Exhibit 10.1

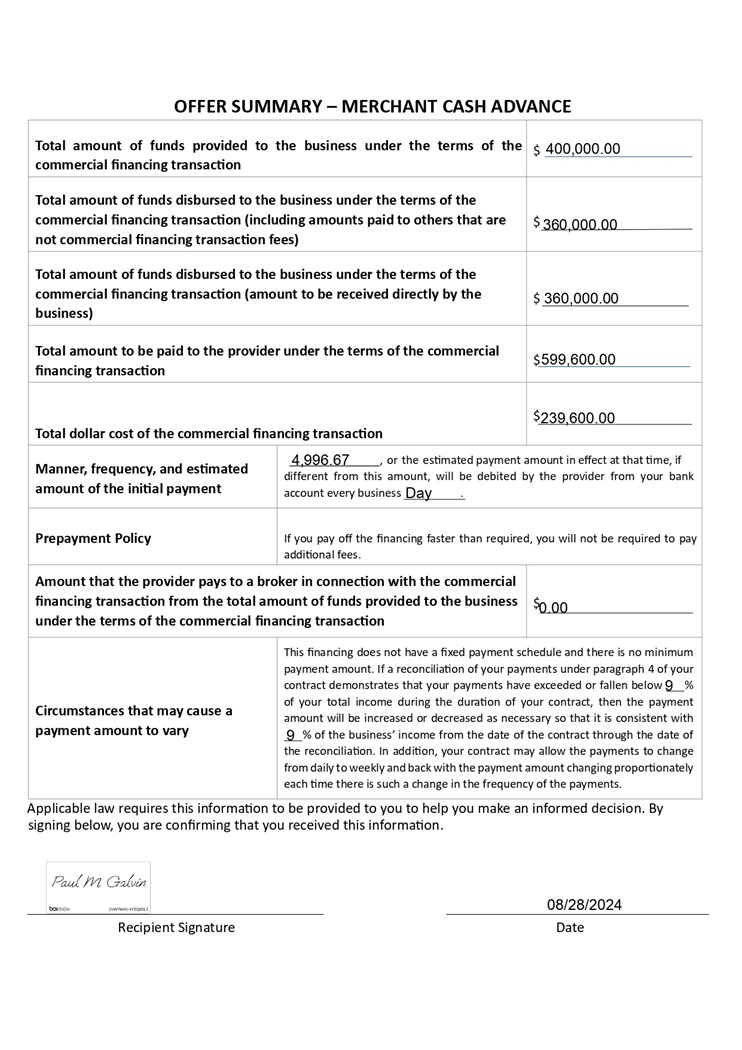

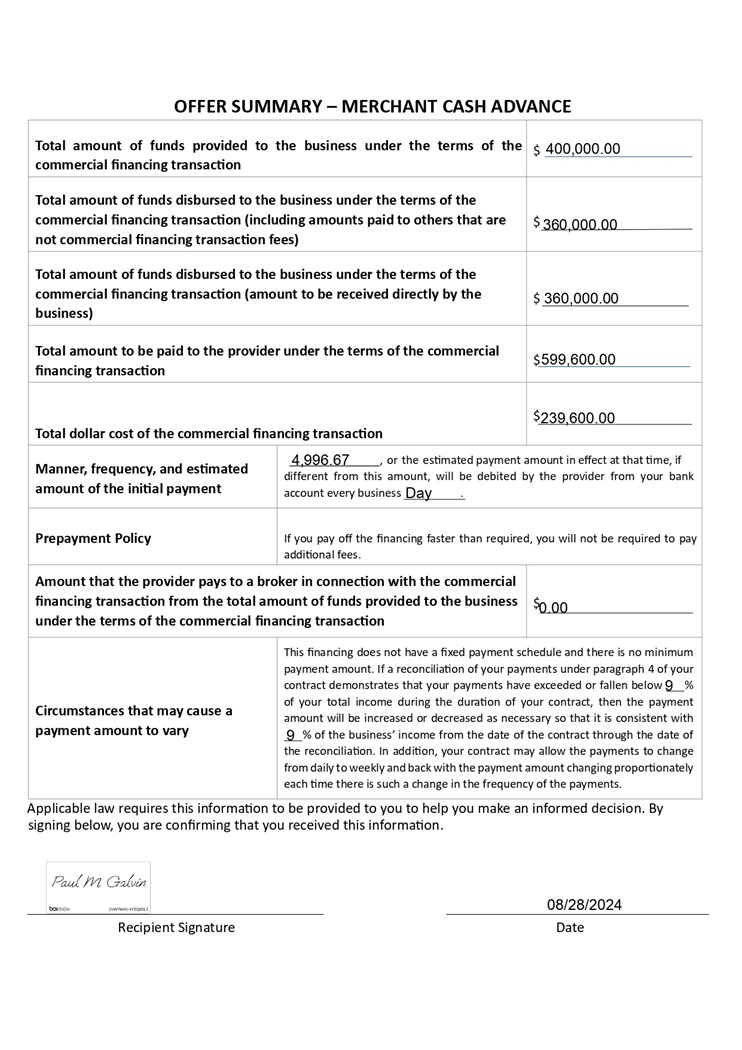

OFFER SUMMARY – MERCHANT CASH ADVANCE Applicable law requires this information to be provided to you to help you make an informed decision. By signing below, you are confirming that you received this information. $ 400,000.00 Total amount of funds provided to the business under the terms of the commercial financing transaction $ 360,000.00 Total amount of funds disbursed to the business under the terms of the commercial financing transaction (including amounts paid to others that are not commercial financing transaction fees) $ 360,000.00 Total amount of funds disbursed to the business under the terms of the commercial financing transaction (amount to be received directly by the business) $ 599,600.00 Total amount to be paid to the provider under the terms of the commercial financing transaction $ 239,600.00 Total dollar cost of the commercial financing transaction 4,996.67 , or the estimated payment amount in effect at that time, if different from this amount, will be debited by the provider from your bank account every business Day . Manner, frequency, and estimated amount of the initial payment If you pay off the financing faster than required, you will not be required to pay additional fees. Prepayment Policy $ 0.00 Amount that the provider pays to a broker in connection with the commercial financing transaction from the total amount of funds provided to the business under the terms of the commercial financing transaction This financing does not have a fixed payment schedule and there is no minimum payment amount . If a reconciliation of your payments under paragraph 4 of your contract demonstrates that your payments have exceeded or fallen below 9 % of your total income during the duration of your contract, then the payment amount will be increased or decreased as necessary so that it is consistent with 9 _ % of the business’ income from the date of the contract through the date of the reconciliation . In addition, your contract may allow the payments to change from daily to weekly and back with the payment amount changing proportionately each time there is such a change in the frequency of the payments . Circumstances that may cause a payment amount to vary R e c i p ie n t S i g n a t u r e 08/28/2024 Date

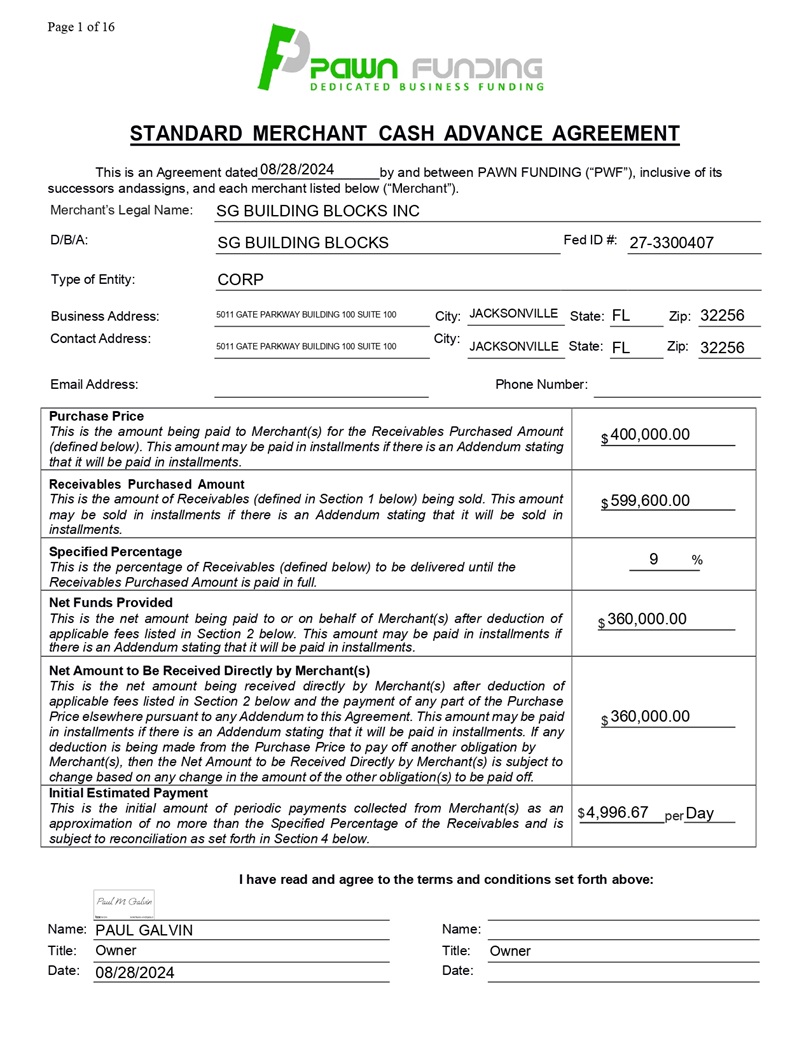

Page 1 of 16 STANDARD MERCHANT CASH ADVANCE AGREEMENT This is an Agreement dated 08/28/2024 by and between PAWN FUNDING (“PWF”), inclusive of its successors andassigns, and each merchant listed below (“Merchant”). Merchant’s Legal Name: D/ B / A : SG BUILDING BLOCKS INC SG BUILDING BLOCKS Fed ID #: 27 - 3300407 CORP B usi n ess A d d r ess: Co nt a ct A dd r ess: Ci ty: State: FL Z i p : E m a i l A dd r ess: P hone Nu m be r : $ 400,000.00 Purchase Price This is the amount being paid to Merchant(s) for the Receivables Purchased Amount (defined below) . This amount may be paid in installments if there is an Addendum stating that it will be paid in installments . $ 599,600.00 Receivables Purchased Amount This is the amount of Receivables (defined in Section 1 below) being sold . This amount may be sold in installments if there is an Addendum stating that it will be sold in installments . 9 % Specified Percentage This is the percentage of Receivables (defined below) to be delivered until the Receivables Purchased Amount is paid in full. $ 360,000.00 Net Funds Provided This is the net amount being paid to or on behalf of Merchant(s) after deduction of applicable fees listed in Section 2 below . This amount may be paid in installments if there is an Addendum stating that it will be paid in installments . $ 360,000.00 Net Amount to Be Received Directly by Merchant(s) This is the net amount being received directly by Merchant(s) after deduction of applicable fees listed in Section 2 below and the payment of any part of the Purchase Price elsewhere pursuant to any Addendum to this Agreement. This amount may be paid in installments if there is an Addendum stating that it will be paid in installments. If any deduction is being made from the Purchase Price to pay off another obligation by Merchant(s), then the Net Amount to be Received Directly by Merchant(s) is subject to change based on any change in the amount of the other obligation(s) to be paid off. $ 4,996.67 per Day I n i t i a l E s t i m a t e d P a y m e n t This is the initial amount of periodic payments collected from Merchant(s) as an approximation of no more than the Specified Percentage of the Receivables and is subject to reconciliation as set forth in Section 4 below . I have read and agree to the terms and conditions set forth above: Da te: T ype of E ntity: City: JACKSONVILLE Z ip: S t a t e : FL 32256 Name: PAUL GALVIN Title: Owner Name : Title : Owner Date : 5011 GATE PARKWAY BUILDING 100 SUITE 100 5011 GATE PARKWAY BUILDING 100 SUITE 100 JACKSONVILLE 32256 08/28/2024

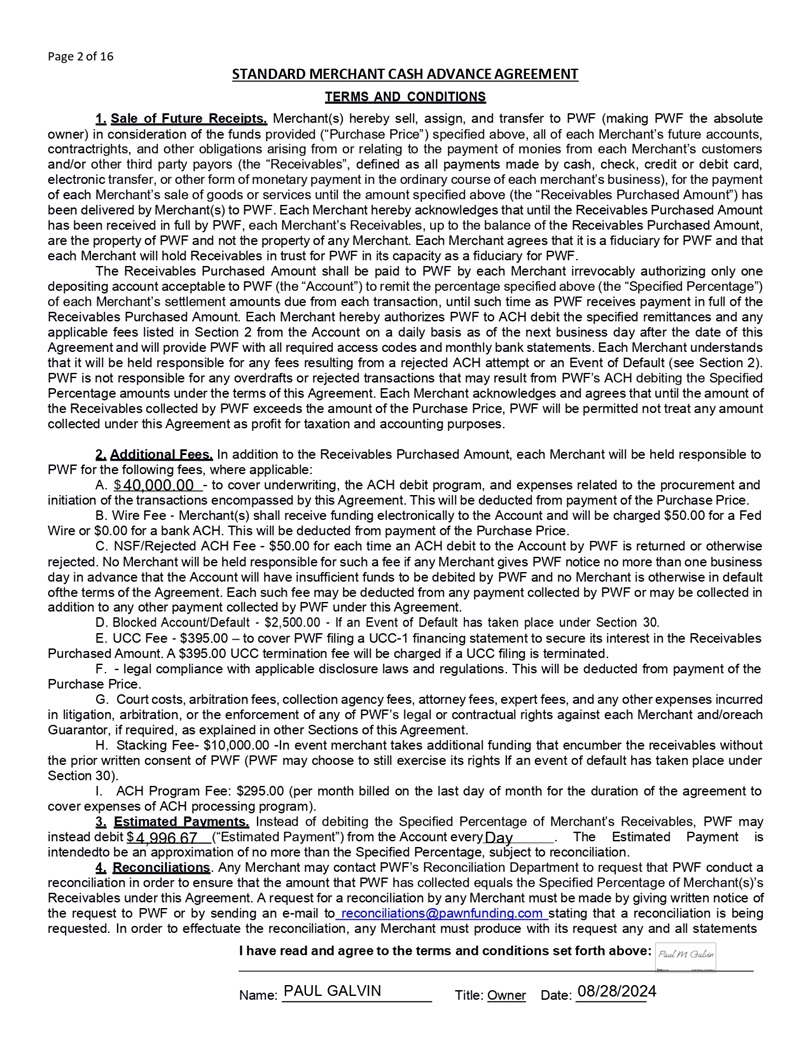

Pa g e 2 o f 16 S T A N D A RD ME R CH A N T C AS H A D V A N CE A G R EE M E N T TERMS AND CONDITIONS 1 . Sale of Future Receipts . Merchant(s) hereby sell, assign, and transfer to PWF (making PWF the absolute owner) in consideration of the funds provided (“Purchase Price”) specified above, all of each Merchant’s future accounts, contractrights, and other obligations arising from or relating to the payment of monies from each Merchant’s customers and/or other third party payors (the “Receivables”, defined as all payments made by cash, check, credit or debit card, electronic transfer, or other form of monetary payment in the ordinary course of each merchant’s business), for the payment of each Merchant’s sale of goods or services until the amount specified above (the “Receivables Purchased Amount”) has been delivered by Merchant(s) to PWF . Each Merchant hereby acknowledges that until the Receivables Purchased Amount has been received in full by PWF, each Merchant’s Receivables, up to the balance of the Receivables Purchased Amount, are the property of PWF and not the property of any Merchant . Each Merchant agrees that it is a fiduciary for PWF and that each Merchant will hold Receivables in trust for PWF in its capacity as a fiduciary for PWF . The Receivables Purchased Amount shall be paid to PWF by each Merchant irrevocably authorizing only one depositing account acceptable to PWF (the “Account”) to remit the percentage specified above (the “Specified Percentage”) of each Merchant’s settlement amounts due from each transaction, until such time as PWF receives payment in full of the Receivables Purchased Amount. Each Merchant hereby authorizes PWF to ACH debit the specified remittances and any applicable fees listed in Section 2 from the Account on a daily basis as of the next business day after the date of this Agreement and will provide PWF with all required access codes and monthly bank statements. Each Merchant understands that it will be held responsible for any fees resulting from a rejected ACH attempt or an Event of Default (see Section 2). PWF is not responsible for any overdrafts or rejected transactions that may result from PWF’s ACH debiting the Specified Percentage amounts under the terms of this Agreement. Each Merchant acknowledges and agrees that until the amount of the Receivables collected by PWF exceeds the amount of the Purchase Price, PWF will be permitted not treat any amount collected under this Agreement as profit for taxation and accounting purposes. 2. Additional Fees. In addition to the Receivables Purchased Amount, each Merchant will be held responsible to PWF for the following fees, where applicable: A. $ 40 , 000 . 00 - to cover underwriting, the ACH debit program, and expenses related to the procurement and initiation of the transactions encompassed by this Agreement . This will be deducted from payment of the Purchase Price . B. Wire Fee - Merchant(s) shall receive funding electronically to the Account and will be charged $ 50 . 00 for a Fed Wire or $ 0 . 00 for a bank ACH . This will be deducted from payment of the Purchase Price . C. NSF/Rejected ACH Fee - $ 50 . 00 for each time an ACH debit to the Account by PWF is returned or otherwise rejected . No Merchant will be held responsible for such a fee if any Merchant gives PWF notice no more than one business day in advance that the Account will have insufficient funds to be debited by PWF and no Merchant is otherwise in default ofthe terms of the Agreement . Each such fee may be deducted from any payment collected by PWF or may be collected in addition to any other payment collected by PWF under this Agreement . D. Blocked Account/Default - $2,500.00 - If an Event of Default has taken place under Section 30. E. UCC Fee - $395.00 – to cover PWF filing a UCC - 1 financing statement to secure its interest in the Receivables Purchased Amount. A $395.00 UCC termination fee will be charged if a UCC filing is terminated. F. - legal compliance with applicable disclosure laws and regulations. This will be deducted from payment of the Purchase Price. G. Court costs, arbitration fees, collection agency fees, attorney fees, expert fees, and any other expenses incurred in litigation, arbitration, or the enforcement of any of PWF’s legal or contractual rights against each Merchant and/oreach Guarantor, if required, as explained in other Sections of this Agreement. H. Stacking Fee - $10,000.00 - In event merchant takes additional funding that encumber the receivables without the prior written consent of PWF (PWF may choose to still exercise its rights If an event of default has taken place under Section 30). I. ACH Program Fee: $295.00 (per month billed on the last day of month for the duration of the agreement to cover expenses of ACH processing program). 3. Estimated Payments . Instead of debiting the Specified Percentage of Merchant’s Receivables, PWF may instead debit $ 4 , 996 . 67 (“Estimated Payment”) from the Account every Day . The Estimated Payment is intendedto be an approximation of no more than the Specified Percentage, subject to reconciliation . 4. Reconciliations . Any Merchant may contact PWF’s Reconciliation Department to request that PWF conduct a reconciliation in order to ensure that the amount that PWF has collected equals the Specified Percentage of Merchant(s)’s Receivables under this Agreement. A request for a reconciliation by any Merchant must be made by giving written notice of the request to PWF or by sending an e - mail to reconciliations@pawnfunding.com stating that a reconciliation is being requested. In order to effectuate the reconciliation, any Merchant must produce with its request any and all statements I have read and agree to the terms and conditions set forth above: Date: 08/28/202 4 PAUL GALVIN Na m e: T itle : Own e r

Pa g e 3 o f 16 Date: 08/28/202 4 PAUL GALVIN Na m e: T itle : Own e r S T A N D A RD ME R CH A N T C AS H A D V A N CE A G R EE M E N T covering the period from the date of this Agreement through the date of the request for a reconciliation and, if available, the login and password for the Account . PWF will complete each reconciliation requested by any Merchant within two business days after receipt of proper notice of a request for one accompanied by the information and documents required for it . PWF may also conduct a reconciliation on its own at any time by reviewing Merchant(s)’s Receivables covering the period from the date of this Agreement until the date of initiation of the reconciliation, each such reconciliation will be completed within two business days after its initiation, and PWF will give each Merchant written notice of the determination made based on the reconciliation within one business day after its completion . If a reconciliation determines that PWF collected more than it was entitled to, then PWF will credit to the Account all amounts to which PWF was not entitled and, if there is an Estimated Payment, decrease the amount of the Estimated Payment so that it is consistent with the Specified Percentage of Merchant(s)’s Receivables from the date of the Agreement through the date of the reconciliation . If a reconciliation determines that PWF collected less than it was entitled to, then PWF will debit from the Account all additional amounts to which PWF was entitled and, if there is an Estimated Payment, increase the amount of the Estimated Payment so that it is consistent with the Specified Percentage of Merchant(s)’s Receivables from the date of the Agreement throughthe date of the reconciliation . Nothing herein limits the amount of times that a reconciliation may be requested or conducted . 5. Merchant Deposit Agreement . Merchant(s) shall appoint a bank acceptable to PWF, to obtain electronic fund transfer services and/or “ACH” payments . Merchant(s) shall provide PWF and/or its authorized agent with all of the information, authorizations, and passwords necessary to verify each Merchant’s Receivables . Merchant(s) shall authorize PWF and/or its agent(s) to deduct the amounts owed to PWF for the Receivables as specified herein from settlement amountswhich would otherwise be due to each Merchant and to pay such amounts to PWF by permitting PWF to withdraw the Specified Percentage by ACH debiting of the account . The authorization shall be irrevocable as to each Merchant absent PWF’s written consent until the Receivables Purchased Amount has been paid in full or the Merchant becomes bankrupt or goes out of business without any prior default under this Agreement . 6. Term of Agreement. The term of this Agreement is indefinite and shall continue until PWF receives the fullReceivables Purchased Amount, or earlier if terminated pursuant to any provision of this Agreement. The provisions ofSections 1, 2, 3, 4, 5, 6, 7, 9, 10, 12, 13, 14, 15, 16, 17, 18, 22, 25, 26, 27, 28, 29, 30, 31, 32, 33, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45, 46, 47, 48, 49, 50, 51, and 52 shall survive any termination of this Agreement. 7. Ordinary Course of Business . Each Merchant acknowledges that it is entering into this Agreement in the ordinary course of its business and that the payments to be made from each Merchant to PWF under this Agreement are being made in the ordinary course of each Merchant’s business . 8. Financial Condition . Each Merchant and each Guarantor (Guarantor being defined as each signatory to the Guarantee of this Agreement) authorizes PWF and its agent(s) to investigate each Merchant’s financial responsibility and history, and will provide to PWF any bank or financial statements, tax returns, and other documents and records, as PWF deems necessary prior to or at any time after execution of this Agreement . A photocopy of this authorization will be deemed as acceptable for release of financial information . PWF is authorized to update such information and financial profiles from time to time as it deems appropriate . 9. Monitoring, Recording, and Electronic Communications . PWF may choose to monitor and/or record telephone calls with any Merchant and its owners, employees, and agents . By signing this Agreement, each Merchant agrees that any call between PWF and any Merchant or its representatives may be monitored and/or recorded . Each Merchant and each Guarantor grants access for PWF to enter any Merchant’s premises and to observe any Merchant’s premises without any prior notice to any Merchant at any time after execution of this Agreement . PWF may use automated telephone dialing, text messaging systems, and e - mail to provide messages to Merchant(s), Owner(s) (Owner being defined as each person who signs this Agreement on behalf of a Merchant), and Guarantor(s) about Merchant(s)’s account . Telephone messages may be played by a machine automatically when the telephone is answered, whether answered by an Owner, a Guarantor, or someone else . These messages may also be recorded by the recipient’s answering machine or voice mail . Each Merchant, each Owner, and each Guarantor gives PWF permission to call or send a text message to any telephone number given to PWF in connection with this Agreement and to play pre - recorded messages and/or send text messages with information about this Agreement and/or any Merchant’s I have read and agree to the terms and conditions set forth above:

Pa g e 4 o f 16 Date: 08/28/202 4 PAUL GALVIN Na m e: T itle : Own e r S T A N D A RD ME R CH A N T C AS H A D V A N CE A G R EE M E N T account over the phone . Each Merchant, each Owner, and each Guarantor also gives PWF permission to communicate such information to them by e - mail . Each Merchant, each Owner, and each Guarantor agree that PWF will not be liable to any of them for any such calls or electronic communications, even if information is communicated to an unintended recipient . Each Merchant, each Owner, and each Guarantor acknowledge that when they receive such calls or electronic communications, they may incur a charge from the company that provides them with telecommunications, wireless, and/or Internet services, and that PWF has no liability for any such charges . 10. Accuracy of Information Furnished by Merchant and Investigation Thereof . To the extent set forth herein, each of the parties is obligated upon his, her, or its execution of the Agreement to all terms of the Agreement . Each Merchant and each Owner signing this Agreement represent that he or she is authorized to sign this Agreement for each Merchant, legally binding said Merchant to its obligations under this Agreement and that the information provided herein and in all of PWF’s documents, forms, and recorded interview(s) is true, accurate, and complete in all respects . PWF may produce a monthly statement reflecting the delivery of the Specified Percentage of Receivables from Merchant(s) to PWF . An investigative report may be made in connection with the Agreement . Each Merchant and each Owner signing this Agreement authorize PWF, its agents and representatives, and any credit - reporting agency engaged by PWF, to (i) investigate any references given or any other statements obtained from or about each Merchant or any of its Owners for the purpose of this Agreement, and (ii) pull credit report at any time now or for so long as any Merchant and/or Owners(s) continue to have any obligation to PWF under this Agreement or for PWF’s ability to determine any Merchant’s eligibility to enter into any future agreement with PWF . Any misrepresentation made by any Merchant or Owner in connection with this Agreement may constitute a separate claim for fraud or intentional misrepresentation . Authorization for soft pulls : Each Merchant and each Owner understands that by signing this Agreement, they are providing ‘written instructions’ to PWF under the Fair Credit Reporting Act, authorizing PWF to obtain information from their personal credit profile or other information from Experian, TransUnion, and Equifax . Each Merchant and each Guarantor authorizes PWF to obtain such information solely to conduct a pre - qualification for credit . Authorization for hard pulls : Each Merchant and each Owner understands that by signing this Agreement, they are providing ‘written instructions’ to PWF under the Fair Credit Reporting Act, authorizing PWF to obtain information from their personal credit profile or other information from Experian, TransUnion, and Equifax . Each Merchant and each Guarantor authorizes PWF to obtain such information in accordance with a merchant cash advance application . 11. Transactional History . Each Merchant authorizes its bank to provide PWF with its banking and/or credit card processing history . 12. Indemnification . Each Merchant and each Guarantor jointly and severally indemnify and hold harmless each Merchant’s credit card and check processors (collectively, “Processor”) and Processor’s officers, directors, and shareholders against all losses, damages, claims, liabilities, and expenses (including reasonable attorney and expert fees) incurred by Processor resulting from (a) claims asserted by PWF for monies owed to PWF from any Merchant and (b) actions taken by any Processor in reliance upon information or instructions provided by PWF . 13. No Liability . In no event will PWF be liable for any claims asserted by any Merchant under any legal theory for lost profits, lost revenues, lost business opportunities, exemplary, punitive, special, incidental, indirect, or consequential damages, each of which is waived by each Merchant and each Guarantor . 14. Sale of Receivables . Each Merchant and PWF agree that the Purchase Price under this Agreement is in exchange for the Receivables Purchased Amount and that such Purchase Price is not intended to be, nor shall it be construed as a loan from PWF to any Merchant . PWF is entering into this Agreement knowing the risks that each Merchant’s business may decline or fail, resulting in PWF not receiving the Receivables Purchased Amount . Any Merchant going bankrupt, going out of business, or experiencing a slowdown in business or a delay in collecting Receivables will not on its own without anything more be considered a breach of this Agreement . Each Merchant agrees that the Purchase Price in exchange for the Receivables pursuant to this Agreement equals the fair market value of such Receivables . PWF has purchased and shall own all the Receivables described in this Agreement up to the full Receivables Purchased Amount as the Receivables are created . Payments made to PWF in respect to the full amount of the Receivables shall be conditioned upon each Merchant’s sale of products and services and the payment therefor by each Merchant’s customers in the manner provided in this Agreement . Each Merchant and each Guarantor acknowledges that PWF does not purchase, sell, I have read and agree to the terms and conditions set forth above:

Pa g e 5 o f 16 Date: 08/28/202 4 PAUL GALVIN Na m e: T itle : Own e r S T A N D A RD ME R CH A N T C AS H A D V A N CE A G R EE M E N T or offer to purchase or sell securities and that this Agreement is not a security, an offer to sell any security, or a solicitation of an offer to buy any security . Although certain jurisdictions require the disclosure of an Annual Percentage Rate or APR in connection with this Agreement, those disclosures do not change the fact that the transaction encompassed by this Agreement is not a loan and does not have an interest rate . 15. Power of Attorney . Each Merchant irrevocably appoints PWF as its agent and attorney - in - fact with full authority to take any action or execute any instrument or document to settle all obligations due to PWF for the benefit of each Merchant and only in order to prevent the occurrence of an Event of Default (as described in Section 30 ) . If an Event of Default takes place under Section 30 , then each Merchant irrevocably appoints PWF as its agent and attorney - in - fact with full authority to take any action or execute any instrument or document to settle all obligations due to PWF from each Merchant, including without limitation (i) to collect monies due or to become due under or in respect of any of the Collateral (which is defined in Section 29 ) ; (ii) to receive, endorse and collect any checks, notes, drafts, instruments, documents, or chattel paper in connection with clause (i) above ; (iii) to sign each Merchant’s name on any invoice, bill of lading, or assignment directing customers or account debtors to make payment directly to PWF ; and (iv) to file any claims ortake any action or institute any proceeding which PWF may deem necessary for the collection of any of the unpaid Receivables Purchased Amount from the Collateral, or otherwise to enforce its rights with respect to payment of the Receivables Purchased Amount . 16. Protections Against Default. The following Protections 1 through 6 may be invoked by PWF, immediately andwithout notice to any Merchant if any Event of Default listed in Section 30 has occurred. Protection 1: The full uncollected Receivables Purchased Amount plus all fees due under this Agreement may become due and payable in full immediately. Protection 2. PWF may enforce the provisions of the Guarantee against Guarantor. Protection 3. PWF may enforce its security interest in the Collateral identified in Section 29. Protection 4. PWF may proceed to protect and enforce its rights and remedies by litigation or arbitration. Protection 5 . PWF may debit any Merchant’s depository accounts wherever situated by means of ACH debit or electronic or facsimile signature on a computer - generated check drawn on any Merchant’s bank account or otherwise, in an amount consistent with the terms of this Agreement . Protection 6 . PWF will have the right, without waiving any of its rights and remedies and without notice to any Merchant and/or Guarantor, to notify each Merchant’s credit card and/or check processor and account debtor(s) of the sale of Receivables hereunder and to direct such credit card processor and account debtor(s) to make payment to PWF of all or any portion of the amounts received by such credit card processor and account debtor(s) on behalf of each Merchant . Each Merchant hereby grants to PWF an irrevocable power - of - attorney, which power - of - attorney will be coupled with an interest, and hereby appoints PWF and its representatives as each Merchant’s attorney - in - fact to take any and all action necessary to direct such new or additional credit card and/or check processor and account debtor(s) to make payment to PWF as contemplated by this Section . 17. Protection of Information . Each Merchant and each person signing this Agreement on behalf of each Merchant and/or as Owner, in respect of himself or herself personally, authorizes PWF to disclose information concerning each Merchant, Owner and/or Guarantor’s credit standing and business conduct to agents, affiliates, subsidiaries, and credit reporting bureaus . Each Merchant, Guarantor, and Owner hereby waives to the maximum extent permitted by law any claim for damages against PWF or any of its affiliates relating to any (i) investigation undertaken by or on behalf of PWF as permitted by this Agreement or (ii) disclosure of information as permitted by this Agreement . 18. Confidentiality . Each Merchant understands and agrees that the terms and conditions of the products and services offered by PWF, including this Agreement and any other PWF documents (collectively, “Confidential Information”) are proprietary and confidential information of PWF . Accordingly, unless disclosure is required by law or court order, Merchant(s)shall not disclose Confidential Information of PWF to any person other than an attorney, accountant, financial advisor, or employee of any Merchant who needs to know such information for the purpose of advising any Merchant (“Advisor”), provided such Advisor uses such information solely for the purpose of advising any Merchant and first agrees in writing to be bound by the terms of this Section 18 . 19. D/B/As. Each Merchant hereby acknowledges and agrees that PWF may be using “doing business as” or I have read and agree to the terms and conditions set forth above:

Pa g e 6 o f 16 Date: 08/28/202 4 PAUL GALVIN Na m e: T itle : Own e r S T A N D A RD ME R CH A N T C AS H A D V A N CE A G R EE M E N T “d/b/a” names in connection with various matters relating to the transaction between PWF and each Merchant, including the filing of UCC - 1 financing statements and other notices or filings. 20. Financial Condition and Financial Information . Each Merchant represents, warrants, and covenants that its bank and financial statements, copies of which have been furnished to PWF, and future statements which will be furnished hereafter at the request of PWF, fairly represent the financial condition of each Merchant at such dates, and that since those dates there have been no material adverse changes, financial or otherwise, in such condition, operation, or ownership of any Merchant . Each Merchant has a continuing affirmative obligation to advise PWF of any material adverse change in its financial condition, operation, or ownership that may have an effect on any Merchant’s ability to generate Receivables or perform its obligations under this Agreement . 21. Governmental Approvals . Each Merchant represents, warrants, and covenants that it is in compliance and shall comply with all laws and has valid permits, authorizations, and licenses to own, operate, and lease its properties and to conduct the business in which it is presently engaged . 22. Authorization . Each Merchant represents, warrants, and covenants that it and each person signing this Agreement on behalf of each Merchant has full power and authority to incur and perform the obligations under this Agreement, all of which have been duly authorized . 23. Electronic Check Processing Agreement . Each Merchant represents, warrants, and covenants that it will not, without PWF’s prior written consent, change its Processor, add terminals, change its financial institution or bank account, or take any other action that could have any adverse effect upon any Merchant’s obligations under this Agreement . 24. Change of Name or Location . Each Merchant represents, warrants, and covenants that it will not conduct its business under any name other than as disclosed to PWF or change any place(s) of its business without giving prior written notice to PWF . 25. No Bankruptcy . Each Merchant represents, warrants, and covenants that as of the date of this Agreement, it does not contemplate and has not filed any petition for bankruptcy protection under Title 11 of the United States Code and there has been no involuntary petition brought or pending against any Merchant . Each Merchant further warrants that it does not anticipate filing any such bankruptcy petition and it does not anticipate that an involuntary petition will be filed against it . 26. Unencumbered Receivables . Each Merchant represents, warrants, and covenants that it has good, complete, and marketable title to all Receivables, free and clear of any and all liabilities, liens, claims, changes,restrictions, conditions, options, rights, mortgages, security interests, equities, pledges, and encumbrances of any kind or nature whatsoever or any other rights or interests that may be inconsistent with this Agreement or adverse to the interests of PWF, other than any for which PWF has actual or constructive knowledge or inquiry notice as of the date of this Agreement . 27. Stacking . Each Merchant represents, warrants, and covenants that it will not enter into with any party other than PWF any arrangement, agreement, or commitment that relates to or involves the Receivables, whether in the form of apurchase of, a loan against, collateral against, or the sale or purchase of credits against Receivables without the prior written consent of PWF . 28. Business Purpose . Each Merchant represents, warrants, and covenants that it is a valid business in good standing under the laws of the jurisdictions in which it is organized and/or operates, and each Merchant is entering into this Agreement for business purposes and not as a consumer for personal, family, or household purposes . 29. Security Interest . To secure each Merchant’s performance obligations to PWF under this Agreement and any future agreement with PWF, each Merchant hereby grants to PWF a security interest in collateral (the “Collateral”), that is defined as collectively : (a) all accounts, including without limitation, all deposit accounts, accounts - receivable, and other receivables, as those terms are defined by Article 9 of the Uniform Commercial Code (the “UCC”), now or hereafter owned I have read and agree to the terms and conditions set forth above:

Pa g e 7 o f 16 S T A N D A RD ME R CH A N T C AS H A D V A N CE A G R EE M E N T or acquired by any Merchant ; and (b) all proceeds, as that term is defined by Article 9 of the UCC . The parties acknowledge and agree that any security interest granted to PWF under any other agreement between any Merchant or Guarantor and PWF (the “Cross - Collateral”) will secure the obligations hereunder and under this Agreement . Negative Pledge : Each Merchant agrees not to create, incur, assume, or permit to exist, directly or indirectly, any lien on or with respect to any of the Collateral or the Cross - Collateral, as applicable . Each Merchant agrees to execute any documents or take any action in connection with this Agreement as PWF deems necessary to perfect or maintain PWF’s first priority security interest in the Collateral and the Cross - Collateral, including the execution of any account control agreements . Each Merchant hereby authorizes PWF to file any financing statements deemed necessary by PWF to perfect or maintain PWF’s security interest, which financing statements may contain notification that each Merchant has granted a negative pledge to PWF with respect to the Collateral and the Cross - Collateral, and that any subsequent lienor may be tortiously interfering with PWF’s rights . Each Merchant shall be liable for and PWF may charge and collect all costs and expenses, including but not limited to attorney fees, which may be incurred by PWF in protecting, preserving, and enforcing PWF’s security interest and rights . Each Merchant further acknowledges that PWF may use another legal name and/or D/B/A or an agent when designating the Secured Party when PWF files the above - referenced financing statement(s) . 30 . Events of Default . An “Event of Default” may be considered to have taken place if any of the following occur : (1) Any representation or warranty by any Merchant to PWF proves to have been made intentionally false or misleading in any material respect when made ; (2) Any Merchant causes any ACH debit to the Account by PWF to be blocked or stopped without providing any advance written notice to PWF with an alternative method for PWF to collect the blocked or stopped payment, which notice may be given by e - mail to reconciliations@pawnfunding . com ; (3) Any Merchant intentionally prevents PWF from collecting any part of the Receivables Purchased Amount ; or (4) Any Merchant causes any ACH debit to the Account by any person or entity other than PWF to be stopped or otherwise returned that would result in an ACH Return Code of R 08 , R 10 , or R 29 and that Merchant does not within two business days thereafter provide PWF with written notice thereof explaining why that Merchant caused the ACH debit to be stopped or otherwise returned, which notice may be given by e - mail to reconciliations@pawnfunding . com . (5) The seller uses multiple depository accounts without obtaining prior written consent of PWF in each instance . (6) The seller fails to deposit any portion of its Future Receipts into the Approved Bank Account. (7) The Guaranty shall for any reason cease to be in full force and effect. (8) The seller takes additional funding that encumber the receivables without the prior written consent of PWF. 31 . Remedies . In case any Event of Default occurs and is not waived, PWF may proceed to protect and enforce its rights or remedies by suit in equity or by action at law, or both, whether for the specific performance of any covenant, agreement, or other provision contained herein, or to enforce the discharge of each Merchant’s obligations hereunder, or any other legal or equitable right or remedy . All rights, powers, and remedies of PWF in connection with this Agreement, including each Protection listed in Section 16 , may be exercised at any time by PWF after the occurrence of an Event of Default, are cumulative and not exclusive, and will be in addition to any other rights, powers, or remedies provided by law or equity . In case any Event of Default occurs and is not waived, PWF may elect that Merchant(s) be required to pay to PWF 25 % of the unpaid balance of the Receivables Purchased Amount as liquidated damages for any reasonable expenses incurred by PWF in connection with recovering the unpaid balance of the Receivables Purchased Amount (“Reasonable Expenses”) and all Merchant(s) and all Guarantor(s) agree that the Reasonable Expenses bear a reasonable relationship to PWF’s actual expenses incurred in connection with recovering the unpaid balance of the Receivables Purchased Amount . 32 . Assignment . This Agreement shall be binding upon and inure to the benefit of the parties and their respective successors and assigns, except that Merchant(s) shall not have the right to assign its rights hereunder or any interest herein without the prior written consent of PWF, which consent may be withheld in PWF’s sole discretion . PWF may assign, transfer, or sell its rights under this Agreement, including, without limitation, its rights to receive the Receivables Purchased Amount, and its rights under Section 29 of this Agreement, the Guarantee, and any other agreement, instrument, or document executed in connection with the transactions contemplated by this Agreement (a “Related Agreement”), or delegate its duties hereunder or thereunder, either in whole or in part . From and after the effective date of any such assignment or transfer by PWF, whether or not any Merchant has actual notice thereof, this Agreement and each Related Agreement shall be deemed amended and modified (without the need for any further action on the part of any Merchant or PWF) such that the assignee shall be deemed a party to this Agreement and any such Related Agreement and,to the extent provided in the assignment document between PWF and such assignee (the “Assignment Agreement”), have the rights and obligations of PWF under this Agreement and such Related Agreements with respect to the portion of the Receivables Purchased Amount set forth in such Assignment Agreement, including but not limited to rights in the I have read and agree to the terms and conditions set forth above: Date: 08/28/202 4 PAUL GALVIN Na m e: T itle : Own e r

Pa g e 8 o f 16 Date: 08/28/202 4 PAUL GALVIN Na m e: T itle : Own e r S T A N D A RD ME R CH A N T C AS H A D V A N CE A G R EE M E N T Receivables, Collateral and Additional Collateral, the benefit of each Guarantor’s guaranty regarding the full and prompt performance of every obligation that is a subject of the Guarantee, PWF’s rights under Section 16 of this Agreement (Protections Against Default), and to receive damages from any Merchant following a breach of this Agreement by any Merchant . In connection with such assignment, PWF may disclose all information that PWF has relating to any Merchant or itsbusiness . Each Merchant agrees to acknowledge any such assignment in writing upon PWF’s request . 33. Notices . All notices, requests, consents, demands, and other communications hereunder shall be delivered by certified mail, return receipt requested, or by overnight delivery with signature confirmation to the respective parties to this Agreement at their addresses set forth in this Agreement and shall become effective only upon receipt . Written notice may also be given to any Merchant or Guarantor by e - mail to the E - mail Address listed on the first page of this Agreement or by text message to the Phone Number listed on the first page of this Agreement if that phone number is for a mobile phone . Each Merchant and each Guarantor must set its spam or junk mail filter to accept e - mails sent by reconciliations@pawnfunding . com and its domain . This Section is not applicable to service of process or notices in any legal proceedings . 34. Choice of Law . Each Merchant acknowledges and agrees that this Agreement was made in the State of New York, that the Purchase Price is being paid by PWF in the State of New York, that the Receivables Purchased Amount is being delivered to PWF in the State of New York, and that the State of New York has a reasonable relationship to the transactions encompassed by this Agreement . This Agreement, any dispute or claim relating hereto, whether sounding in contract, tort, law, equity, or otherwise, the relationship between PWF and each Merchant, and the relationship between PWF and each Guarantor will be governed by and construed in accordance with the laws of the State of New York, without regard to any applicable principles of conflict of laws . Each Merchant represents that it does not have a principal place of business located in the Commonwealth of Virginia and that therefore the provisions of Chapter 22 . 1 of Title 6 . 2 of the Virginia Code are not applicable to this Agreement . Each Merchant agrees that the provisions of Division 9 . 5 of the California Financial Code are not applicable to this Agreement if no Business Address listed on the first page of this Agreement or in any addendum hereto is located in the State of California . 35. Venue and Forum Selection . Any litigation relating to this Agreement, whether sounding in contract, tort, law, equity, or otherwise, or involving PWF on one side and any Merchant or any Guarantor on the other must be commenced and maintained in any court located in the Counties of Kings, Nassau, New York, or Sullivan in the State of New York (the “Acceptable Forums”) . The parties agree that the Acceptable Forums are convenient, submit to the jurisdiction of the Acceptable Forums, and waive any and all objections to the jurisdiction or venue of the Acceptable Forums . If any litigation is initiated in any other venue or forum, the parties waive any right to oppose any motion or application made by any party to transfer such litigation to an Acceptable Forum . The parties agree that this Agreement encompasses the transaction of business within the City of New York and that the Civil Court of the City of New York (“Civil Court”) will havejurisdiction over any litigation relating to this Agreement that is within the jurisdictional limit of the Civil Court . Notwithstanding any provision in this Agreement to the contrary, in addition to the Acceptable Forums, any action or proceeding to enforce a judgment or arbitration award against any Merchant or Guarantor or to restrain or collect any amount due to PWF may be commenced and maintained in any other court that would otherwise be of competent jurisdiction, and each Merchant and each Guarantor agree that those courts are convenient, submit to the jurisdiction of those courts, waive any and all objections to the jurisdiction or venue of those courts, and may oppose any motion or application made by any party to transfer any such litigation to an Acceptable Forum . 36. Jury Waiver. The parties agree to waive trial by jury in any dispute between them. 37. Counterclaim Waiver. In any litigation or arbitration commenced by PWF, each Merchant and each Guarantorwill not be permitted to interpose any counterclaim. 38. Statutes of Limitations . Each Merchant and each Guarantor agree that any claim, whether sounding in contract, tort, law, equity, or otherwise, that is not asserted against PWF within one year after its accrual will be time barred . Notwithstanding any provision in this Agreement to the contrary, each Merchant and each Guarantor agree that any objection by any of them to the jurisdiction of an arbitrator or to the arbitrability of the dispute and any application made by any of them to stay an arbitration initiated against any of them by PWF will be time barred if made more than 20 days after I have read and agree to the terms and conditions set forth above:

Pa g e 9 o f 16 Date: 08/28/202 4 PAUL GALVIN Na m e: T itle : Own e r S T A N D A RD ME R CH A N T C AS H A D V A N CE A G R EE M E N T receipt of the demand for arbitration . 39. Costs and Legal Fees . If an Event of Default occurs or PWF prevails in any litigation or arbitration with any Merchant or any Guarantor, then each Merchant and each Guarantor must pay PWF’s reasonable attorney fees, which mayinclude a contingency fee of up to 40 % of the amount claimed, as well as administrative or filing fees and arbitrator compensation in any arbitration, expert witness fees, and costs of suit . 40. Prejudgment and Postjudgment Interest . If PWF becomes entitled to the entry of a judgment against any Merchant or any Guarantor, then PWF will be entitled to the recovery of prejudgment interest at a rate of 24 % per annum (or 16 % per annum if any Merchant is a sole proprietorship), or the maximum rate permitted by applicable law if less, and upon entry of any such judgment, it will accrue interest at a postjudgment rate of 24 % per annum (or 16 % per annum if any Merchant is a sole proprietorship), or the maximum rate permitted by applicable law if less, which rate will govern over the statutory rate of interest up until actual satisfaction of the judgment . 41. Class Action Waiver . PWF, each Merchant, and each Guarantor agree that they may bring claims against each other relating to this Agreement only in their individual capacities, and not as a plaintiff or class action member in any purported class or representative proceedings . 42. Arbitration . Any action or dispute, whether sounding in contract, tort, law, equity, or otherwise, relating to this Agreement or involving PWF on one side and any Merchant or any Guarantor on the other, including, but not limited to issues of arbitrability, will, at the option of any party to such action or dispute, be determined by arbitration in the State of New York . A judgment of the court shall be entered upon the award made pursuant to the arbitration . The arbitration will be administered either by the American Arbitration Association under its Commercial Arbitration Rules as are in effect at that time, which rules are available at www . adr . org, by Arbitration Services, Inc . under its Commercial Arbitration Rules asare in effect at that time, which rules are available at www . arbitrationservicesinc . com, by JAMS under its Streamlined Arbitration Rules & Procedures as are in effect at that time, which rules are available at www . jamsadr . com, by Mediation And Civil Arbitration, Inc . under its Commercial Arbitration Rules as are in effect at that time, which rules are available at www . mcarbitration . org, or by Resolute Systems, LLC under its Commercial Arbitration Rules as are in effect at that time, which rules are available at www . resolutesystems . com . Once an arbitration is initiated with one of these arbitral forums, it must be maintained exclusively before that arbitral forum and no other arbitral forum specified herein may be used . As a prerequisite to making a motion to compel arbitration in any litigation, the party making the motion must first file a demand for arbitration with the chosen arbitral tribunal and pay all required filing and/or administrative fees . If the American Arbitration Association is selected, then notwithstanding any provision to the contrary in its Commercial Arbitration Rules, the Expedited Procedures will always apply and its Procedures for Large, Complex Commercial Disputes will not apply . Notwithstanding any provision to the contrary in the arbitration rules of the arbitral forum selected, the arbitration will be heard by one arbitrator and not by a panel of arbitrators, any arbitration hearing relating to this Agreement must be held in the Counties of Nassau, New York, Queens, or Kings in the State of New York, any party, representative, or witness in an arbitration hearing will be permitted to attend, participate, and testify remotely by telephone or video conferencing, and the arbitrator appointed will not be required to be a national of a country other than that of the parties to the arbitration . Each Merchant acknowledges and agrees that this Agreement is the product of communications conducted by telephone and the Internet, which are instrumentalities of interstate commerce, that the transactions contemplated under this Agreement will be made by wire transfer and ACH, which are also instrumentalities of interstate commerce, and that this Agreement therefore evidences a transaction affecting interstate commerce . Accordingly, notwithstanding any provision in this Agreement to the contrary, all matters of arbitration relating to this Agreement will be governed by and construed in accordance with the provisions of the Federal Arbitration Act, codified as Title 9 of the United States Code, however any application for injunctive relief in aid of arbitration or to confirm an arbitration award may be made under Article 75 of the New York Civil Practice Law and Rules or the laws of the jurisdiction in which the application is made, andthe application will be governed by and construed in accordance with the laws under which the application is made, without regard to any applicable principles of conflict of laws . The arbitration agreement contained herein may also be enforced by any employee, agent, attorney, member, manager, officer, subsidiary, affiliate entity, successor, or assign of PWF and by any party to a lawsuit in which PWF and any Merchant or any Guarantor are parties . 43. Service of Process. Each Merchant and each Guarantor consent to service of process and legal notices I have read and agree to the terms and conditions set forth above:

Pa g e 1 0 o f 16 S T A N D A RD ME R CH A N T C AS H A D V A N CE A G R EE M E N T made by First Class or Priority Mail delivered by the United States Postal Service and addressed to the Contact Address set forth on the first page of this Agreement or any other address(es) provided in writing to PWF by any Merchant or any Guarantor, and unless applicable law or rules provide otherwise, any such service will be deemed complete upon dispatch . Each Merchant and each Guarantor agrees that it will be precluded from asserting that it did not receive service of process or any other notice mailed to the Contact Address set forth on the first page of this Agreement if it does not furnish a certified mail return receipt signed by PWF demonstrating that PWF was provided with notice of a change in the Contact Address . 44. Survival of Representations, etc . All representations, warranties, and covenants herein shall survive the execution and delivery of this Agreement and shall continue in full force until all obligations under this Agreement shall have been satisfied in full and this Agreement shall have terminated unless specified otherwise in this Agreement . 45. Waiver . No failure on the part of PWF to exercise, and no delay in exercising, any right under this Agreement, shall operate as a waiver thereof, nor shall any single or partial exercise of any right under this Agreement preclude any other or further exercise thereof or the exercise of any other right . The remedies provided hereunder are cumulative and not exclusive of any remedies provided by law or equity . 46. Independent Sales Organizations/Brokers . Each Merchant and each Guarantor acknowledge that it may have been introduced to PWF by or received assistance in entering into this Agreement or its Guarantee from an independent sales organization or broker (“ISO”) . Each Merchant and each Guarantor agree that any ISO is separate from and is not an agent or representative of PWF . Each Merchant and each Guarantor acknowledge that PWF is not bound by any promises or agreements made by any ISO that are not contained within this Agreement . Each Merchant and ea ch Guarantor exculpate from liability and agree to hold harmless and indemnify PWF and its officers, directors, members, shareholders, employees, and agents from and against all losses, damages, claims, liabilities, and expenses (including reasonable attorney and expert fees) incurred by any Merchant or any Guarantor resulting from any act or omission byany ISO . Each Merchant and each Guarantor acknowledge that any fee that they paid to any ISO for its services is separate and apart from any payment under this Agreement . Each Merchant and each Guarantor acknowledge that PWF does not in any way require the use of an ISO and that any fees charged by any ISO are not required as a condition or incident to this Agreement . 47. Modifications ; Agreements . No modification, amendment, waiver, or consent of any provision of this Agreement shall be effective unless the same shall be in writing and signed by all parties . 48. Severability . If any provision of this Agreement is deemed invalid or unenforceable as written, it will be construed, to the greatest extent possible, in a manner which will render it valid and enforceable, and any limitation on the scope or duration of any such provision necessary to make it valid and enforceable will be deemed to be part thereof . If any provision of this Agreement is deemed void, all other provisions will remain in effect . 49. Headings . Headings of the various articles and/or sections of this Agreement are for convenience only and do not necessarily define, limit, describe, or construe the contents of such articles or sections . 50. Attorney Review . Each Merchant acknowledges that it has had an opportunity to review this Agreement and all addenda with counsel of its choosing before signing the documents or has chosen not to avail itself of the opportunity to do so . 51. A Entire Agreement . This Agreement, inclusive of all addenda, if any, executed simultaneously herewith constitutes the full understanding of the parties to the transaction herein and may not be amended, modified, or canceled except in writing signed by all parties . Should there arise any conflict between this Agreement and any other document preceding it, this Agreement will govern . This Agreement does not affect any previous agreement between the parties unless such an agreement is specifically referenced herein . This Agreement will not be affected by any subsequent agreement between the parties unless this Agreement is specifically referenced therein . 51 B . Interpretation . If per the relevant religious laws this Agreement were to be deemed anything other than a true purchase of receivables and thus requires a Heter Iska Klali, this Agreement should be governed by the Heter Iska Klali executed by the Principals of Pawn Funding, that shall be available upon request . 52 . Counterparts ; Fax and Electronic Signatures . This Agreement may be executed electronically and in counterparts . Facsimile and electronic copies of this Agreement will have the full force and effect of an original . I have read and agree to the terms and conditions set forth above: Date: 08/28/202 4 PAUL GALVIN Na m e: T itle : Own e r

Pa g e 1 1 o f 16 S T A N D A RD ME R CH A N T C AS H A D V A N CE A G R EE M E N T EACH UNDERSIGNED HEREBY ACCEPTS THE TERMS OF THIS AGREEMENT F OR T H E M E RCHAN T /O WN E R ( #1) P r in t Na m e SS#: ### - ## - #### Title Signature Driver License Number: 350 - 223 - 843 F OR T H E M E RCHAN T /O WN E R ( #2) P r in t Na m e SS #: T itle Driver License Number: Signature Approved for PAWN FUNDING by: I have read and agree to the terms and conditions set forth above: PAUL GALVIN Date: 08/28/202 4 PAUL GALVIN Na m e: T itle : Own e r Owner Owner

Pa g e 1 6 o f 16 S T A N D A RD ME R CH A N T C AS H A D V A N CE A G R EE M E N T BANK INFOR M A T I O N Dear Merchant, We look forward to being your funding partner. You authorize PAWN FUNDING to collect the Receivables Purchased Amount under this Agreement by ACH debiting your bank account with the bank listed below. PAWN FUNDING will require viewing access to your bank account each business day. PAWN FUNDING will also require viewing access to your bank account, prior to funding, aspart of our underwriting process. Please fill out the form below with the information necessary to access your account. * Be sure to indicate capital or lower - case letters. Name of Bank: Name of account: Acc oun t nu m b e r: Routing number: Bank Portal Website: Username: Password: Security Question/Answer 1: Security Question/Answer 2: Security Question/Answer 3: Any other information necessary to access your account: If you have any questions please feel free to contact us directly at 929 - 263 - 2295 . I have read and agree to the terms and conditions set forth above: CITY NATIONAL BANK OF FL Date: 08/28/202 4 PAUL GALVIN Na m e: T itle : Own e r SG BUILDING BLOCKS 30000509302 066004367

Page 1 of 2 ADD E NDU M T O S T ANDAR D ME R C HAN T CA SH AD V ANC E A G R EEM E N T FOR ADDITIONAL REMEDIES T hi s i s a n A dden d u m da t e d 08/28/2024 t o t h e St anda rd M e r c han t Ca s h A d v a n ce Agreement (“Agreement”) dated 08/28/2024 between PAWN FUNDING (“PWF”) and SG BUILDING BLOCKS I (“Merchant”). This Addendum incorporates the Agreement by reference. The terms of this Addendum will control to the extent they conflict with any of the terms in the Agreement. R 1 . Remedies . In addition to all other remedies available to PWF, in case any Event of Default occurs and is not waived, PWF will be entitled to the issuance of an injunction, restraining order, or other equitable or provisional relief in PWF’s favor, subject to court or arbitrator approval, restraining each Merchant’s accounts and/or receivables up to the amount due to PWF as a result of the Event of Default, and each Merchant will be deemed to have consented to the granting of an application for the same to any court or arbitral tribunal of competent jurisdiction without any prior notice to any Merchant or Guarantor and without PWF being required to furnish a bond or otherundertaking in connection with the application . To the extent applicable, Merchant(s) and Guarantor(s) waive the right to a notice and hearing under Connecticut General Statutes sections 52 - 278 a to 52 - 278 g, inclusive, and consent to the issuance of a writ for a prejudgment remedy without securing a court order . R 2 . Arbitration . In case any Event of Default occurs and is not waived, each Merchant consents to PWF making an application in arbitration, without notice to any Merchant or any Guarantor, for the issuance of an injunction, restraining order, or other equitable relief in PWF’s favor, subject to court or arbitrator approval, restraining each Merchant’s accounts and/or receivables up to the amount due to PWF as a result of the Event of Default . Each Merchant irrevocably authorizes and directs its financial institutions and account debtors to comply with any injunction, restraining order, or other equitable relief issued in PWF’s favor in arbitration under the terms of this Agreement, will hold harmless and indemnify PWF and its employees, agents, attorneys, members, managers, officers, subsidiaries, affiliate entities, successors, and assigns from and against all losses, damages, claims, liabilities, and expenses (including reasonable attorney and expert fees) relating to the making or enforcement of any application for the issuance of an injunction, restraining order, or other equitable relief in PWF’s favor to restrain each Merchant’s accounts and/or receivables, and will hold harmless and indemnify all financial institutions and account debtors from and against all losses, damages, claims, liabilities, and expenses (including reasonable attorney and expert fees) relating to compliance with any injunction, restraining order, or other equitable relief issued in favor of PWF .

ADD E NDU M T O S T ANDAR D ME R C HAN T CA SH AD V ANC E A G R EEM E N T FOR ADDITIONAL REMEDIES FOR THE MERCHANT/OWNER (#1) By: FOR THE MERCHANT/OWNER (#2) Owner PAUL GALVIN (Signature) (Print Title) (Print Name) By: (Print Name) Owner (Print Title) (Signature) Page 2 of 2

A DD E N D U M T O M E R C HAN T C A SH A D V A N C E A G R E E M E N T FOR ADDITIONAL FEES This is an Addendum, dated 08/28/2024 , to the Merchant Cash Advance Agreement (“Agreement”), dated 08 / 28 / 2024 , between PAWN FUNDING (“PWF”) and . . SG BUILDING BLOCKS INC (“Merchant”) . This Addendum incorporates the Agreement by reference . The terms of this Addendum will control to the extent they conflict with any of the terms in the Agreement . Each Merchant may be held responsible for an NSF/ Rejected ACH Fee of $ 50 . 00 for each time an ACH debit to the Account by PWF is returned or otherwise rejected . No Merchant will be held responsible for such a fee if any Merchant gives PWF advance notice ofno more than one business day in advance that the Account has insufficient funds to be debited by PWF and no Merchant is otherwise in default of the terms of the Agreement . Each such fee may be deducted from any payment collected by PWF or may be collected in addition to any other payment collected by PWF under this Agreement . FOR THE MERCHANT/OWNER (# 1 ) By: PAUL GALVIN Owner (Print Name) (Print Title) (Signature) FOR THE MERCHANT/OWNER (#2) By: (Print Name) Owner (Print Title) (Signature)

DECLARATION OF ORDINARY COURSE OF BUSINESS Each undersigned hereby declares the following: 1. I am duly authorized to sign the Merchant Cash Advance Agreement By: PAUL GALVIN (Print Name) Owner (Print Title) FOR THE MERCHANT/OWNER (#2) By: (Print Name) Owner (Print Title) (Signature) (“Agreement”), dated 08/28/2024 , between PAWN FUNDING (“PWF”) and SG BUILDING BLOCKS INC (“Merchant”) on behalf of Merchant. 2. This Declaration incorporates by reference the Agreement and every addendum to it. 3. I acknowledge that I am authorized to sign the Agreement and every addendum to it on behalf of each Merchant. 4. I acknowledge that I had sufficient time to review the Agreement and every addendum to it before signing it. 5. I acknowledge that I had an opportunity to seek legal advice from counsel of my choosing before signing the Agreement and every addendum to it. 6. I acknowledge that each Merchant is entering into the Agreement voluntarily and without any coercion. 7. I acknowledge that each Merchant is entering into the Agreement in the ordinary course of its business. 8. I acknowledge that the payments to be made from any Merchant to PWF under the Agreement are being made in the ordinary course of each Merchant’s business. 9. I am aware of each Merchant’s right to request a reconciliation of the pa ym en t s m a d e u nde r t h e A g r e e m en t a t an y t i m e . 10. I DECLARE UNDER PENALTY OF PERJURY THAT THE FOREGOING IS TRUE AND CORRECT. Executed on (Date) FOR THE MERCHANT/OWNER (#1) (Signature)

ADD E N DU M T O ME RCHAN T CA SH AD V A N C E A G R EEME N T FO R ADD ITIO NA L SECURITY INTERESTS This is an Addendum dated 08/28/2024 to the Merchant Cash Advance Agreement (“Agreement”) dated 08/28/2024 between PAWN FUNDING (“PWF”) and SG BUILDING BLOCKS IN (“Merchant”). This Addendum incorporates the Agreement by reference. The terms of this Addendum will control to the extent they conflict with anyof the terms in the Agreement. S 1 . Each entity and/or sole proprietor listed below (“Additional Security Interest Grantor”) agrees to the following terms and conditions . All references herein to Additional Security Interest Grantor refer to each entity and/or sole proprietor both in thecollective and the alternative . S 2 . In addition to the security interest granted by each Merchant in the Agreement, each Additional Security Interest Grantor grants to PWF a security interest in collateral (the “Additional Collateral”), that is defined as collectively : (a) all accounts, including without limitation, all deposit accounts, accounts - receivable, and other receivables, chattel paper, documents, equipment, general intangibles, instruments, andinventory, as those terms are defined by Article 9 of the Uniform Commercial Code (the “UCC”), now or hereafter owned or acquired by that Additional Security Interest Grantor ; and (b) all proceeds, as that term is defined by Article 9 of the UCC . Each Additional Security Interest Grantor acknowledges and agrees that any security interest granted to PWF under any other agreement between any Merchant and PWF (the “Cross - Collateral”) will secure the obligations hereunder and under this Addendum . Negative Pledge : Each Additional Security Interest Grantor agrees not to create, incur, assume, or permit to exist, directly or indirectly, any lien on or with respect to any of the Additional Collateral or the Cross - Collateral, as applicable . S 3 . Each Additional Security Interest Grantor agrees to execute any documents or take any action in connection with this Addendum as PWF deems necessary to perfect or maintain PWF’s first priority security interest in the Additional Collateral and the Cross - Collateral, including the execution of any account controlagreements . Each Additional Security Interest Grantor hereby authorizes PWF to file any financing statements deemed necessary by PWF to perfect or maintain PWF’s security interest, which financing statements may contain notification that the Additional Security Interest Grantor has granted a negative pledge to PWF with respect to the Additional Collateral and the Cross - Collateral, and that any subsequent lienor may be tortiously interfering with PWF’s rights . Each Additional Security Interest Grantor shall be liable for and PWF may charge and collect all costs and expenses, including but not limited to attorney fees, which may be incurred by PWF in protecting, preserving, and enforcingPWF’s security interest and rights granted by that Additional Security Interest Grantor . Each Additional Security Interest Grantor further acknowledges that PWF may use another legal name and/or D/B/A or an agent when designating the Secured Party when PWF files the above - referenced financing statement(s) . Page 1 of 15

Page 2 of 15 S 4 . In case any Event of Default occurs under the Agreement and is not waived, PWF will be entitled to the issuance of an injunction, restraining order, or other equitable relief in PWF’s favor, subject to court or arbitrator approval, restraining each Additional Security Interest Grantor’s Additional Collateral, including but not limited to accounts and/or receivables, up to the amount due to PWF as a result of the Event of Default, and each Additional Security Interest Grantor will be deemed to have consented to the granting of an application for the same to any court or arbitral tribunal of competent jurisdiction without any prior notice to any Additional Security Interest Grantor and without PWF being required to furnish a bond or other undertaking in connection with the application . S 5 . Each Additional Security Interest Grantor acknowledges and agrees that this Addendum was made in the State of New York and that the State of New York has a reasonable relationship to the transactions encompassed by the Agreement . This Addendum and the relationship between PWF, each Merchant, each Guarantor, and eachAdditional Security Interest Grantor will be governed by and construed in accordance with the laws of the State of New York, without regard to any applicable principles of conflict of laws . S 6 . Any litigation relating to this Addendum or involving PWF on one side and any Merchant, any Guarantor, or any Additional Security Interest Grantor on the other must be commenced and maintained in any court located in the Counties of Nassau, New York, or Sullivan in the State of New York (the “Acceptable Forums”) . EachAdditional Security Interest Grantor agrees that the Acceptable Forums are convenient, submits to the jurisdiction of the Acceptable Forums, and waives any and all objections to the jurisdiction or venue of the Acceptable Forums . If any litigation is initiated in any other venue or forum, each Additional Security Interest Grantor waives any right to oppose any motion or application made by any party to transfer such litigation to an Acceptable Forum . Each Additional Security Interest Grantor agrees that this Addendum encompasses the transaction of business within the City of New York and that the Civil Court of the City of New York (“Civil Court”) will have jurisdiction over any litigation relating to this Addendum that is within the jurisdictional limit of the Civil Court . In addition to the Acceptable Forums, any action or proceeding to enforce a judgment or arbitration award against any Merchant, Guarantor, or Additional Security Interest Grantor or to restrain or collect any amount due to PWF may be commenced andmaintained in any other court of competent jurisdiction . S 7 . Each Additional Security Interest Grantor agrees to waive trial by jury in any dispute with PWF . S 8 . In any litigation or arbitration commenced by PWF, each Merchant, each Guarantor, and each Additional Security Interest Grantor will not be permitted to interpose any counterclaim . S 9 . Each Merchant, each Guarantor, and each Additional Security Interest Grantor agree that any claim that is not asserted against PWF within one year of its accrual will be time barred .

Page 3 of 15 S 10 . Each Merchant, each Guarantor, and each Additional Security Interest Grantor must pay all of PWF’s reasonable costs associated with a breach by any Merchant of the covenants in this Addendum and the enforcement thereof, including but not limited to collection agency fees, expert witness fees, and costs of suit . S 11 . If PWF becomes entitled to the entry of a judgment against any Merchant, any Guarantor, or any Additional Security Interest Grantor, then PWF will be entitled to therecovery of prejudgment interest at a rate of 24 % per annum (or 16 % per annum if any Merchant or Additional Security Interest Grantor is a sole proprietorship), or the maximum rate permitted by applicable law if less, and upon entry of any such judgment, it will accrue interest at a rate of 24 % per annum (or 16 % per annum if any Merchant or any Additional Security Interest Grantor is a sole proprietorship), or the maximum rate permitted by applicable law if less, which rate will govern over the statutory rate of interest up until actual satisfaction of the judgment . S 12 . If PWF prevails in any litigation or arbitration with any Merchant, any Guarantor, or any Additional Security Interest Grantor, then that Merchant, Guarantor, and/or Additional Security Interest Grantor must pay PWF’s reasonable attorney fees, which may include a contingency fee of up to 40 % of the amount claimed . S 13 . PWF, each Merchant, each Guarantor, and each Additional Security Interest Grantor agree that they may bring claims against each other relating to this Addendum only in their individual capacities, and not as a plaintiff or class action member in any purported class or representative proceedings . S 14 . Any action or dispute relating to this Addendum or involving PWF on one side and any Merchant, any Guarantor, or any Additional Security Interest Grantor on the other, including, but not limited to issues of arbitrability, will, at the option of any party to such action or dispute, be determined by arbitration before a single arbitrator . The arbitration will be administered either by Arbitration Services, Inc . under its Commercial Arbitration Rules as are in effect at that time, which rules are available at www . arbitrationservicesinc . com, or by Mediation & Civil Arbitration, Inc . under its Commercial Arbitration Rules as are in effect at that time, which rules are available at www . mcarbitration . org . Once an arbitration is initiated with one of these arbitral forums, it must be maintained exclusively before that forum . Any arbitration relating to this Agreement must be conducted in the Counties of Nassau, New York, Queens, or Kings in the State of New York . Notwithstanding any provision of any applicable arbitration rules, any witness in an arbitration who does not reside in or have a place for the regular transaction of business located in New York City or the Counties of Nassau, Suffolk, or Westchester in the State of New York will be permitted to appear and testify remotely by telephone or video conferencing . The arbitration agreement containedherein may also be enforced by any employee, agent, attorney, member, manager, officer, subsidiary, affiliate entity, successor, or assign of PWF . In case any Event of Default occurs and is not waived, each Additional Security Interest Grantor consents to PWF making an application to the arbitrator, without notice to any Merchant, any Guarantor, or any Additional Security Interest Grantor for the issuance of an injunction,

Page 4 of 15 restraining order, or other equitable relief in PWF’s favor, subject to court or arbitrator approval, restraining each Additional Security Interest Grantor’s Additional Collateral, including but not limited to accounts and/or receivables up to the amount due to PWF as aresult of the Event of Default . S 15 . Each Additional Security Interest Grantor acknowledges and agrees that this Addendum is the product of communications conducted by telephone and the Internet, which are instrumentalities of interstate commerce, that the transactions contemplated under this Addendum will be made by instrumentalities of interstatecommerce, and that this Agreement therefore evidences a transaction affecting interstate commerce . Accordingly, notwithstanding any provision in the Agreement or this Addendum to the contrary, all matters of arbitration relating to the Agreement or this Addendum will be governed by and construed in accordance with the provisions of the Federal Arbitration Act, codified as Title 9 of the United States Code, however any application for injunctive relief in aid of arbitration or to confirm an arbitration award maybe made under Article 75 of the New York Civil Practice Law and Rules . The arbitration agreement contained in this Section may also be enforced by any employee, agent, attorney, member, manager, officer, subsidiary, affiliate entity, successor, or assign of PWF . S 16 . Each Additional Security Interest Grantor consents to service of process and legal notices made by First Class or Priority Mail delivered by the United States Postal Service and addressed to its corresponding Contact Address set forth herein or any other address(es) provided in writing to PWF by any Merchant, any Guarantor, or anyAdditional Security Interest Grantor, and unless applicable law or rules provide otherwise, any such service will be deemed complete upon dispatch . Each Merchant, each Guarantor, and each Additional Security Interest Grantor agree that it will be precluded from asserting that it did not receive service of process or any other notice mailed to the Contact Address set forth on the first page of the Agreement if it does not furnish a certified mail return receipt signed by PWF demonstrating that PWF was provided with notice of a change in the Contact Address .

STANDARD MERCHANT CASH ADVANCE AGREEMENT ADDENDUM C CHAN GI N G F R E Q U E NC Y O F E S T I M A T ED P A YME N T S This is an Addendum, dated 08 / 28 / 2024 , to the Standard Merchant Cash Advance Agreement (“Agreement”), dated 08 / 28 / 2024 , between PAWN FUNDING (“P WF ”) an d SG BUILDING BLOCKS I (“M e rc han t ”) . T hi s A dd e ndu m in c o r p o r a t e s t h e Agreement by reference . The terms of this Addendum will control to the extent they conflict with any of the terms in the Agreement . C 1 . Changing Frequency of Estimated Payment . Upon one day’s advance written notice to Merchant(s), PWF may elect to change the frequency of the Estimated Payment from daily to weekly or from weekly to daily . If the frequency of the Estimated Payment is being changed from weekly to daily, then the amount of the daily Estimated Payment will be one fifth of the amount of the weekly Estimated Payment . If thefrequency of the Estimated Payment is being changed from daily to weekly, then the amount of the weekly Estimated Payment will be five times of the amount of the daily Estimated Payment . No Estimated Payment will be debited on a daily basis during a week in which a weekly payment was already successfully collected from the Account . Ifany Estimated Payment was debited from the Account on a daily basis, then any Estimated Payment debited on a weekly basis during that week must be reduced by thetotal of all daily payments already successfully collected from the Account for that week . FOR THE MERCHANT/OWNER (#1) P r in t Na m e T itle Signature SS#: 089 - 56 - 2479 FOR THE MERCHANT/OWNER (#2) Owner Print Name Title Signature SS #: PAUL GALVIN Owner

STANDARD MERCHANT CASH ADVANCE AGREEMENT ADDENDUM P DEDUCTION(S) FROM PURCHASE PRICE FOR PAYOFF(S) This is an Addendum, dated 08 / 28 / 2024 , to the Standard Merchant Cash Advance Agreement (“Agreement”), dated 08 / 28 / 2024 , between PAWN FUNDING (“PWF”) and SG BUILDING BLOCKS INC (“Merchant”) . Merchant(s) instruct PWF to pay up to $ 0 . 00 of the Purchase Price set forth in the Agreement to N/A instead of to Merchant(s) . The balance of the Purchase Price will be paid to Merchant(s) . Merchant(s) instruct PWF to pay up to $ 0 . 00 of the Purchase Price set forth in the Agreement to N/A instead of to Merchant(s) . The balance of the Purchase Price will be paid to Merchant(s) . Additional comments : FOR THE MERCHANT/OWNER (#1) By: FOR THE MERCHANT/OWNER (#2) Owner PAUL GALVIN (Signature) (Print Title) (Print Name) By: (Print Name) Owner (Print Title) (Signature)