under the Plan, the Company may be permitted to claim a federal income tax deduction for such compensation, subject to various limitations that may apply under applicable law.

For example, Section 162(m) of the Internal Revenue Code disallows the deduction of certain compensation in excess of $1.0 million per year payable to any of the “covered employees” of a public company. The Compensation Committee has granted stock options under the Plan that were intended to be exempt from the $1 million deduction limit of Section 162(m). However, as a result of changes to Section 162(m) pursuant to the Tax Cuts and Jobs Act, which was enacted on December 22, 2017, compensation paid in 2018 or a later fiscal year to one of our covered employees generally will not be deductible by the Company to the extent that it exceeds $1.0 million, except as otherwise permitted by applicable transition rules.

Further, to the extent that compensation provided under the Plan may be deemed to be contingent upon a change in control of the Company, a portion of such compensation may be non-deductible by the Company under Section 280G of the Internal Revenue Code and may be subject to a 20% excise tax imposed on the recipient of the compensation.

Plan Benefits. Because it is within the discretion of the Compensation Committee to determine which non-employee directors, employees and consultants will receive awards and the amount and type of awards received, it is not presently possible to determine the number of individuals to whom awards will be made in the future under the Plan or the amount of the awards except that we have adopted a non-employee director compensation policy that provides that each non-employee director will receive RSUs having a value of $80,000, which grant will not be made unless this proposal is approved.

Interests of Directors and Executive Officers. Our current directors and executive officers have substantial interests in the matters set forth in this proposal since equity awards may be granted to them under the Plan.

Registration with the Securities and Exchange Commission. After approval of the Amendment to the Plan by our stockholders, we intend to file with the SEC a Registration Statement on Form S-8 relating to the additional shares reserved for issuance under the Plan.

New Plan Benefits

As of the date of this proxy statement, we are unable to determine any specific grants of awards under the Plan that will be made. However, subject to approval by our stockholders of an amendment to our Plan to increase the number of shares issuable thereunder by 5,000,000 (Proposal 2), we do anticipate issuing: (i) to our Chief Executive Officer-RSUs representing a contingent right to receive such number of shares of Common Stock as will result in him owning a total of 9.9% of our outstanding shares of our Common Stock; (ii) to each of our non-employee directors as of the Record Date for their annual compensation, RSUs representing a contingent right to receive shares of Common Stock with a grant date value of $80,000, which shall vest quarterly over one year ; (iii) to each of our non-employee directors appointed subsequent to the Record Date, RSUs representing a contingent right to receive shares of Common Stock with a grant date value of $80,000, which shall vest quarterly over two years. The dollar value of these awards cannot be determined at this time.

Since it is not possible to determine the exact number of awards that will be granted under the Plan, the awards granted during fiscal 2022 under the Plan are set forth in the following table.

|

Name and position |

Number of |

Number of |

||

|

Paul Galvin, Chief Executive Officer |

250,000 |

— |

||

|

Gerald Sheeran, Former Chief Financial Officer |

— |

|||

|

William Rogers, Chief Operating Officer |

— |

|||

|

All Current Executive Officers as a Group |

250,000 |

|||

|

All Current Non-employee Directors as a Group |

20,000 |

|||

|

All Current Non-Executive Officer Employees as a Group |

795,000 |

16

Equity Compensation Plan Information

As of December 31, 2022, the following securities issued under equity compensation were outstanding:

|

Plan Category |

Number of |

Weighted- |

Number of Shares |

||||

|

Equity compensation plans approved by security holders |

3,248,940 |

$ |

78.71 |

376,060 |

|||

|

Equity compensation plans not approved by security holders |

— |

|

— |

— |

|||

|

Total |

3,248,940 |

$ |

78.71 |

376,060 |

|||

____________

(1) Includes 36,436 shares issuable upon the exercise of options and 3,212,504 shares issuable upon the vesting of RSUs outstanding under the SG Blocks, Inc. Incentive Plan.

(2) The weighted average exercise price excludes RSUs.

(3) Represents shares available for issuance under the SG Blocks, Inc. Stock Incentive Plan.

Interests of Directors and Executive Officers

Our directors and executive officers have substantial interests in the matters set forth in this proposal since equity awards may be granted to them under the Plan.

Vote Required

The affirmative vote of a majority of the shares present in person or represented by proxy at the 2023 Special Meeting is required to approve the Amendment to the Plan. Abstentions will have the same effect as a vote against the proposal and broker non-votes will not be counted for purposes of determining the number of shares represented and voted on this proposal in the meeting and, accordingly, will not affect the outcome of this proposal. Shares represented by properly executed proxies of record holders will be voted, if specific instructions are not otherwise given, in favor of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE AMENDMENT TO THE SG BLOCKS, INC. STOCK INCENTIVE PLAN TO INCREASE THE NUMBER OF SHARES AVAILABLE FOR ISSUANCE THEREUNDER IN AN AMOUNT OF 5,000,000 SHARES, FROM 3,625,000 TO 8,625,000 SHARES.

17

EXECUTIVE COMPENSATION

We are a “smaller reporting company” and the following compensation disclosure is intended to comply with the requirements applicable to smaller reporting companies. Although the rules allow us to provide less detail about our executive compensation program, the Compensation Committee is committed to providing the information necessary to help stockholders understand our executive compensation-related decisions. Accordingly, this section includes supplemental narratives that describe the 2022 executive compensation program for our named executive officers.

The following discussion and table relates to compensation arrangements on behalf of, and compensation paid by our Company to, our “named executive officers”: Paul M. Galvin, Gerald Sheeran, and William Rogers.

Summary Compensation Table

The following table sets forth all compensation awarded to, paid to or earned by the following named executive officers for the fiscal years ended December 31, 2022 and 2021:

|

Name and Principal Position |

Year |

Salary |

Bonus |

Stock |

All Other |

Total |

|||||||||||

|

Paul M. Galvin, |

2022 |

$ |

450,000 |

$ |

150,000 |

$ |

402,500 |

$ |

36,705 |

$ |

1,039,205 |

||||||

|

Chairman and Chief Executive Officer and Interim Chief Financial Officer |

2021 |

$ |

400,000 |

$ |

100,000 |

$ |

1,183,000 |

$ |

40,657 |

$ |

1,723,657 |

||||||

|

|

|

|

|

|

|||||||||||||

|

Gerald Sheeran, |

2022 |

$ |

196,875 |

$ |

56,250 |

$ |

— |

$ |

175,814 |

$ |

428,939 |

||||||

|

Former Acting Chief Financial Officer and Controller |

2021 |

$ |

191,250 |

$ |

64,250 |

$ |

338,000 |

$ |

17,529 |

$ |

611,029 |

||||||

|

|

|

|

|

|

|||||||||||||

|

William Rogers |

2022 |

$ |

300,000 |

$ |

75,000 |

$ |

— |

$ |

26,210 |

$ |

401,210 |

||||||

|

Chief Operating Officer |

2021 |

$ |

300,000 |

$ |

75,000 |

$ |

802,750 |

$ |

9,903 |

$ |

1,187,653 |

||||||

____________

(1) On November 3, 2022, the Compensation Committee granted RSUs with a value of $402,500 to Mr. Galvin. On October 1, 2021, the Compensation Committee granted RSUs with a value of $1,183,000 to Mr. Galvin, $802,750 to Mr. Rogers and $338,000 to Mr. Sheeran. This column indicates the aggregate grant date fair value, as determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation — Stock Compensation (“FASB ASC Topic 718”). See “Note 19 — Share-based Compensation” of the Notes to Consolidated Financial Statements contained in our Annual Report on Form 10-K for the year ended December 31, 2022 for an explanation of the assumptions made in valuing these awards.

(2) For 2022, all other compensation consisted of: Mr. Galvin — automobile allowance of $9,600, medical insurance allowance of $25,305 and phone allowance of $1,800; Mr. Sheeran — phone allowance of $500, automobile allowance of $2,000, medical insurance allowance of $4,064, restricted common shares with an approximate value of $38,000 from his separation agreement and a separation payment of $131,250; Mr. Rogers — medical insurance allowance of $10,410, and $14,300 matching contributions under the Company’s qualified 401(k) plan and $1,500 phone allowance. For 2021, all other compensation consisted of: Mr. Galvin — automobile allowance of $9,600, medical insurance allowance of $29,257 and phone allowance of $1,800; Mr. Sheeran — phone allowance of $1,500, automobile allowance of $1,500, $5,125 matching contributions under the Company’s 401(k) plan, medical insurance allowance of $9,404; Mr. Rogers — medical insurance allowance of $8,278 and $1,625 phone allowance.

(3) Mr. Sheeran’s employment with us terminated on May 12, 2022. Mr. Galvin was appointed Interim Chief Financial Officer on May 18, 2022.

Narrative Disclosure to Summary Compensation Table

Following is a brief summary of each core element of the compensation program for our named executive officers.

Base Salary

We provide competitive base salaries that are intended to attract and retain key executive talent. Base salary levels depend on the executive’s position, responsibilities, experience, market factors, recruitment and retention factors, internal equity factors and our overall compensation philosophy. Effective January 1, 2017, we entered into an employment agreement with Mr. Galvin as described further below under “Employment Agreements.” On July 24, 2018, the Compensation Committee approved an increase to the annual base salary of Mr. Galvin, the Company’s

18

President, retroactive to January 1, 2018. Mr. Galvin’s salary increased from $240,000 to $370,000. Such increases were based on a competitive market assessment provided by Haigh & Company, the Compensation Committee’s independent compensation consultant. On December 1, 2019, the annual base salary for Mr. Galvin decreased from $370,000 to $180,000. On April 24, 2020, the annual base salary for Mr. Galvin increased from $180,000 to $400,000. On July 5, 2022, the annual base salary for Mr. Galvin increased to $500,000.